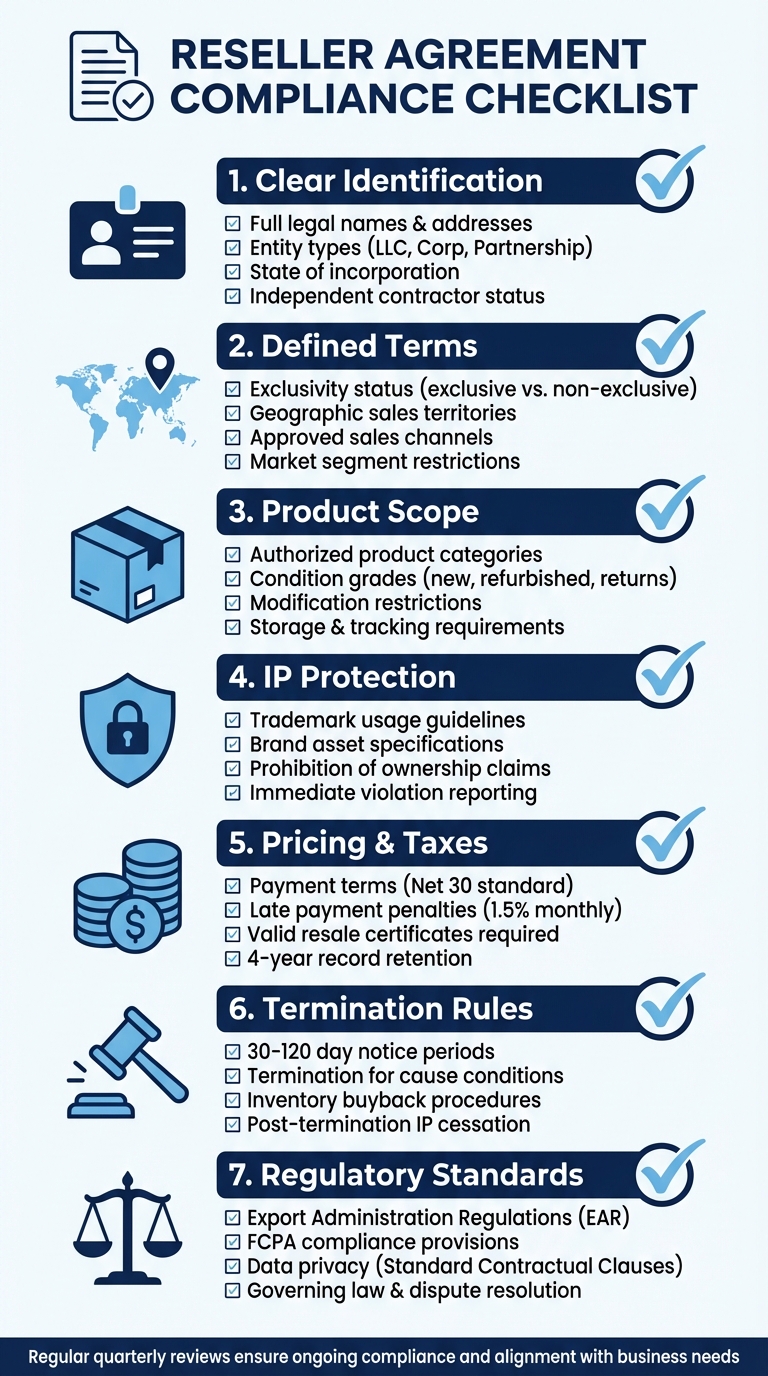

Managing reseller agreements is essential for avoiding legal, financial, and operational issues. These agreements define the relationship between suppliers and resellers, covering responsibilities like pricing, intellectual property use, and tax compliance. Ignoring these details can lead to disputes, penalties, and damaged partnerships.

Key Points:

- Clear Identification: Use full legal names, addresses, and entity types for both parties.

- Defined Terms: Specify exclusivity, sales territories, and approved channels.

