AI is transforming how businesses handle surplus inventory, making it faster and smarter to manage. By analyzing real-time data like sales trends, demand forecasts, and competitor pricing, AI helps retailers reduce waste, increase revenue, and save time. Key benefits include:

- Faster decisions: AI reduces decision-making time from days to minutes.

- Better accuracy: Inventory tracking improves from 40% to nearly 100%.

- Higher recovery rates: AI-driven pricing boosts sell-through rates by up to 30%.

- Reduced waste: Companies cut dead stock and lower storage costs.

For example, H&M improved inventory turnover by 33% in one year, while IKEA reduced food waste by 30% using AI tools. Platforms like ForthClear automate tasks like pricing, listing, and channel management, helping businesses recover value from slow-moving stock without manual effort. AI turns liquidation into a data-driven process that saves money and maximizes returns.

LiquiFlow AI: Automating Inventory Liquidity & Dead Stock Recovery

How AI Identifies Slow-Moving and Excess Inventory

AI takes inventory analysis to a whole new level, replacing outdated manual tracking methods with continuous, automated insights. Instead of waiting for quarterly reviews to discover dead stock, AI systems analyze sales data in real time to detect problems as they arise. By pulling data from sources like sales orders, forecasts, inventory changes, and even external factors like weather or social media trends, these systems create a unified, up-to-the-minute view of inventory. This constant monitoring paves the way for detailed SKU-level analysis.

The true strength of AI lies in its ability to recognize patterns in data. It tracks the sales velocity of each SKU, comparing current performance to historical trends and regional benchmarks. If an item starts to slow down - or stops selling altogether - the system flags it immediately. As Chandler Kneer, Manager at Clarkston Consulting, points out:

"AI is exceptionally strong at pattern recognition, finding correlations that may not be apparent to human supply chain analysts."

And the results speak for themselves. In 2024, H&M used predictive analytics to assess historical sales and shifts in regional demand, boosting its inventory turnover from 3.9x to 5.2x annually while slashing production waste by 19%. IKEA also adopted AI-driven systems to manage food inventory in its store restaurants, cutting kitchen food waste by 30% in just one year.

AI-Powered SKU Analysis

AI digs deep into each SKU's historical performance and future demand, handling complexities that manual methods simply can’t manage at scale. It evaluates turnover rates and consumption patterns, identifying underperforming items. Beyond just looking at past data, AI predicts future risks by analyzing "weeks of supply" and consumption trends, flagging inventory likely to become excess before it even hits the end of its selling cycle.

This level of precision is a game-changer for businesses managing thousands of SKUs. AI-powered predictive models can achieve up to 98% accuracy in demand forecasting, far outpacing what human planners can achieve. With this granular insight, companies can adopt proactive inventory strategies. For example, AI uses ABC analysis to prioritize high-value items that carry the most financial risk if they turn into dead stock. This allows businesses to channel their liquidation efforts where they’ll make the biggest difference.

Automatic Alerts for Dead Stock

AI systems can also send automatic alerts when inventory meets specific criteria for dead stock. For instance, you can configure notifications to trigger when a product hasn’t moved in any customer segment for 60 days or more. Along with the alert, the system provides actionable recommendations, such as markdowns, bundling, or redistributing inventory to locations with higher demand.

This proactive approach transforms how businesses handle liquidation. Charlie Ifrah, Co-founder of INTURN, explains:

"By leveraging AI to predict inventory at risk of becoming slow-moving or excess, teams can understand the most effective way to offload that inventory earlier in the product lifecycle."

Automated alerts also integrate seamlessly with platforms like ForthClear, further streamlining the process. For example, the system can identify items sitting unsold for over 60 days and automatically list them for verified bulk buyers. This turns potential dead stock into recovered revenue - before it loses more value.

AI-Based Pricing for Liquidation

AI-powered pricing has revolutionized the way businesses approach liquidation, replacing guesswork with precise, data-driven strategies. Liquidation pricing is a delicate balancing act: set prices too high, and inventory lingers; go too low, and profits take a hit. By analyzing historical sales trends, brand popularity, material composition, and how long items have been on the shelf, AI can pinpoint the ideal price range for each product. Instead of relying on flat discounts or intuition, AI dives into past purchase data, pricing history, and product details to predict how price changes will influence sales.

