Surplus inventory management is evolving. Businesses are moving away from outdated methods like bulk sales and wasteful disposal, which hurt profits and the planet. Instead, platforms like ForthClear offer smarter ways to resell or repurpose unsold goods, aligning with rising consumer demand for sustainable options.

Key points:

- Consumer trends: 80% of Gen Z prioritize sustainability in brand choices, while secondhand markets are booming (projected $350B by 2027).

- Financial challenges: Liquidating inventory traditionally recoups only 10–30% of costs, while returns processing can cost up to 66% of an item's price.

- Environmental costs: The U.S. discards $10B in e-waste annually, and extending product lifecycles can cut emissions significantly.

Modern solutions like ForthClear automate liquidation, reduce waste, and protect brand reputation. With features like secure payments, bulk pricing, and reverse logistics tools, these platforms help businesses recover more revenue while addressing consumer expectations.

How Liquidating Unwanted Goods Became A $644 Billion Business

1. Conventional Liquidation Methods

Traditionally, businesses have dealt with surplus inventory through bulk sales, auctions, or even destroying unsold stock to gain tax benefits. In 2023 alone, the U.S. retail industry faced around $428 billion in merchandise returns. To put this into perspective, the salvage and overstock goods market was valued at $644 billion in 2020. These staggering numbers highlight the massive volume of surplus inventory flowing through these conventional channels. Unfortunately, these methods often lead to inefficient financial recovery, creating further challenges for businesses.

Revenue Recovery

Unsold goods are often sold off quickly at steep discounts, which can significantly cut into profits. On average, returns make up 16.6% of sales, and processing a return can cost retailers as much as 66% of the item's original price. Even the most effective recovery programs for surplus inventory typically recoup only 10–30% of the original investment.

"The reduced revenue from liquidated goods often fails to cover the production and operational costs, leading to financial losses." - Jessica Gonzalez, Founder, Happen Ventures

To mitigate these losses, some companies opt for strategies like white labeling or private labeling their inventory before selling it to discount retailers, helping to shield their brand identity. Others leverage tax advantages: U.S. laws, for instance, allow for a 99% duty refund on destroyed unsold goods. However, in regions like Europe, tax structures often make donations more expensive than disposal. A striking example comes from France, where approximately €180 million worth of unsold hygiene and beauty products are destroyed annually. Similarly, Boston Beer Company, the makers of Truly Hard Seltzer, decided in 2021 to destroy surplus inventory instead of discounting it, aiming to protect their brand’s premium image.

Environmental Impact

The environmental toll of traditional liquidation methods is staggering. Companies spend 3–5% of their replacement capital each year on storage, security, and maintenance for idle goods that could otherwise be avoided. When surplus inventory ends up in landfills, the damage escalates. Diverting just one ton of material from a landfill can prevent up to 3 tons of CO2e emissions. In the EU, the value of destroyed textiles and electronics could reach as high as €21.74 billion annually. Extending the life of electronic devices by even one year could cut global e-waste by 16%. These environmental consequences only add to the logistical and financial challenges of traditional liquidation.

Operational Complexity

On top of financial and environmental concerns, conventional liquidation methods also complicate logistics. Retail systems are typically designed for forward logistics - moving products from manufacturers to consumers. However, reverse logistics, which involves handling returns and liquidations, is often neglected and inefficient. Poorly optimized processes drive up handling costs and reduce recovery value. In some cases, these inefficiencies lead to "obsolescence costs", where the expense of processing surplus inventory surpasses its remaining value.

Brand Reputation

Frequent clearance sales or heavy discounting can damage a brand’s image, especially among premium customers. Additionally, when eco-conscious buyers learn that companies destroy inventory to maintain exclusivity, the backlash can be severe. A growing number of consumers are paying attention to the environmental impact of their purchases - 77% of Americans express concern about this issue. In March 2025, 49% of Americans reported buying environmentally friendly products, up six percentage points from August 2024. Despite this growing awareness, only 64% of companies currently view liquidation or donations as a key part of their waste reduction or ESG (Environmental, Social, and Governance) strategies. This gap is notable, especially as ESG-focused funds have grown from $5.4 billion in 2018 to $51.1 billion in 2020. Clearly, there’s a pressing need for businesses to rethink their approaches to surplus management.