- Product Scope: Detail authorized items, conditions, and handling rules.

- IP Protection: Outline branding rights, usage rules, and penalties for misuse.

- Pricing & Taxes: Include payment schedules, tax obligations, and resale certificate requirements.

- Termination Rules: Set conditions for ending agreements and post-termination duties.

- Regulatory Standards: Address export laws, privacy rules, and governing jurisdiction.

A structured reseller agreement protects your business, ensures compliance, and minimizes risks. Regularly reviewing and updating agreements helps maintain alignment with business needs and regulations.

7 Essential Components of Reseller Agreement Compliance Checklist

How to Draft a Solid Distribution Agreement for Franchise and Non Franchise States

Core Components of a Reseller Agreement

A well-crafted reseller agreement is essential to avoid disputes, ensure enforceability, and maintain compliance. Leaving out key details or using vague language can create unnecessary complications down the road.

Party Identification and Appointment Terms

Start with the essentials: the complete legal names and registered addresses of both parties. Use the full, registered business names - not trade names, nicknames, or abbreviations. Be sure to include the entity type (e.g., LLC, Corporation, Partnership) and the state of incorporation. This ensures the agreement legally binds the correct entity.

For instance, the agreement should clearly state the full legal names and addresses of both the supplier and the reseller, along with their business structures. It should also clarify the relationship between the parties, explicitly stating that they are independent contractors and not partners or joint ventures. This avoids unintended liabilities or misunderstandings.

To avoid problems later, verify the reseller’s legal standing by cross-checking their name against state business records. Even small errors in identification can complicate dispute resolution.

The agreement should also define the reseller's appointment terms. Specify whether the reseller is exclusive (the sole authorized seller in a specific territory) or non-exclusive (one of several). Outline the geographic territory and approved sales channels, whether online, in retail stores, through government contracts, or within specific market segments. For surplus inventory, clarify whether the reseller can operate across multiple platforms or is limited to certain ones.

Finally, ensure the agreement includes a clear definition of the products and services covered. This avoids future disagreements.

Product and Service Definitions

The agreement must detail the products and services the reseller is authorized to sell. For surplus inventory, this means being precise about product categories, condition grades (e.g., new, refurbished, customer returns), and any exclusions.

"The scope of the reseller's activities, the products and services to be resold... must be outlined explicitly within the agreement in order to fully protect both parties involved." - Genie AI

Consider using a dedicated exhibit or schedule to list authorized products and services. This approach allows for updates without renegotiating the entire contract, which is particularly useful when dealing with surplus inventory that may change over time. The agreement should also address whether the reseller is permitted to sell competing products or is restricted to your offerings.

Include provisions to prevent unauthorized modifications to products. For instance, prohibit altering serial numbers, repackaging items, or making technical changes without prior written approval. For surplus goods, specify whether the reseller can commingle inventory with other products or if items must be stored and tracked separately. This level of detail helps protect both parties from potential disputes.

Intellectual Property and Branding Rights

Intellectual property clauses are crucial for ensuring that vendors maintain full ownership of their assets - such as trademarks, patents, copyrights, and trade secrets - while granting resellers a limited, non-exclusive license to market and sell approved products.

"Entering into a license agreement enables an IP owner to authorize another party to exercise some of the IP owner's rights in the IP while retaining ownership and control of the IP." - Practical Law Intellectual Property & Technology

Ownership and License Rights

It's important to define what intellectual property assets resellers are permitted to use. This might include trademarks, copyrights, patents, or trade secrets. For software or SaaS products, the agreement should explicitly prohibit activities like reverse engineering, decompiling, or modifying the source code.

The agreement should also clarify whether resellers can sublicense intellectual property to third parties. Typically, this right is withheld to safeguard brand integrity. For surplus inventory resellers - such as those using platforms like ForthClear - specify whether they can use the manufacturer’s product images and descriptions or if they need to create their own marketing materials.

