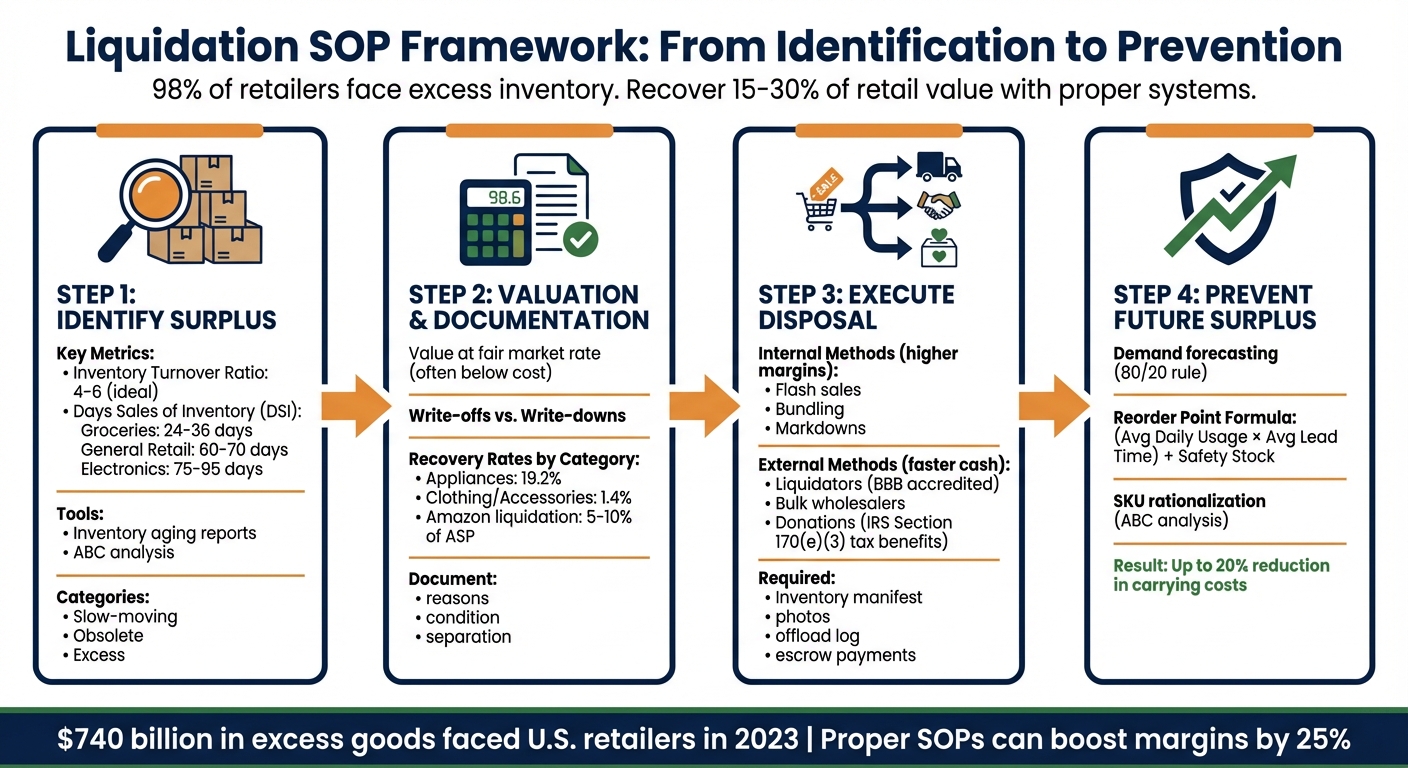

Liquidation SOPs (Standard Operating Procedures) help businesses efficiently manage surplus inventory, reducing losses and improving cash flow. Here's what you need to know:

- Why It Matters: 98% of retailers face excess inventory, with 30% becoming obsolete. Without proper systems, businesses recover only 15–30% of retail value during liquidation.

- Key Steps:

- Identify Surplus: Use tools like inventory aging reports, ABC analysis, and metrics such as Inventory Turnover Ratio and Days Sales of Inventory (DSI).

