Managing surplus inventory is a major headache for businesses. It ties up cash, increases storage costs, and often forces companies to sell at a loss. Global supply chains, while cost-efficient, struggle with long lead times, unpredictable disruptions, and demand forecasting issues, leading to overstock. Localized supply chains, on the other hand, offer faster response times and better control but come with higher costs and scaling challenges.

Key Takeaways:

- Global Supply Chains: Prone to risks like geopolitical instability, long lead times, and the bullwhip effect, which amplify inventory imbalances.

- Local Supply Chains: Offer better visibility and quicker adjustments but face higher costs and limited scalability.

- Hybrid Models: Combining local and global sourcing can reduce overstock by 30% during disruptions.

- Tools & Strategies: AI-driven forecasting tools and platforms like ForthClear help businesses manage surplus effectively.

For businesses, balancing cost efficiency, speed, and risk management is crucial to avoid inventory pitfalls.

Why is the global supply chain so fragile and how can it be fixed?

Global Supply Chains: How They Create Surplus Inventory Risks

Global supply chains, with their intricate web of suppliers, manufacturers, and distributors spanning multiple countries, often lead to surplus inventory. These international operations are inherently risky, with economic shifts, logistical challenges, and unexpected disruptions frequently triggering overstock issues. Let’s break down some of the key factors behind these risks.

Political and Economic Uncertainty

Unpredictable trade policies and economic upheavals often force companies into premature or excessive inventory decisions. Take the 2018 US–China trade war, for instance. Shipping rates surged by more than 70%, prompting many businesses to stockpile goods in anticipation of further disruptions. When demand patterns shifted unexpectedly, these companies were left with surplus inventory.

Similarly, the Russia–Ukraine conflict caused energy and material shortages, especially in Europe, pushing companies to hold extra stock as a safety measure against supply interruptions. In fact, over 76% of European shippers reported supply chain disruptions in 2024, with many increasing their safety stock levels - only to see those buffers turn into surplus.

Exchange rate fluctuations add another layer of complexity. When a currency strengthens, companies often over-order to take advantage of lower costs. But if demand doesn’t meet expectations, they’re left managing excess inventory that eats into profits.

Extended Lead Times and Demand Forecasting Challenges

The long shipping times associated with global suppliers create a disconnect between when orders are placed and when goods are actually needed. This forces businesses to predict demand months in advance, a task fraught with uncertainty.

The bullwhip effect further complicates the situation. Even small changes in consumer demand can cause significant ripple effects upstream, as each link in the supply chain adds buffer stock to avoid running out of inventory. This overcompensation often leads to surplus.

Extended lead times also push companies to place larger orders to meet supplier minimums or to offset high per-unit shipping costs. Since 2020, increasing supplier delivery times have only made these forecasting challenges harder to manage.

How Disruptions Impact Inventory Management

Even the best-laid inventory plans can unravel when real-time disruptions strike. Global events can quickly turn carefully balanced stock levels into surplus.

For example, the semiconductor shortage hit the automotive industry hard, forcing manufacturers to rethink their inventory strategies as demand shifted unpredictably and chip production lagged behind. Similarly, natural disasters in manufacturing hubs and cyberattacks on logistics systems can grind operations to a halt or compromise data accuracy. Without reliable information, companies often make decisions that lead to misaligned inventory levels.

The lumber industry’s boom-and-bust cycle in 2021 is a perfect case study. Supply chain bottlenecks initially caused shortages, prompting companies to stockpile lumber at high prices. But when those bottlenecks cleared, the market was flooded, leaving businesses with excess inventory they couldn’t sell.

In 2024, nearly 80% of businesses reported supply chain disruptions, with global losses estimated at $184 billion. To hedge against such volatility, many companies build up safety stock. While this approach offers short-term protection, it often results in surplus inventory once market conditions stabilize.

Localized Supply Chains: Reducing Surplus Inventory Risks

As global supply chains grapple with numerous challenges, localized supply chains present a different approach, offering greater immediacy and control. By operating closer to home, businesses can better manage risks tied to surplus inventory and maintain tighter oversight of stock levels. Unlike global models, local systems provide a more streamlined way to handle inventory.