2. Eco-Friendly Liquidation Platforms (e.g., ForthClear)

Modern liquidation platforms are transforming the outdated take-make-dispose model by creating circular value chains. These systems extend product lifecycles, recover revenue, and promote more sustainable business practices.

Revenue Recovery

Eco-friendly platforms offer businesses a way to turn unsold inventory into profit by connecting them with verified bulk buyers. Take ForthClear, for example. Its Shopify integration simplifies the process by automatically identifying and listing dead stock. The platform operates on a flat 5% fee structure, only applied when a sale is successful. Payments are securely held in a Stripe escrow account and released to sellers once delivery is confirmed or after 14 days. To speed up clearance, sellers can use tiered pricing to incentivize bulk purchases with discounts for larger orders, making it easier to move surplus inventory while protecting margins.

"ForthClear has revolutionized how we handle excess inventory. The secure payment system and quality suppliers have made our sourcing process efficient."

– Gordon Belch, Co-founder, vybey

Environmental Impact

These platforms do more than just recover revenue - they also make a notable difference for the planet. By diverting surplus inventory to active markets, they help prevent waste and reduce the need for new production. This means longer product lifecycles and greater resource reuse, spanning categories like electronics, apparel, and even items close to expiration.

"Reimagining the traditional linear flow of supply chains to support circularity could be a growing source of value for companies, consumers, and the planet."

– McKinsey & Company

Advanced tools also make it easier to redistribute surplus across borders, ensuring supply meets demand in different regions.

Operational Complexity

Automation is a game-changer when it comes to simplifying liquidation. ForthClear, for instance, uses an auto-detection feature to scan inventory history and flag items unsold for over 60 days, cutting down on manual tracking. Additional tools like CSV bulk uploads and auto-image search streamline the product listing process.

"Easy to get started and offload some of our products that were nearing expiry date. Very helpful that ForthClear helps to find buyers in the process."

– Hylke Reitsma, Co-founder, vybey

The platform's escrow payment system further ensures secure transactions, holding funds until delivery is confirmed. This safeguards both buyers and sellers in B2B secondary markets.

Brand Reputation

Adopting circular liquidation strategies isn’t just smart for the bottom line - it’s also a way to stand out. Companies that align their surplus management with sustainability goals can enhance their brand image. This approach resonates with today’s consumers, who increasingly favor businesses committed to resource reuse and environmental responsibility.