- Valuation: Determine fair market value and document write-offs or write-downs for accurate financial reporting.

- Disposal Channels: Start with internal methods like markdowns or bundles, then consider external partners like liquidators or donations (potential tax benefits under IRS Section 170(e)(3)).

- Execution:

- Create detailed inventory manifests and listings.

- Use secure payment methods, like escrow services, to protect transactions.

- Track every step with an offload log for compliance and audits.

- Prevention: Avoid future surplus by improving demand forecasting, setting reorder points, and streamlining product catalogs.

Tools like ForthClear simplify liquidation by automating surplus detection, managing listings, and securing payments, making the process faster and more reliable. By combining preventive measures with clear SOPs, businesses can recover more value and reduce carrying costs.

Liquidation SOP Process: 4-Step Framework for Managing Surplus Inventory

A 3-Step Strategy To Liquidate Unwanted Inventory

sbb-itb-bc600a0

Core Components of Liquidation SOPs

Creating effective liquidation SOPs involves pinpointing surplus inventory, establishing valuation guidelines, and selecting the right disposal channels. Each step requires clear metrics, defined thresholds, and well-documented processes to maintain consistency across your organization.

How to Identify Surplus Inventory

Start by categorizing inventory into slow-moving items (low sales velocity), obsolete stock (no current or future demand), and excess inventory (stock levels surpassing anticipated demand). Without clear definitions, you risk liquidating products that are still sellable or holding onto inventory that drains resources.

Metrics like the Inventory Turnover Ratio - ideally between 4 and 6 - and Days Sales of Inventory (DSI) can help flag problem areas. Industry benchmarks vary: groceries typically see 24–36 days, general retail averages 60–70 days, and consumer electronics hover around 75–95 days.

Inventory aging reports are another essential tool, organizing stock into time-based categories (e.g., 0–30 days, 31–60 days, 90+ days). Pair this with ABC analysis, which ranks SKUs by value. High-value "A" items lingering in the 90+ day bucket should immediately grab your attention, as they tie up the most capital. Assign someone to monitor these metrics and enforce shelf-life limits - for example, 30 days for perishables or 180 days for furniture.

Valuation and Write-Off Guidelines

Surplus inventory should be valued at its fair market rate, which is often lower than its original cost. It's important to differentiate between write-offs (removing the item’s entire value) and write-downs (partial value reduction) for accurate financial reporting.

For accounting, you can use the direct write-off method to record losses immediately or the allowance method, which reserves for anticipated losses. While the allowance method offers a clearer financial picture, the direct method is simpler to execute.

Recovery rates vary widely by category. For example, appliances typically see a 19.2% recovery rate, while clothing and accessories can dip to as low as 1.4%. Liquidating through Amazon may return just 5–10% of an item’s average selling price. Keep thorough documentation for every write-off, including reasons like damage or obsolescence, to justify financial decisions. Physically separate damaged or obsolete stock to prevent it from being mistakenly counted as viable inventory during audits.

Once inventory is appropriately valued and documented, you can focus on selecting disposal channels that align with your financial and branding goals.

Choosing the Right Disposal Channel

Your disposal strategy should prioritize speed, cash recovery, or brand protection, depending on your objectives. Internal methods like flash sales or bundling slow-moving items with popular products offer higher margins and better brand control but require more effort from your team. External options like liquidators and bulk wholesalers provide faster cash flow and free up warehouse space but generally yield lower returns.

Begin with internal efforts, such as markdowns, bundling, or supplier returns, before turning to external partners. If you opt for third-party liquidators, ensure they have BBB accreditation, positive reviews, and contracts with clear payout terms. For products that are sensitive to brand perception, you might use private B2B marketplaces instead of offering steep discounts on public-facing platforms.

Charitable donations can also be an effective option. They help avoid disposal costs and may qualify for federal tax deductions under IRS Section 170(e)(3). However, these require fair-market valuations, which can be calculated using cost-based or comparable-sales methods. Your SOP should outline which channels are appropriate for each inventory type and include the necessary documentation for compliance with tax and regulatory requirements.