Better Visibility and Flexibility

Geographic proximity plays a crucial role in effective inventory management. Local supply chains strengthen relationships with suppliers and customers, enabling real-time insights and quick adjustments to orders.

Take, for example, a retailer in the U.S. sourcing goods domestically. They can adjust replenishment schedules and respond to sales trends within just a few days. In contrast, a retailer relying on overseas shipments might need weeks to make similar changes. This allows for smaller, more frequent shipments that align closely with actual market demand. Industries like fashion benefit greatly from this flexibility, as it enables quick restocking and adjustments for seasonal trends.

This operational adaptability also helps shield localized supply chains from global risks, which we’ll explore further in the next section.

Lower Exposure to Global Disruptions

Localized supply chains are naturally less exposed to the risks that often plague global operations. Issues like geopolitical tensions, trade policy changes, currency fluctuations, and cross-border regulations have a much smaller impact on local systems. Domestic operations also avoid international tariff hikes, which can complicate inventory planning.

Transportation challenges, such as port congestion, container shortages, and delays in international shipping, are also less of a concern. During the COVID-19 pandemic, many U.S. retailers and manufacturers pivoted to regional suppliers to sidestep these issues. Apparel brands sourcing fabrics domestically managed to restock popular items faster, while food distributors working with nearby farms experienced fewer disruptions.

Scale and Cost Limitations

Despite their advantages, localized supply chains come with certain trade-offs. Higher wages and stricter regulations in the U.S. can drive up costs, particularly for price-sensitive products. Local suppliers may also offer fewer options or specialized capabilities compared to global suppliers, which can limit product diversity.

Additionally, smaller regional suppliers often struggle to compete with the cost advantages and production efficiencies of large global manufacturers. Achieving economies of scale can be more challenging. To address these limitations, many companies adopt a hybrid strategy - sourcing critical or fast-moving items locally while using global suppliers for non-urgent or high-volume products. Advanced inventory management systems can help businesses strike the right balance by analyzing demand patterns, costs, and risk tolerance.

While localized supply chains may involve higher initial costs, the ability to reduce surplus inventory, respond faster to market changes, and enhance customer satisfaction often makes the investment worthwhile. Striking the right balance between cost and control is essential for successful inventory management.

sbb-itb-bc600a0

Global vs. Local Supply Chains: Surplus Inventory Management Comparison

Managing surplus inventory differs significantly between global and local supply chains. Each approach comes with its own set of strengths and hurdles, influencing how businesses handle excess stock and adapt to shifting market demands.

Risk Factors and Results

The challenges tied to global and local supply chains lead to distinct outcomes, particularly when it comes to managing surplus inventory.

Global supply chains often experience high inventory volatility. This is largely driven by amplified shifts in demand, which can result in overordering and subsequent surpluses when demand stabilizes. A clear example of this occurred in the 2021 lumber market, where shortages led to overordering, followed by a surplus and a sharp drop in prices.

While global supply chains typically offer lower per-unit costs, disruptions can dramatically increase surplus management expenses, including shipping, storage, and insurance costs. For instance, during the 2018 US–China trade war, shipping rates from China to the US West Coast soared by over 70%, adding to the financial strain of managing surplus inventory. On the other hand, local supply chains, despite higher production costs per unit, can better navigate these challenges. Their ability to adapt quickly to demand changes helps minimize overstock and avoids the high costs associated with long-distance logistics .

Additionally, local supply chains can adjust inventory levels within days, whereas global networks often require weeks or even months. This delay increases the risk of surplus buildup in global systems .

Comparison Table: Global vs. Local Supply Chains

| Factor | Global Supply Chains | Localized Supply Chains |

|---|---|---|

| Risk Exposure | High exposure to geopolitical and economic risks | Lower exposure, shaped by local conditions |

| Lead Times | Long and variable (weeks to months) | Short and predictable (days to weeks) |

| Inventory Volatility | High due to amplified demand signals | Lower with more precise demand matching |

| Cost Pressures | Lower unit costs but higher disruption expenses | Higher unit costs but fewer disruption costs |

| Response Speed | Slower, requiring multi-region coordination | Faster, aided by proximity and fewer layers |

| Supply Chain Visibility | Limited by fragmented regional data | High, with real-time monitoring and direct communication |

| Disruption Impact | Widespread and severe | Localized and easier to address |

| Recovery Time | Longer, requiring extended rebalancing periods | Quicker recovery from disruptions |

The data highlights these contrasts clearly. In 2025, global supply chain disruptions led to losses of about $184 billion annually, and 76% of European shippers faced disruptions in 2024. On average, disruptions lasting over a month occur every 3.7 years, underscoring the cyclical challenges faced by global networks in managing surplus inventory. Localized supply chains, with shorter lead times and better visibility, are generally more equipped to adjust before surplus issues escalate.