A key concept driving this is price elasticity - how much demand shifts when prices change by 1%. For liquidation, AI evaluates whether steep discounts will generate enough sales volume to offset slimmer margins. It also accounts for time-sensitive factors like expiration dates or sell-through deadlines, dynamically adjusting prices to meet those targets. The results? AI can make pricing decisions 15 times faster than manual methods and deliver up to 30% higher sell-through rates.

Marshall Fisher, Santiago Gallino, and Jun Li, writing for Harvard Business Review, highlight the power of this approach:

"The essence of the approach... is the complete cycle of 'model, measure, maximize.' A piecemeal solution... may achieve minor improvements... But the integrated use of all three, powered by AI tools, will reward retailers with substantial improvements."

Real-world examples bring this to life. In 2023, a Chinese online retailer specializing in baby products implemented AI pricing for its top 30 feeding bottle SKUs. By analyzing competitor stockouts and brand preferences, the retailer increased revenue by 11% while maintaining a 10% gross margin. Similarly, a U.S. retailer applied dynamic pricing to over 10,000 home furnishing products and saw a 15% revenue boost and a 10% profit increase within a month.

This level of precision allows for real-time adjustments as market conditions change.

Real-Time Price Adjustments

AI doesn’t just set prices - it continuously fine-tunes them based on live market data. By monitoring competitors and inventory in real-time, AI can instantly respond to changes. For instance, if a competitor runs out of a similar product, AI might raise prices to capture higher margins. On the flip side, if demand slows or stock piles up, the system lowers prices just enough to move inventory without eroding profits. This flexibility is crucial for liquidation, where time is a critical factor. Retailers using AI-powered pricing often report gross profit increases of 5% to 10%.

Another benefit is price hygiene - ensuring pricing makes sense to customers. For example, AI ensures prices follow logical patterns (like ending in .99) and maintains reasonable differences between product sizes or brands. With tools like ForthClear’s AI-driven pricing, sellers can maximize the value recovered from surplus stock.

Tiered Pricing for Bulk Orders

AI doesn’t stop at individual pricing - it also optimizes bulk pricing to encourage larger purchases. For liquidation, tiered pricing is essential to drive volume sales. AI calculates price elasticity at a detailed level, predicting how bulk buyers respond to various discounts. Instead of offering a flat percentage off, AI models determine the likelihood of bulk purchases at specific price points, tailoring discounts to match buyer behavior. This strategy, often called price lining, uses psychological pricing techniques to nudge buyers toward larger orders. As sales data comes in, AI continuously refines these pricing tiers, even making adjustments within the same day for high-speed liquidation events.

Alasdair Hamilton from Awayco underscores the importance of this approach:

"The ability to set the 'right' price can spell the difference between eroding margins and sustainable growth."

Companies using AI-driven pricing report closing deals 12 percentage points more often than those relying on manual methods. For platforms like ForthClear, AI-powered tiered pricing integrates seamlessly with bulk upload tools, automatically calculating the best volume discounts based on factors like inventory age, stock levels, and current demand. This transforms liquidation from a static clearance sale into a dynamic, revenue-optimizing strategy.

Managing Multi-Channel Liquidation with AI

Handling surplus inventory across multiple sales channels can feel like a juggling act without the right tools. Listing the same SKU on websites, marketplaces, and B2B channels increases the risk of overselling if inventory updates aren’t instant. This is where AI steps in, offering a centralized view of inventory across all platforms. When a sale happens on one channel, AI ensures the inventory is updated everywhere else in real time, avoiding the delays caused by outdated batch updates that might only run once a day.

The stakes are high - studies show that around 60% of inventory records are inaccurate, and fixing these discrepancies can lead to a 4% to 8% boost in sales. By pulling data from ERPs, warehouse management systems, and point-of-sale terminals, AI creates a real-time "digital twin" of your inventory. This allows businesses to confidently manage and liquidate surplus stock across channels. Let’s take a closer look at how AI enables precise, real-time inventory tracking.

Real-Time Inventory Tracking

AI leverages tools like IoT sensors, RFID tags, and barcode scanners to track inventory movements as they happen. For instance, when a pallet leaves the warehouse or a box is scanned at checkout, the system instantly updates stock levels across all sales channels. This real-time synchronization is especially crucial during peak liquidation events, where delays can lead to costly errors.

