Escrow services can make bulk sales safer for both buyers and sellers by acting as a neutral third party to hold funds until all conditions of a transaction are met. Whether you're purchasing thousands of products or shipping large orders overseas, escrow minimizes risks like fraud, non-payment, and disputes over product quality.

Key Takeaways:

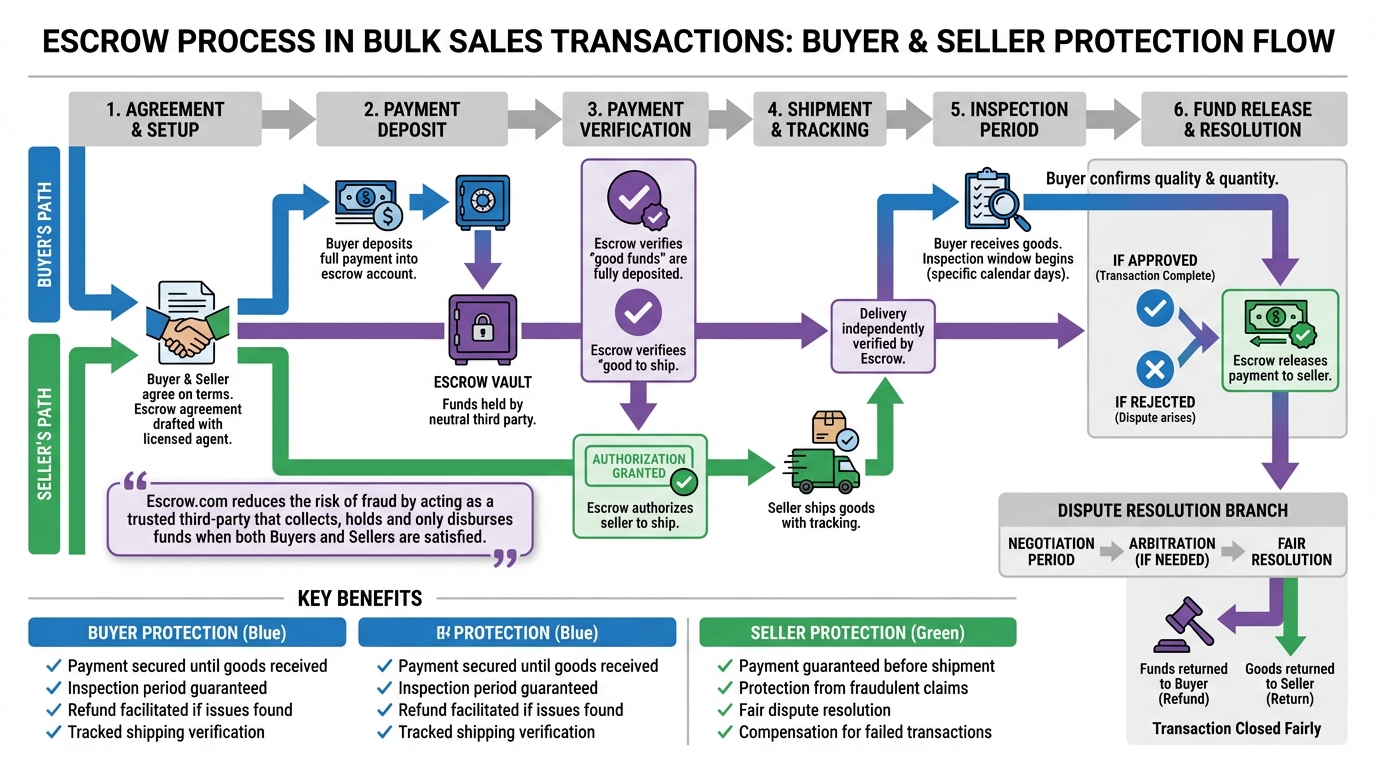

- For Buyers: Escrow ensures your money is secure until you receive and inspect the goods. If items are damaged or not delivered, refunds can be facilitated.

- For Sellers: Payment is guaranteed before shipment, reducing the risk of fraudulent claims or non-payment.

- Dispute Resolution: Escrow agents mediate conflicts, ensuring fair outcomes for both sides.

- How It Works: Funds are deposited with an escrow agent, released only after delivery confirmation and buyer approval.