Fragmented data in global systems often delays the detection of inventory imbalances. In contrast, localized supply chains leverage real-time insights and direct communication with suppliers to prevent surplus .

These findings suggest that hybrid supply chain strategies could offer the best of both worlds. Businesses can rely on local suppliers for critical, time-sensitive items while maintaining global partnerships for high-volume, less urgent products, striking a balance between scale and agility in surplus inventory management.

Managing Surplus Inventory Across Supply Chains

Managing surplus inventory effectively requires a mix of precise forecasting, diversified sourcing strategies, and efficient liquidation methods. Together, these strategies help balance risks across both global and local supply chains.

Data-Driven Forecasting Tools

Forecasting tools like SAP Integrated Business Planning, Oracle NetSuite, and Microsoft Dynamics 365 leverage historical data, market trends, and AI to refine reorder points and minimize surplus. Companies using these tools have reported cutting excess stock by as much as 20%.

To stay on track, businesses should monitor key metrics like inventory turnover ratio, days sales of inventory (DSI), forecast accuracy, supplier lead times, and order fill rates. For example, consistently tracking DSI and forecast accuracy has helped companies reduce surplus inventory by 10-20% within a fiscal year. These metrics act as early warning signals, flagging when inventory levels deviate from optimal ranges.

Predictive analytics also help smooth out supply chain disruptions, like the bullwhip effect, by delivering more accurate demand signals. This prevents overreactions, which often lead to surplus stock piling up.

With more accurate forecasting reducing excess inventory, businesses can further safeguard their operations by adopting diversified sourcing strategies.

Diversified Sourcing and Partnerships

Diversifying your sourcing strategy means working with a mix of global and local suppliers rather than relying on just one. Companies that took this approach saw 30% fewer overstock incidents during major global disruptions.

A key step in this process is mapping out your supply chain and segmenting suppliers based on risk. This practice has been shown to cut overstock incidents by 30%. For instance, a US-based apparel retailer added local suppliers to their network, which reduced lead times and surplus inventory by 15% during international shipping delays. This hybrid model allowed them to enjoy the cost benefits of global sourcing while having local backup options for critical items.

Scenario planning and regular reviews of supplier performance can also help businesses identify potential issues before they escalate. During the 2018 US-China trade war, shipping rates from China to the US West Coast surged by over 70%. Companies with diversified supplier networks were able to pivot quickly, avoiding the inventory buildup that plagued businesses dependent on single-region sourcing.

Establishing relationships with regional suppliers early on ensures you can respond quickly to disruptions and minimize surplus inventory. However, even with strong forecasting and sourcing strategies, some surplus is inevitable - this is where efficient liquidation comes in.