AI-powered Supply Chain Control Towers take this tracking to the next level. These dashboards provide a comprehensive, real-time view of inventory across warehouses, helping identify potential issues - like a shipment arriving but not being scanned - before they cause disruptions. Companies using AI in their distribution processes have reported a 20% to 30% reduction in inventory levels by cutting redundancies and improving visibility. Platforms like ForthClear integrate these capabilities, allowing sellers to confidently list surplus stock with accurate, up-to-date inventory counts. With real-time data as a foundation, AI then shifts its focus to optimizing channel performance for even faster liquidation.

Channel Performance Optimization

AI doesn’t just track inventory - it also ensures it moves through the most effective channels. By analyzing sales velocity, customer behavior, and historical trends, AI identifies which platforms are performing well and which need adjustments. This data enables businesses to proactively transfer stock to high-demand channels or tweak pricing strategies to stimulate sales on slower platforms.

Take Danone, for example. By using AI-powered demand forecasting, the company reduced forecast errors by 20% and increased accuracy to 92%. With this level of precision, businesses can predict which channels will sell out first and shift inventory before stockouts occur. AI also uses digital twins to simulate "what-if" scenarios - like testing the impact of a 10% price drop or a bulk discount - without taking real-world risks. Companies that adopt predictive analytics for inventory planning are 2.3 times more likely to achieve above-average supply chain visibility and efficiency.

ForthClear’s platform incorporates these AI-driven insights, enabling sellers to track performance across buyer segments and fine-tune pricing or stock allocation based on real-time demand. The result? Faster stock clearance, fewer markdowns, and higher recovery value across all channels.