Trademark licensing should be strictly limited to product resale. This avoids inadvertently creating a franchise relationship, which could trigger additional regulatory requirements. Detailed brand usage rules are essential for further protecting the vendor's intellectual property.

Brand Usage Rules and Violation Procedures

A "Trademark Use Guidelines" exhibit is a helpful addition to clearly define how logos and brand assets should be used. This document should include details on approved visual styles, color codes, minimum size requirements, and prohibited modifications (e.g., altering logo colors, adding effects, or combining logos with other branding elements without explicit approval).

The agreement must also prohibit resellers from claiming any ownership of the vendor’s intellectual property. IP rights should never be transferred to the reseller. To ensure compliance, vendors should retain audit rights to monitor the proper use of branding and intellectual property.

For violations, the agreement should outline clear steps for resolution. Resellers must notify the vendor immediately if they discover unauthorized third-party use of the brand. The contract should define "Termination for Cause" specifically for IP misuse, giving the vendor the right to terminate the agreement immediately if branding rules are violated. Upon termination, the reseller must stop using the vendor’s trademarks, remove digital listings, and return or destroy all proprietary materials.

Pricing, Payment Terms, and Tax Obligations

Financial disagreements can quickly derail business relationships. To avoid conflicts, it's essential to clearly define prices, payment schedules, and tax responsibilities upfront. Ambiguity in these areas can lead to unnecessary friction and harm otherwise profitable partnerships.

Pricing Structure and Payment Schedules

Start by outlining all prices, discount levels, and any restrictions on resale pricing. For SaaS or digital products, clarify whether resellers are allowed to offer their own discounts or bundle services. Unchecked discounting can eat into your margins and hurt your brand's reputation. Additionally, include a process for price changes, specifying how much advance notice (typically 30-60 days) will be provided before adjustments take effect.

Lay out detailed invoicing procedures. Specify when invoices will be generated (e.g., upon shipment), payment terms (Net 30 is a common standard), and penalties for late payments (such as 1.5% monthly interest or the maximum rate permitted by law). Make sure to clarify who is responsible for customer billing and subscription renewals in cases involving recurring revenue models, as this helps avoid revenue loss.

Consider structured pricing models that encourage timely payments while ensuring consistent cash flow. For instance, offering early payment discounts for wire transfers made within a specific timeframe can accelerate cash flow and provide resellers with a financial incentive.

Reserve the right to adjust credit limits based on the reseller’s payment history or financial situation. Include audit rights in your agreement, allowing you to review the reseller’s financial records to ensure compliance. If you’re working with platforms like ForthClear for surplus inventory, specify whether pricing applies to wholesale lots or individual units, and detail any volume-based discounts.

Once pricing is clearly addressed, focus on tax collection and reporting obligations.

Tax Collection and Reporting Requirements

While tax compliance is primarily the reseller’s responsibility, your agreement should clearly document this. Require resellers to provide a valid resale certificate before shipping products - this safeguards you from potential sales tax liability. The certificate must include the purchaser’s name and address, their seller’s permit number, a description of the purchased property, a statement that the items are "for resale", the date, and a signature.

Avoid vague language. Purchase orders must explicitly state "for resale." Simply marking the tax amount as $0 on a purchase order doesn’t suffice. For repeat customers, a blanket resale certificate can be used to cover all similar transactions, eliminating the need for new paperwork each time.

Ensure resale certificates are obtained before billing, within the billing cycle, or upon delivery. Receiving certificates late doesn’t absolve tax liability. Both parties should retain copies of resale certificates and purchase orders for at least four years to support tax deductions in case of audits.

The agreement should also address district tax responsibilities, as rates can vary significantly by location. For example, California’s statewide sales tax is 7.25%, but additional district taxes can push the total higher. Since April 25, 2019, businesses with over $500,000 in combined California sales must collect district use taxes in every district where they are considered "engaged in business". Clearly state whether the reseller or vendor is responsible for tracking and remitting these location-specific taxes.

sbb-itb-bc600a0

Termination Procedures and Post-Agreement Duties

Even the strongest business partnerships sometimes come to an end. To avoid unnecessary legal and financial headaches, it’s essential to have clear termination procedures in place. Your agreement should spell out how either party can exit the relationship and what responsibilities remain after the agreement ends.