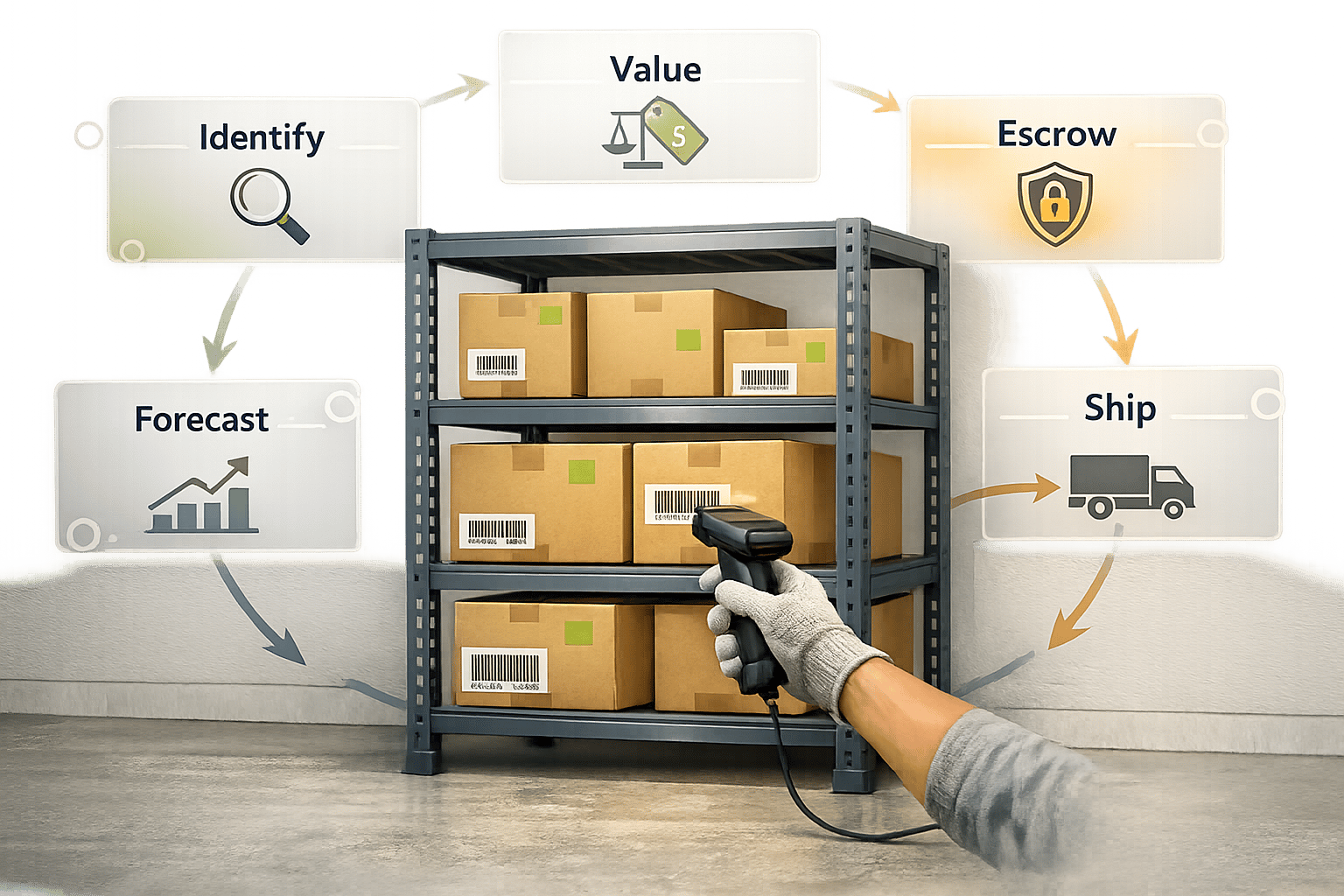

Using ForthClear for Inventory Liquidation

When excess inventory accumulates, finding an efficient way to liquidate it is crucial. ForthClear provides a secure platform that facilitates this process with features like escrow payments, verified suppliers, bulk pricing, real-time communication, and order tracking.

Electronics retailers, for example, have used ForthClear to offload surplus items, recovering up to 60% of their original value while connecting with new buyers. The platform’s escrow system, powered by Stripe Connect, ensures secure transactions by holding funds until goods are delivered and confirmed.

"ForthClear has revolutionized our approach to excess inventory with secure payments and quality suppliers", says Gordon Belch, Co-founder.

ForthClear supports a variety of inventory types, including electronics, apparel, and home goods, making it a versatile option for ecommerce businesses. Sellers can quickly list inventory manually or via CSV uploads, set tiered bulk pricing, and respond to buyer requests for quotes. With a 95% customer satisfaction rate and a 5-star rating, the platform has become a trusted tool for converting surplus into cash.

"Easy to get started and offload some of our products that were nearing expiry date. Very helpful that ForthClear helps to find buyers in the process", notes Hylke Reitsma, Co-founder.