sbb-itb-bc600a0

Measuring AI's Impact on Liquidation Performance

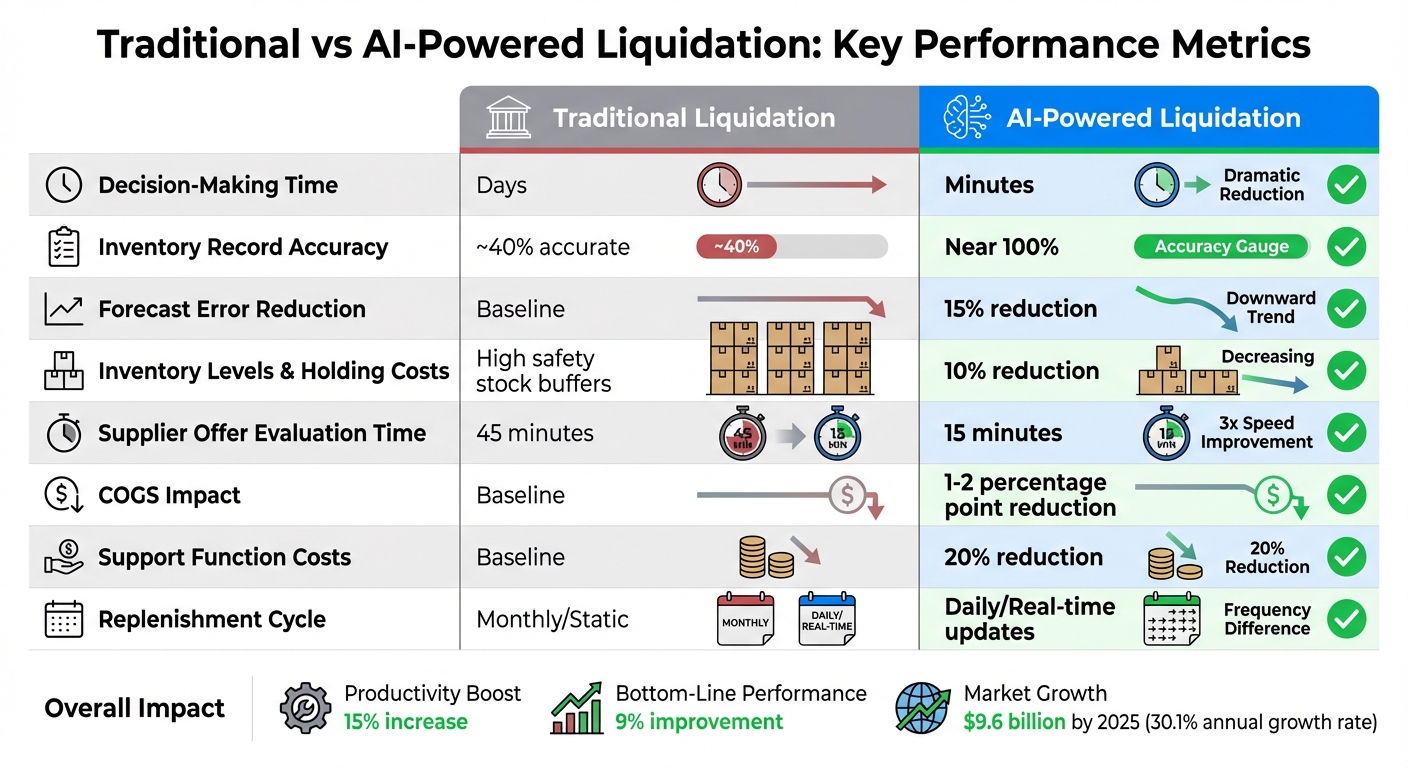

Traditional vs AI-Powered Liquidation: Performance Metrics Comparison

When it comes to liquidation, the numbers don’t lie - AI’s influence is clear and measurable. By focusing on specific metrics, businesses can see firsthand how AI enhances liquidation efficiency and profitability.

Key Performance Indicators to Monitor

One of the most telling metrics is inventory holding periods, which track how long stock sits unsold. AI helps cut these periods significantly by identifying slow-moving items early and dynamically adjusting prices. This means companies can free up cash tied up in inventory faster, with noticeable reductions in days on hand.

Another critical metric is forecast accuracy, which measures how closely demand predictions align with actual sales. AI-driven forecasting models can reduce errors by 15% or more, directly lowering the amount of excess inventory that needs liquidation in the first place.

Capital recovery rates are also worth watching. This metric shows how much of the initial investment is recouped during liquidation. With AI, businesses often see a 1 to 2 percentage point improvement in recovery rates, thanks to better pricing strategies and lower merchandising costs. Additionally, tracking dead stock reduction percentages reveals how much obsolete inventory is being cleared out, further boosting efficiency.

"You can't fix what you don't measure. And when it comes to inventory, the right KPIs help you spot issues before they become expensive problems." - Wasp Barcode Technologies

Another often-overlooked metric is decision-making cycle time - the time it takes to analyze inventory and set liquidation prices. AI can shrink this process from days to minutes, enabling businesses to react quickly to market changes. On top of that, reducing storage and carrying costs becomes easier as excess inventory is cleared faster, cutting down expenses tied to warehouse space, labor, and insurance.

Before and After AI Implementation

The shift from traditional liquidation methods to AI-enhanced processes brings noticeable improvements across the board. Here’s how these metrics stack up:

| Metric / Process | Traditional Liquidation | AI-Powered Liquidation |

|---|---|---|

| Decision-Making Time | Days | Minutes |

| Inventory Record Accuracy | ~40% accurate | Near 100% (via sensors/AI) |

| Forecast Error | Baseline | 15% reduction |

| Inventory Levels | High safety stock buffers | 10% reduction in levels and holding costs |

| Supplier Offer Evaluation | 45 minutes | 15 minutes |

| COGS Impact | Baseline | 1–2 percentage point reduction |

| Support Function Costs | Baseline | 20% reduction |

| Replenishment Cycle | Monthly/Static | Daily/Real-time updates |

AI doesn’t just speed things up - it transforms the entire workflow. Companies using AI-powered tools typically see a 15% boost in productivity and a 9% improvement in bottom-line performance. The growing demand for AI in inventory management is reflected in market projections, with the sector expected to hit $9.6 billion by 2025, driven by a 30.1% annual growth rate.

Platforms like ForthClear showcase these benefits in action. Their integrated AI tools enable sellers to monitor performance metrics in real time, making informed decisions about pricing, channel allocation, and stock prioritization. The result? Faster liquidation cycles, higher recovery values, and reduced storage costs - all backed by data-driven insights.

Setting Up AI-Powered Liquidation Workflows

To start integrating AI into your liquidation process, focus on solving a specific challenge - like managing dead stock or speeding up pricing decisions. This approach avoids the disruption of a complete supply chain overhaul and allows you to implement changes gradually.

The backbone of any AI-driven workflow is having clean, connected data. Begin by consolidating information from your ERP, warehouse, and sales channels into a single, real-time dashboard. Use AI-powered OCR to digitize any outdated, paper-based records. To test the waters, try running a one-week pilot on a small product batch or within a single warehouse zone to ensure the system’s accuracy.

Prioritizing Inventory for Liquidation

Once your data is unified and AI is in place, the next step is to determine which inventory should be liquidated first. Traditional ABC analysis - where "A" items account for 70% of your inventory value and "C" items only 5% - can feel static and outdated. AI takes this method to the next level by continuously analyzing each SKU based on real-time factors like demand, storage costs, and consumption patterns. This dynamic approach identifies high-value, slow-moving items for early liquidation and flags low-value stock for clearance, helping to minimize financial losses.