How to Execute Liquidation SOPs

Creating Listings and Required Documentation

Once you've identified and valued surplus inventory, the next step is to create detailed listings and gather essential documentation to streamline the liquidation process.

Start by compiling a thorough inventory manifest. Include key details such as SKU, product description, quantity, unit cost, retail price, condition, and UPC/ASIN codes. This detailed breakdown not only aids in market research but also speeds up deal negotiations.

Add high-quality photos of individual items and packaged lots, whether loose boxes or pallets, to your listings. Including original brochures, spec sheets, or professionally taken images can help boost buyer confidence. Make sure to document pallet count, weight, dimensions, and pickup location. Also, note any brand-protection rules, licensing restrictions, or expiration dates to avoid complications after inspection.

Maintain a central offload log to track every step of the process. This log should include the date, disposition method, recipient, value, and the approving manager's information. Require an electronic signature from a controller or manager before offloading inventory. This log acts as an audit trail, ensuring every unit is accounted for in your financial records - whether as recovered revenue or a write-down.

"The more information you can provide, the more likely you are to get a deal going quickly with minimal back-and-forth emails." - LiquidateNow

Payment Security and Transaction Protection

Securing payment and protecting transactions is essential when dealing with liquidation buyers. Start by vetting buyers thoroughly - check their BBB accreditation, reviews, and overall reputation in the industry. If a payment offer seems unusually high, it’s often a red flag. Carefully review contract terms, paying close attention to payout timelines, return policies, and any potential fees.

Using an escrow service adds an extra layer of security. These systems hold funds until both parties fulfill their obligations. For example, ForthClear's escrow service ensures sellers receive payment only after buyers confirm the inventory matches the listing, while buyers benefit from knowing their funds are protected until they receive the goods.

Document every transaction with signed Bills of Lading and inventory transfer forms. If you’re donating items, make sure to obtain proper tax documentation. For international sales, require proof of export to prevent goods from re-entering domestic markets, which could conflict with your brand strategy. Keep in mind that IRS and SEC regulations typically require businesses to retain inventory disposition records for three to seven years.

With secure transactions in place, you can focus on evaluating the success of your liquidation efforts.

Evaluating Liquidation Results

After finalizing listings and securing transactions, it’s time to measure how effective your liquidation process has been.

Two key metrics help gauge success: recovery rate and time to liquidation. The recovery rate shows the percentage of the original cost or retail value you’ve recouped. On average, retailers recover only 15% to 30% of the original value during liquidation. Exceeding this range can indicate a well-executed process.

Time to liquidation measures how quickly you clear out inventory. While faster liquidation can free up warehouse space and cut carrying costs, rushing the process might lower your recovery rate. Calculate net recovery by subtracting all fees and expenses from the gross recovery. Be sure to update your financial records immediately to reflect both the revenue generated and the savings from reduced storage needs.

Finally, conduct quarterly internal "resale audit compliance" reviews. These ensure that physical inventory counts align with your offload log and financial statements, keeping everything accurate and transparent.

Reducing Future Surplus Inventory

Avoiding surplus inventory is key to keeping liquidation processes efficient. By integrating preventive measures into your daily operations, you can significantly reduce the chances of surplus inventory piling up.

Using Demand Forecasting and Reorder Points

Dynamic demand forecasting and smart reorder points are powerful tools to prevent overstocking. Instead of sticking to fixed minimums, calculate your Reorder Point (ROP) with this formula:

(Average Daily Usage × Average Lead Time) + Safety Stock.

This formula accounts for your sales rate and supplier lead times, ensuring you restock just in time.

Focus your forecasting efforts strategically with the 80/20 rule - about 80% of your sales often come from just 20% of your products. Concentrate detailed forecasting on these high-performing items, while using simpler methods or higher safety buffers for less critical stock. Companies that refine their planning can cut inventory carrying costs by up to 20%.