Beyond financial recovery, ForthClear also supports sustainable commerce by keeping products out of landfills. This aligns with growing consumer demand for environmentally responsible practices while helping businesses maintain healthier cash flow.

A US-based electronics distributor showcased the power of combining AI-driven demand forecasting, diversified sourcing, and ForthClear liquidation during the 2021 global shipping crisis. This integrated strategy led to a 25% reduction in surplus inventory and improved cash flow, proving how these approaches can work together effectively.

Key Takeaways for Ecommerce Businesses

Managing surplus inventory in today's unpredictable market requires a well-rounded, adaptable strategy. Global supply chains, while offering cost benefits, come with challenges like extended lead times, political instability, and tricky forecasting. In fact, nearly 80% of businesses faced supply chain disruptions in 2024. On the flip side, localized supply chains provide better visibility and quicker response times, though they may come with higher costs and scaling limitations. The solution? A hybrid approach that blends the strengths of both.

This mixed sourcing strategy has proven effective. Businesses that combined global and local sourcing reported 30% fewer overstock incidents during major disruptions. It’s a way to balance cost efficiency with the agility needed to respond to market changes.

Another game-changer is advanced forecasting. Tools that track key metrics like inventory turnover and Days Sales of Inventory (DSI) can reduce surplus inventory by as much as 20%. These tools, when used proactively, help businesses stay ahead of potential issues.

When it comes to liquidating excess stock, platforms like ForthClear make the process seamless. Offering secure escrow payments, verified buyers, and a highly rated platform, ForthClear helps turn surplus inventory into cash while supporting sustainable business practices.

"ForthClear has revolutionized our approach to excess inventory with secure payments and quality suppliers", says Gordon Belch, Co-founder.

"Easy to get started and offload some of our products that were nearing expiry date. Very helpful that ForthClear helps to find buyers in the process", notes Hylke Reitsma, Co-founder.

The most resilient ecommerce businesses rely on a combination of accurate forecasting, diversified sourcing, and dependable liquidation platforms. This integrated approach not only safeguards cash flow but also ensures your business can adapt swiftly to market shifts.

FAQs

How can businesses balance the advantages of global supply chains with the flexibility of local ones to reduce surplus inventory?

To strike the right balance between global and local supply chains, businesses should aim to merge the cost advantages and diverse product options of global networks with the agility and quick response capabilities of local suppliers. This strategy allows companies to adapt swiftly to market demands while reducing the risk of accumulating excess inventory.

When it comes to managing surplus stock, tools like ForthClear can be a game-changer. This platform facilitates the buying and selling of surplus inventory across various categories, including electronics, apparel, and home goods. With features such as secure escrow payments, verified supplier networks, bulk pricing options, real-time communication, and order tracking, ForthClear not only streamlines the process but also supports sustainable practices and boosts operational efficiency.

How can AI-driven forecasting tools help manage surplus inventory, and what steps can businesses take to integrate them into their supply chain strategies?

AI-powered forecasting tools are transforming how businesses handle surplus inventory. By analyzing data patterns, these tools can predict demand with greater accuracy and flag potential overstock risks before they become an issue. They rely on advanced algorithms to sift through massive datasets, including sales trends, seasonal changes, and market dynamics. This allows companies to make smarter decisions about production and inventory levels.

To successfully integrate these tools into supply chain strategies, businesses should start by organizing and streamlining their data. From there, it’s essential to choose tools tailored to their specific needs - whether that’s real-time demand tracking or monitoring supplier performance. Equally important is training team members to understand and apply AI-driven insights in day-to-day operations. This combination of technology and human expertise can significantly improve inventory management while cutting down on waste.

How does ForthClear help businesses sell surplus inventory while supporting sustainable practices?

ForthClear simplifies the process of selling excess inventory by providing businesses with tools to list products, set bulk pricing, and handle buyer inquiries. Sellers can input inventory details - like SKUs, quantities, and prices - either manually or through a CSV upload. On the other side, buyers can search for available stock, submit requests for quotes (RFQs), and negotiate directly with sellers.

To keep transactions secure, payments are held in escrow and only released once the buyer confirms delivery. By connecting businesses to trade surplus stock, ForthClear not only helps reduce waste but also turns unused inventory into profitable opportunities.