Take Sunbeam Foods as an example: they implemented an AI-driven classification system and saw their total inventory value drop by 52% while cutting excess stock by 80% over 17 months. AI handled the heavy lifting of categorizing thousands of products, allowing their team to focus on strategic decisions for high-value inventory. Automated triggers further streamlined their process, sending alerts when storage durations exceeded set limits or when holding costs outweighed potential recovery value.

Automating Listing and Performance Tracking

After identifying which items to liquidate, the next step is to simplify the listing process and track performance. AI can take minimal information - like a product image, URL, or basic title - and generate SEO-optimized descriptions tailored for platforms like eBay, Amazon, or Shopify. This automation eliminates hours of manual work while ensuring your listings are competitive right from the start.

Platforms like ForthClear illustrate how this can work in practice. By connecting their Shopify App, the system scans your inventory for unsold products and flags them for liquidation automatically. Listings can be created in minutes without manual data entry, and features like Auto Image Search even find product photos during bulk uploads. Real-time performance tracking lets you monitor which items are selling and adjust prices as needed. Secure Stripe escrow payments also ensure smooth transactions for both buyers and sellers.

Start by automating straightforward tasks, such as generating listings for surplus items that consistently sell. However, keep human oversight for unusual cases. For example, audit anomaly alerts every 30 days to catch pricing errors or stock shortages, and use those insights to refine your AI rules. This can reduce recurring issues by up to 50%. By balancing automation with human review, you can build confidence in the system while addressing any edge cases before they escalate into bigger problems.

Conclusion

AI is revolutionizing how businesses approach liquidation, turning it from a last-minute scramble into a strategic, data-backed process. With tools like automated visual tagging and listing generation, companies can achieve quicker processing, minimize waste by spotting near-expiry products early, and make smarter decisions with real-time pricing updates and predictive buyer matching. For instance, in early 2025, ThredUp leveraged AI visual tools to boost productivity by 10% and list 9% more items quarter-over-quarter.

Platforms such as ForthClear are bringing these advancements directly to Shopify merchants and other e-commerce businesses. Their Shopify App scans inventory automatically, flagging items that haven’t sold in over 60 days - eliminating the need for manual tracking. Features like Auto Image Search and AI-powered listing generation cut hours of tedious work down to just minutes. Plus, secure Stripe escrow payments and real-time performance tracking streamline the entire process.

FAQs

How does AI speed up and improve liquidation decisions?

AI-powered tools make liquidation smoother by quickly analyzing massive amounts of inventory data and delivering actionable insights in real time. Instead of spending days on manual reviews, machine learning models dive into sales history, market trends, and product conditions to recommend pricing and strategies almost instantly. This means businesses can make faster and smarter decisions.

These tools are also great at spotting overstocked items, identifying the best liquidation channels, and estimating potential revenue for each option. For instance, platforms like ForthClear use AI to boost efficiency by connecting sellers with the most profitable buyers, automating tasks like escrow payments, and speeding up listing and transaction processes. The benefits? Less waste, better cash flow, and quicker inventory turnover - key advantages for businesses managing liquidation in the U.S. market.

How does AI help improve inventory accuracy and minimize waste?

AI has transformed inventory management by introducing real-time tracking, predictive analytics, and automation. These tools allow businesses to keep a closer eye on stock levels, anticipate demand more accurately, and cut down on mistakes in managing inventory.

With the ability to swiftly align physical stock with digital records, AI helps reduce overstock, spoilage, and waste. This not only leads to smarter resource use and cost efficiency but also promotes a more sustainable way of handling surplus inventory.

How does AI help improve pricing strategies for faster inventory liquidation?

AI-driven pricing strategies use machine learning to process real-time sales data, market trends, competitor pricing, and inventory levels. These tools automatically adjust prices based on demand, striking the right balance between selling quickly and maximizing profits. For example, AI can predict how fast a product will sell and either discount slow-moving items to clear them out or increase prices on high-demand goods - all without requiring manual intervention.

On platforms like ForthClear, this approach can dramatically improve sell-through rates, shorten the time inventory remains unsold, and unlock capital stuck in excess stock. Businesses that adopt AI for pricing often experience faster inventory turnover, reduced storage costs, and a more efficient liquidation process overall.