Termination Conditions and Notice Requirements

Start by outlining the specific conditions that allow for immediate termination. Common reasons for termination for cause include major breaches like intellectual property misuse, non-payment, or failure to meet compliance standards. For instance, if a reseller repeatedly misses payment deadlines or misuses your trademarks beyond the agreed terms, you should have the right to terminate the agreement immediately or after a short cure period.

"Ingram may terminate this Agreement immediately for cause upon written notice, which includes a ten-day cure period." - ContractsCounsel, Resale Agreement Sample

You should also include provisions for termination without cause (often called termination for convenience). This allows either party to end the relationship without a breach, provided they give adequate notice - usually between 30 and 120 days, depending on the complexity of the partnership. For example, Missouri’s Farm Implement Dealership statute requires a 90-day notice period before terminating or opting not to renew an agreement. Additionally, performance-based clauses can allow termination if sales targets or minimum purchase commitments are consistently not met.

Insolvency scenarios should be addressed explicitly. Most agreements permit immediate termination without notice if a party files for bankruptcy, becomes insolvent, or appoints a receiver. To avoid confusion, all termination notices should be required in writing and sent via certified mail or verified email to create a clear legal record.

"Inconsistent reasons for termination are a terminated distributor's best friend, and the supplier's worst nightmare, especially in front of a jury." - Armstrong Teasdale LLP

It’s also crucial to enforce termination standards uniformly across your reseller network. Uneven enforcement can weaken your position in court and leave you open to claims of unfair treatment. By clearly defining these termination conditions, you set the foundation for smooth post-agreement transitions.

Obligations After Termination

Once the agreement ends, specific post-termination responsibilities must be addressed, covering inventory, pending orders, intellectual property, and data security.

Inventory management is a key consideration. Decide whether you will repurchase unsold inventory at the original cost, offer a discounted rate, or allow the reseller a sell-off period (typically 30 to 90 days) to clear their stock. Without clear guidelines, disputes over leftover inventory can arise.

For pending orders, establish whether accepted but undelivered orders will be canceled or fulfilled. The Uniform Commercial Code requires that any resale of goods after a breach be conducted in a commercially reasonable manner, including appropriate notice to the other party.

Resellers must also immediately stop using your trademarks and remove proprietary materials from both physical and digital platforms after the sell-off period. Provisions like confidentiality, indemnification, limitation of liability, and dispute resolution should explicitly remain in effect even after termination.

Data security is another critical area. Resellers must have their access to systems like VPNs, cloud applications, and APIs revoked immediately. Additionally, they should provide a signed affidavit confirming the secure deletion of all sensitive data.

"When a vendor is offboarded, the vendor should return or securely delete all your records." - Mitratech Staff

For surplus inventory transactions on platforms like ForthClear, ensure that outstanding invoices are finalized and company assets are returned promptly. Using a centralized checklist can help coordinate efforts across IT, legal, and finance teams, ensuring no crucial steps are missed during the termination process.

Legal and Regulatory Compliance Requirements

A reseller agreement acts as a legal safety net, embedding compliance measures right from the start. By building these standards directly into your contract, you’re setting up protections upfront rather than scrambling to address issues later.

Regulatory Compliance Standards

When dealing with tech products, it’s essential to include compliance with the Export Administration Regulations (EAR) and Section 232 of the Trade Expansion Act. These provisions help prevent illegal exports and protect against national security risks.

Additionally, incorporate FCPA compliance provisions to prohibit bribery and ensure transparent financial recordkeeping. For data transfers, rely on Standard Contractual Clauses (SCCs) to meet privacy law requirements. Tailor these compliance measures to your industry’s unique needs, and don’t overlook adding anti-counterfeiting clauses - this is especially critical for surplus inventory platforms like ForthClear.