Escrow provides peace of mind in high-stakes transactions, making it a reliable tool for managing financial risks in bulk sales.

How a Bulk Sale Escrow Protects the Buyer

sbb-itb-bc600a0

Common Risks in Bulk Sales

Understanding the potential pitfalls in bulk sales highlights the importance of using escrow mechanisms. When large inventories change hands, both buyers and sellers face considerable financial risks. Here's a breakdown of the challenges each side may encounter.

Risks for Buyers: Fraud, Non-Delivery, and Poor Quality

For buyers, the dangers are significant. Fraudulent merchandise or even scams involving fake escrow services can lead to major losses. Another common issue is non-delivery - where the purchased goods simply never arrive. And even when products are delivered, they might be damaged or fail to meet the agreed-upon standards.

Legal risks also come into play. For example, if bulk sale laws - such as notifying creditors - are overlooked, buyers could find themselves entangled in legal disputes. Additionally, in cases where sellers face financial trouble, there’s a chance they could misuse the buyer’s payment to settle other debts instead of fulfilling the order.

While these challenges are daunting for buyers, sellers also face their own set of risks.

Risks for Sellers: Non-Payment and Disputes

Sellers often worry about not getting paid, particularly in international transactions. There’s also the possibility of receiving fraudulent payments or funds that can’t be guaranteed.

Disputes over product quality can cause delays and complicate the transaction process. Another issue arises when shipping isn’t properly tracked - if a buyer claims non-receipt, the seller may struggle to prove delivery. In bulk sales involving business assets, sellers face additional risks from unsecured creditors who might attempt to void the sale or seize the goods after they’ve been delivered to the buyer.

These challenges make it clear that secure payment systems are essential for protecting both parties involved in bulk sales.

How Escrow Protects Buyers and Sellers

How Escrow Works in Bulk Sales: Step-by-Step Process

Escrow services act as a safety net for bulk transactions by holding funds with a neutral third party until all agreed-upon conditions are fulfilled. Platforms like ForthClear integrate escrow systems to provide a secure and transparent process for buyers and sellers.

Protection for Buyers

For buyers, escrow ensures your payment is safeguarded until specific conditions are met. Funds are only released after the escrow verifies that the payment is fully deposited and authorizes shipment. Once the goods are delivered, you get an inspection period to confirm the order's quality and quantity.

If the inspection reveals any issues, you can reject the shipment, and escrow facilitates the return and refund process. Additionally, requiring tracked shipping methods ensures that both shipment and delivery are independently verified, eliminating disputes over whether goods were sent or received. This system simplifies conflict resolution and provides peace of mind.

"Escrow.com reduces the risk of fraud by acting as a trusted third-party that collects, holds and only disburses funds when both Buyers and Sellers are satisfied." - Escrow.com

Protection for Sellers

Sellers benefit from the same structured safeguards. One of the biggest risks for sellers is shipping valuable goods without guaranteed payment. Escrow eliminates this concern by requiring buyers to make full upfront payment, which is only released after delivery is confirmed and the inspection period passes.

If a buyer makes a fraudulent claim about the goods, the escrow service holds the payment until the dispute is resolved. This prevents sellers from facing immediate financial losses and ensures a fair resolution process.

"If the buyer is unable or unwilling to complete the purchase, the seller is still able to receive payment according to the terms of the escrow agreement. This helps compensate sellers for lost time and expenses associated with a failed transaction." - American Deposit Management Co.

Using Escrow to Resolve Disputes

Escrow services also play a critical role in resolving disputes. If conflicts arise, the escrow system enforces a negotiation period. If no agreement is reached, formal arbitration determines how the funds should be disbursed.

The neutral escrow agent oversees this process and ensures that funds are only released once all contractual obligations have been genuinely fulfilled.

How to Use Escrow in Bulk Sales

When dealing with bulk sales, escrow services can provide an extra layer of security. Here's how to incorporate escrow into your process effectively.

Setting Up Your Escrow Agreement

Start by drafting a detailed escrow agreement. This document should name a licensed escrow agent and clearly outline the conditions for releasing funds - such as confirmation of delivery via tracking and a specific inspection period. Make sure to define the buyer's inspection window in calendar days, beginning from the confirmed receipt of goods.