sbb-itb-bc600a0

Advantages and Disadvantages

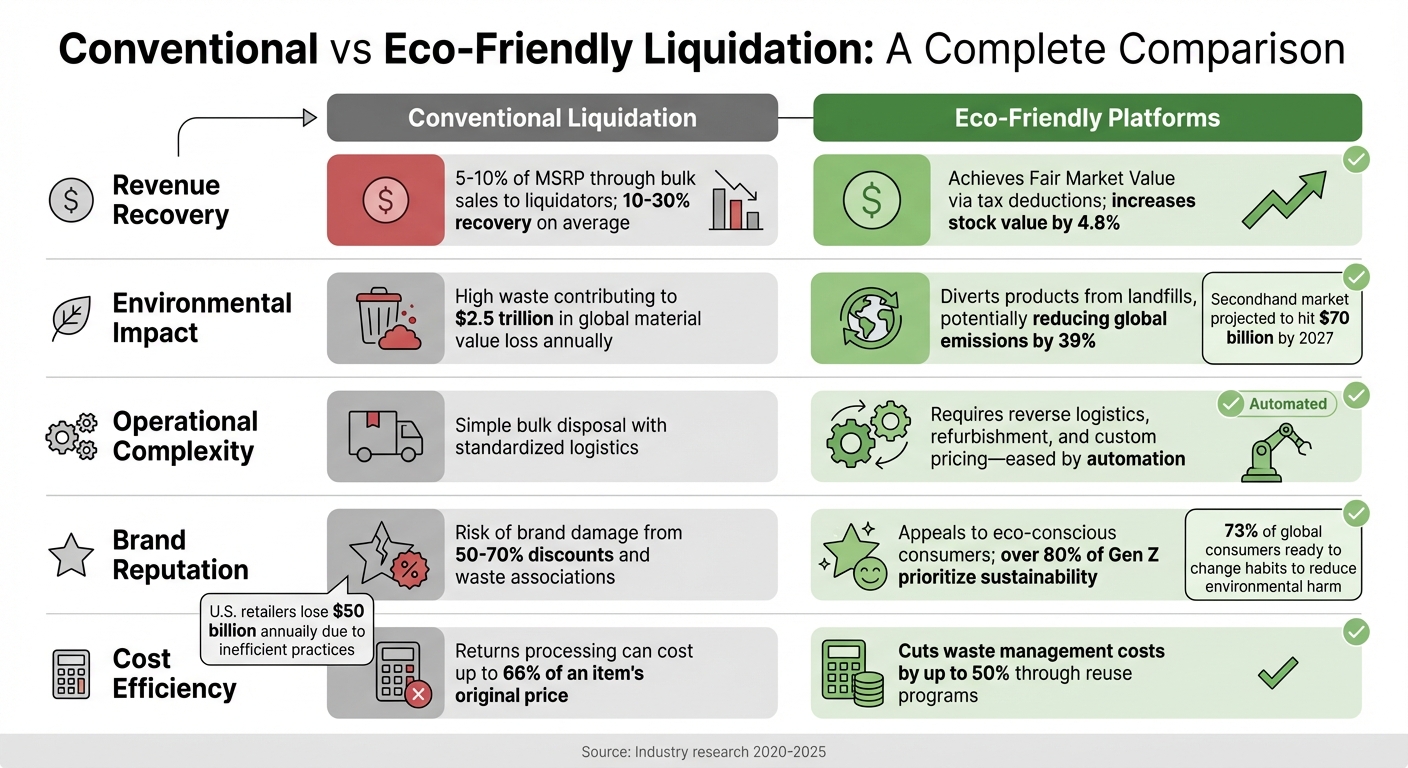

Conventional vs Eco-Friendly Liquidation: Revenue, Impact & Cost Comparison

Deciding between traditional liquidation and eco-friendly alternatives often comes down to balancing speed with long-term value. The table below provides a side-by-side comparison of how these approaches stack up for businesses managing surplus inventory.

| Criterion | Conventional Liquidation | Eco-Friendly Platforms |

|---|---|---|

| Revenue Recovery | 5–10% of MSRP through bulk sales to liquidators | Achieves Fair Market Value via tax deductions; increases stock value by 4.8% |

| Environmental Impact | High waste, contributing to $2.5 trillion in global material value loss annually | Diverts products from landfills, potentially reducing global emissions by 39% |

| Operational Complexity | Simple bulk disposal with standardized logistics | Requires reverse logistics, refurbishment, and custom pricing - eased by automation |

| Brand Reputation | Risk of brand damage from 50–70% discounts and waste associations | Appeals to eco-conscious consumers; over 80% of Gen Z prioritize sustainability when choosing brands |

| Cost Efficiency | Returns processing can cost up to 66% of an item's original price | Cuts waste management costs by up to 50% through reuse programs |

These differences highlight the trade-offs businesses face. Traditional liquidation methods are quick and straightforward, often involving bulk sales to liquidators at around 28% of MSRP. However, the financial toll is significant - U.S. retailers lose roughly $50 billion annually due to inefficient practices. On the flip side, the secondhand market in the U.S. is on track to hit $70 billion by 2027, signaling a shift toward more sustainable approaches.

"In the U.S. alone, retailers lose a staggering $50 billion annually due to inefficient liquidation practices."