Leverage automated triggers within your inventory system. Set Min/Max levels so that reorders happen automatically when stock hits the minimum and pause as it nears the maximum. This prevents overstock while keeping cash flow healthy. For high-value orders, you can also set automated approval thresholds.

To calculate safety stock, use this formula:

(Max Daily Sales × Max Lead Time) – (Avg Daily Sales × Avg Lead Time).

This creates a safety net for demand spikes without causing overstock. Be sure to calculate lead times using business days.

"Inventory forecasting isn't about perfection. It's about making smarter decisions with less guesswork." - Qoblex

Clean up your historical data by removing anomalies caused by one-off events. Align your Sales & Operations Planning (S&OP) decisions with your ERP or warehouse management system at the start of each cycle. This ensures that your daily execution stays in sync with your strategic goals. These forecasting practices create a leaner, more adaptable inventory system while also supporting better catalog management.

Streamlining Your Product Catalog

Accurate forecasting is just the beginning - tightening up your product catalog is another crucial step in avoiding surplus inventory. A cluttered catalog adds complexity and increases the risk of excess stock. By cutting out redundant or underperforming SKUs, you can simplify inventory tracking, lower carrying costs, and free up capital tied to slow-moving items.

Use ABC analysis to categorize inventory into three groups:

- "A" items: Top sellers, making up 80% of your revenue.

- "B" items: Moderate movers, contributing about 15%.

- "C" items: Low performers, accounting for just 5%.

Focus on trimming or consolidating the "C" items that drain resources without adding much value.

Watch for product cannibalization, where similar items compete with each other and dilute overall sales. For instance, if you have three nearly identical versions of a product, consider merging them into one SKU. This reduces complexity while still offering customers meaningful choices.

"Companies that undergo rigorous SKU rationalization boost margins by as much as 25% while accelerating cycle times, increasing turns, and driving greater operational efficiencies." - Versa Cloud ERP

Plan regular SKU reviews, especially after peak seasons, to identify underperformers or clear space for new products. Real-time inventory management software can also help you spot shifts in buying trends, allowing you to adjust orders before surplus builds up. A streamlined catalog not only reduces inventory risks but also makes it easier for customers to find what they want, avoiding the "choice paralysis" that can hurt sales.

How ForthClear Improves Liquidation SOPs

After refining your catalog and improving forecasting, the next challenge is handling liquidation efficiently when surplus inventory arises. ForthClear streamlines liquidation processes by automating tasks like identifying unsold stock and managing payments. This allows you to recover capital quickly without pulling resources away from your core operations. The platform ensures a smooth workflow from spotting surplus to completing liquidation.

Automatic Dead Stock Detection

Manual audits can eat up hours and delay identifying surplus inventory. With ForthClear’s Shopify integration, your inventory is monitored in real-time, automatically flagging items that haven’t sold in 60 days or more. This eliminates the need for manual data analysis and helps you catch stagnant stock before it ties up more capital.

Once flagged, the system provides financial decision support, showing you original costs, projected revenue, and potential profit or loss. This information helps you decide whether to liquidate or explore other disposal options. From there, ForthClear simplifies the process by enabling you to create liquidation listings with just a few clicks, saving time compared to manual listing creation.

Protected Payments Through Escrow

Payment security is a significant concern in secondary markets, especially given the scale of liquidation needs. In 2023, U.S. retailers faced around $740 billion in excess goods requiring liquidation, creating opportunities for fraud. ForthClear addresses this with its built-in escrow system, powered by Stripe, which ensures secure transactions for both buyers and sellers.

Here’s how it works: when a buyer pays, the funds are held in escrow until the buyer confirms delivery or 14 days pass without a dispute. Only then are the funds released to the seller, minus a 5% platform fee. This system builds trust between parties and reduces the risk of non-payment or fraud, which are common hurdles in liquidation transactions.

Bulk Upload Tools and International Selling

One of the most time-consuming parts of liquidation is creating listings. Manually entering hundreds of SKUs can be exhausting and prone to errors. ForthClear solves this with its CSV bulk upload tool, which allows you to upload entire inventories at once. The platform even includes an automatic image search feature that finds product photos for your listings, significantly reducing the time spent on documentation.