Governing Law and Dispute Resolution Methods

After setting regulatory standards, clearly define the legal framework for handling disputes. Specify the governing law and venue to avoid jurisdictional confusion. For example, if your business operates in Delaware, you could stipulate that Delaware law and courts govern the agreement.

To streamline conflict resolution, consider alternative methods such as binding arbitration or mediation. These approaches can resolve disputes more efficiently, saving both time and money while keeping matters confidential.

To maintain compliance throughout the agreement term, include audit rights that allow periodic reviews of the reseller’s records. Pair these rights with strict confidentiality clauses to protect sensitive information during and after the agreement. Leverage model agreements and checklists from trusted sources like the Office of the General Counsel (OGC) to ensure all necessary legal protections are in place. Following a structured review process - similar to those used by government agencies - can help ensure that legal, financial, and technical stakeholders approve all compliance standards prior to execution.

Conclusion

A reseller agreement isn’t just a piece of paperwork - it’s the legal and financial backbone that supports your business. By clearly defining roles, intellectual property rights, pricing structures, and tax obligations, such agreements shield your operations from potential disputes and regulatory pitfalls. The checklist provided emphasizes key measures to safeguard your business and ensure stability and compliance.

Keeping your agreements up to date is equally important. Regular reviews help you stay aligned with evolving business conditions and regulatory changes. The checklist serves as a practical reference to ensure no compliance detail is overlooked.

"A reseller agreement enables a business owner to retain authority over their brand while earning funds from other sources." - ContractsCounsel

Make it a habit to conduct quarterly reviews of pricing, tax procedures, and licensing requirements. Regularly auditing credit limits can also help mitigate financial risks. For more complex agreements or when export regulations shift, consulting specialized legal counsel is a smart move.

Whether you’re offloading excess inventory on platforms like ForthClear or running a traditional e-commerce operation, treating your reseller agreements as adaptable tools is essential. By keeping them dynamic and responsive to your business's needs, you’ll protect your brand, stabilize revenue streams, and minimize legal risks over time. Continuous monitoring, as outlined in the checklist, ensures every compliance aspect - from party roles to regulatory standards - is always up to date.

FAQs

What should be included in a reseller agreement to prevent disputes?

To minimize potential conflicts, a reseller agreement should spell out the essential terms and responsibilities in detail. This includes specifying the scope of the agreement, any territory restrictions, the pricing structure, payment terms, and the obligations of each party. It’s equally important to address intellectual property rights, define conditions for termination, and outline a clear process for resolving disputes.

By laying out these details from the start, both parties can avoid confusion and work together more effectively. Seeking advice from legal professionals or compliance experts can also help ensure the agreement aligns with all relevant regulations and business needs.

What steps can businesses take to meet tax compliance requirements in reseller agreements?

To navigate tax compliance in reseller agreements, businesses need to focus on proper documentation and a clear understanding of relevant tax laws. One key element is the use of valid resale certificates. These certificates let businesses purchase goods intended for resale without paying sales tax. However, to avoid potential tax issues, these certificates must be filled out correctly and securely stored.

It’s also crucial to understand state-specific regulations tied to resale certificates and tax reporting. For example, some states mandate that businesses report resale transactions and keep certificates on file for a designated time frame. Keeping up with both local and federal tax laws, maintaining detailed records, and ensuring accurate reporting are all essential steps to stay compliant.

What should I do if a reseller violates intellectual property rights?

If a reseller steps over the line and infringes on intellectual property rights, it’s crucial to address the situation head-on. Start by issuing a takedown notice to have the infringing content removed. You can also alert authorities, like customs, to stop unauthorized goods from entering the market. Should the issue continue, legal action for trademark or copyright infringement might be necessary to defend your rights.

Acting quickly doesn’t just protect your intellectual property - it sends a clear message about the importance of compliance within your reseller network.