– Jessica Gonzalez, Founder, Happen Ventures

Eco-friendly platforms, while more complex, offer compelling benefits. They require upfront work like diagnostics, repairs, and tailored pricing, but circular models are proving to be financially rewarding. With 73% of global consumers ready to change their habits to reduce environmental harm, sustainable liquidation aligns with both ethical and profitable goals.

Advancements in technology are also making these platforms more accessible. Features like automated dead stock detection and secure escrow payments simplify processes that once demanded extensive coordination. This evolution is opening the door for smaller businesses to adopt circular liquidation strategies.

Conclusion

Eco-friendly liquidation offers a smarter way to manage surplus while balancing financial goals with environmental responsibility. By following a value recovery hierarchy - starting with direct resale, then moving to repurposing, donation, recycling, and using disposal only as a last option - businesses can achieve both cost savings and environmental gains.

Modern tools and processes, like automation and secure transaction platforms, make liquidation more efficient. For instance, some platforms can flag inventory that hasn’t moved in over 60 days and facilitate escrow payments with verified bulk buyers. These features help businesses liquidate excess stock without compromising their brand image or resorting to steep discounts.

Industry leaders emphasize the strategic importance of sustainable liquidation:

"Sustainable asset decommissioning - the reselling or recycling of underutilized or obsolete machines and equipment - is not just about being green, it's about being smart." – Liquidity Services

To get started, audit your inventory to identify marketable surplus versus obsolete items. Then, consider connecting with a B2B marketplace like ForthClear, which charges only a 5% fee on successful sales.

FAQs

How do eco-friendly liquidation platforms like ForthClear help businesses recover revenue from surplus inventory?

Eco-friendly liquidation platforms, such as ForthClear, offer businesses a smart way to turn surplus inventory into a revenue source rather than a financial drain. By directly linking sellers with verified bulk buyers, ForthClear cuts out the middlemen, allowing companies to sell excess stock at competitive, market-driven prices. Features like real-time inventory tracking, escrow-protected payments, and streamlined communication simplify the process, ensuring faster and safer transactions. This approach helps reduce risks like non-payment and lowers carrying costs.

ForthClear also leverages advanced data tools to help businesses recover more revenue. With predictive analytics and break-even analysis, companies can set pricing strategies that protect margins without resorting to steep discounts. Real-time insights highlight slow-moving inventory, enabling businesses to act quickly and reduce surplus by up to 40%. Coupled with secure payment systems, these tools ensure efficient revenue recovery while promoting sustainable practices and cutting down on waste.

How does eco-friendly liquidation benefit the environment?

Eco-friendly liquidation plays a key role in reducing waste by giving usable products a second life instead of sending them to landfills. This not only cuts down on pollution but also helps conserve valuable resources. By redistributing surplus inventory, businesses can reclaim value from excess stock while contributing to sustainability. It also lessens the need to manufacture new products, which means fewer raw materials are extracted and processed - ultimately lowering carbon emissions tied to production.

On top of that, sustainable liquidation helps cut greenhouse gas emissions linked to storage and transportation. By managing inventory more efficiently and redistributing goods, fewer items are left sitting in warehouses, which reduces energy consumption for heating, cooling, and lighting. Reselling these surplus items also trims down the need for energy-heavy production cycles, further reducing the strain on the environment. This approach strikes a balance between protecting natural resources, cutting waste, and staying profitable.

How can businesses maintain their brand reputation while liquidating surplus inventory?

Businesses can safeguard their brand reputation during surplus liquidation by treating it as a chance to showcase their commitment to sustainability. Strategies such as refurbishing, recycling, or donating excess inventory not only minimize waste but also resonate with consumers who value eco-conscious practices. These steps help build trust and loyalty among customers.

To steer clear of negative impressions, companies should focus on non-destructive approaches like recycling, charitable donations, or offering items at discounted prices. Highlighting these efforts in marketing materials can further emphasize the brand’s dedication to responsible practices. Using a reliable platform like ForthClear adds another layer of assurance by facilitating secure and transparent transactions with verified buyers. By blending responsible inventory management with clear communication, businesses can transform surplus stock into an opportunity to enhance their brand image.