The agreement should also spell out the escrow agent's responsibilities and limitations. For bulk sales involving business assets, include an "Allocation of Purchase Price" section. This part should break down amounts for items like furniture, fixtures, equipment, goodwill, inventory, and leasehold improvements. If you're conducting the transaction in California, ensure your escrow agent secures necessary tax "Certificate of Release" documents from state agencies (e.g., the State Board of Equalization, Employment Development Department, and Franchise Tax Board). This step protects you from inheriting any unpaid taxes from the seller.

Selecting an Escrow Provider

Choosing the right escrow provider is key to minimizing risks. Look for providers that meet strict licensing and operational standards. Verify that they are bonded and licensed by state regulators, such as the California Department of Financial Protection and Innovation or the Arizona Department of Financial Institutions. These providers are subject to regular audits to ensure proper handling of funds.

A trustworthy escrow provider will hold funds in dedicated trust accounts, reducing the risk of fraud or chargebacks. They should confirm that the buyer's payment qualifies as "good funds" before instructing the seller to ship the merchandise. Additionally, they should have clear protocols for handling disputes, including a set negotiation period before moving to arbitration.

For example, platforms like ForthClear integrate Stripe's secure escrow payments directly into their marketplace. Payments are held in escrow upon purchase and released after delivery confirmation or after 14 days if no disputes arise.

Adding Escrow to E-Commerce Platforms

For sellers using e-commerce platforms, integrating escrow services can simplify bulk transactions. If you're selling through Shopify, ForthClear’s app can automate much of the process. The app syncs with your inventory and flags items unsold for 60 or more days. Once a sale occurs, Stripe holds the payment in escrow until the transaction is finalized.

When you ship the goods, the platform updates tracking details automatically, triggering the inspection period. It also allows direct communication between buyer and seller for any clarifications.

If you manage your own e-commerce site, ensure your escrow integration is robust. It should send automatic notifications when tracking information updates, calculate inspection periods in full calendar days, and clearly communicate deadlines to both parties. These features help streamline the process and keep everyone on the same page.

Conclusion: Building Trust with Escrow

Bulk transactions come with their fair share of risks for both buyers and sellers. Buyers often worry about receiving subpar or incomplete goods, while sellers face concerns about delayed payments or fraudulent chargebacks. Escrow services help bridge this gap by acting as a neutral third party, holding funds securely until both sides meet their agreed-upon terms.

FAQs

How does escrow help prevent fraud in bulk transactions?

Escrow services play a crucial role in minimizing fraud in bulk transactions by serving as a neutral middleman. Here's how it works: the buyer deposits their payment into an escrow account, while the seller ships the goods. The funds are only released to the seller after the buyer has inspected and approved the shipment. This process ensures that sellers are paid only when the buyer is satisfied, addressing concerns like non-delivery, subpar goods, or payment scams.

Platforms such as ForthClear take this a step further by offering features like secure escrow payments, verified suppliers, and real-time communication. These tools help establish a reliable and transparent environment, making bulk transactions safer and smoother for everyone involved.

How does escrow help reduce risks in bulk sales?

Escrow services play a crucial role in making bulk sales safer and more reliable by acting as a neutral third party. They hold the buyer's payment until all agreed conditions are fulfilled, reducing risks like non-payment or receiving incorrect goods. This process offers peace of mind for both buyers and sellers.

Here’s how it works: Both parties first agree on the transaction details, such as the payment amount and delivery terms. The buyer then deposits the funds into the escrow account. Once the payment is confirmed, the seller ships the goods. After the buyer receives and approves the goods, the funds are released to the seller.

This step-by-step process not only safeguards high-value transactions but also builds trust between both parties, ensuring a smoother experience.

What should I look for in a reliable escrow service?

When selecting an escrow service you can trust, focus on platforms that emphasize secure payment options, verified seller information, and clear, straightforward procedures. These key elements are crucial for building confidence and reducing potential risks in your transactions.

Take ForthClear, for instance. This platform offers secure escrow payments, ensures suppliers are verified, and includes real-time communication features - making it a solid option for managing bulk sales. Always review the provider's reputation, confirm their payment systems are secure, and ensure their processes are transparent and user-friendly to safeguard your dealings.