For companies aiming to reach international buyers, ForthClear simplifies the process with built-in tariff calculations. This feature automates the task of determining duties for different countries, saving you from hours of manual research. By automating listing creation and regulatory tasks, ForthClear helps you quickly move surplus items into B2B liquidation channels, which are often more effective for selling large volumes than waiting for individual consumer sales. The quicker you list, the faster you can recover funds and clear space in your warehouse.

Conclusion

Having effective liquidation SOPs in place is crucial for protecting cash flow and keeping operations running smoothly. Excess inventory is a common challenge, but a structured approach can turn stagnant stock into working capital, rather than letting it drain resources through high carrying costs. The secret lies in treating liquidation as a planned strategy rather than a last-minute fix. By using tiered disposal channels and carefully timing your efforts, you can recover more value while minimizing financial strain and preserving your brand's reputation.

For e-commerce businesses, tools like ForthClear simplify the process even further. This platform automates dead stock detection, enables bulk uploads, and connects surplus inventory with verified buyers quickly. Its built-in escrow system ensures secure transactions, so sellers only receive payment after delivery is confirmed - providing peace of mind for large-scale B2B liquidation. Incorporating ForthClear into your strategy can turn proactive planning into faster capital recovery.

The best approach balances prevention and execution. Demand forecasting helps reduce future overstock, while efficient liquidation channels ensure you're ready to act when surplus inventory arises. By optimizing both aspects of inventory management, businesses can free up capital more quickly and lessen the environmental toll of overproduction. Whether clearing out seasonal items or slow-moving SKUs, having clear SOPs and the right tools in place ensures you recover the most value while maintaining operational efficiency and brand integrity.

FAQs

How can businesses accurately value surplus inventory for liquidation?

When figuring out the fair market value (FMV) of surplus inventory for liquidation, there are a few key things to keep in mind. Factors like the age of the inventory, its condition, and the current market demand play a big role. A good starting point is to research the selling prices of similar items in the market. This helps you establish a realistic value based on what a buyer would reasonably pay a seller under normal circumstances.

You can also use other approaches, like analyzing recent sales data or applying valuation models such as the lower of cost or market rule. Keeping an eye on market trends is critical to avoid pricing your inventory too high or too low. Tools like ForthClear can make this process easier by providing real-time analytics and bulk pricing insights. These resources allow businesses to set competitive and accurate prices.

By blending thorough market research with reliable tools, you can ensure a smooth and fair liquidation process.

What are the best ways to handle different types of surplus inventory?

The best approach to managing surplus inventory largely depends on what you're dealing with and its condition. If you have overstock or slow-moving items, consider offering discounts, bundling products, or running flash sales. These tactics not only help move inventory quickly but also allow you to recover some of the investment. Creating urgency with limited-time deals can be especially effective in drawing attention and encouraging purchases.

For high-value or niche products, it's worth exploring options like selling on multiple online marketplaces, direct-to-consumer platforms, or partnering with liquidation services. This approach can help you recover more value while cutting down on storage costs. Sorting your inventory based on condition, demand, and value is key to choosing the right channel, whether that's wholesale buyers, discount retailers, or liquidation platforms.

When it comes to outdated or unsellable stock, platforms like ForthClear offer a reliable way to offload surplus inventory. Not only does this reduce waste, but it also supports sustainability efforts. Tailor your strategy to match the inventory's condition, market demand, and your business objectives to make the most out of the situation.

How can demand forecasting help reduce surplus inventory?

Demand forecasting allows businesses to predict future customer needs, helping them adjust inventory levels to match expected demand. By examining historical sales data, identifying market trends, and considering seasonal patterns, companies can avoid stocking too much and reduce the chances of holding surplus inventory.

Getting the forecast right doesn't just cut down on waste - it also helps lower storage costs and improves cash flow. This forward-thinking strategy promotes smarter resource use and boosts overall efficiency in operations.