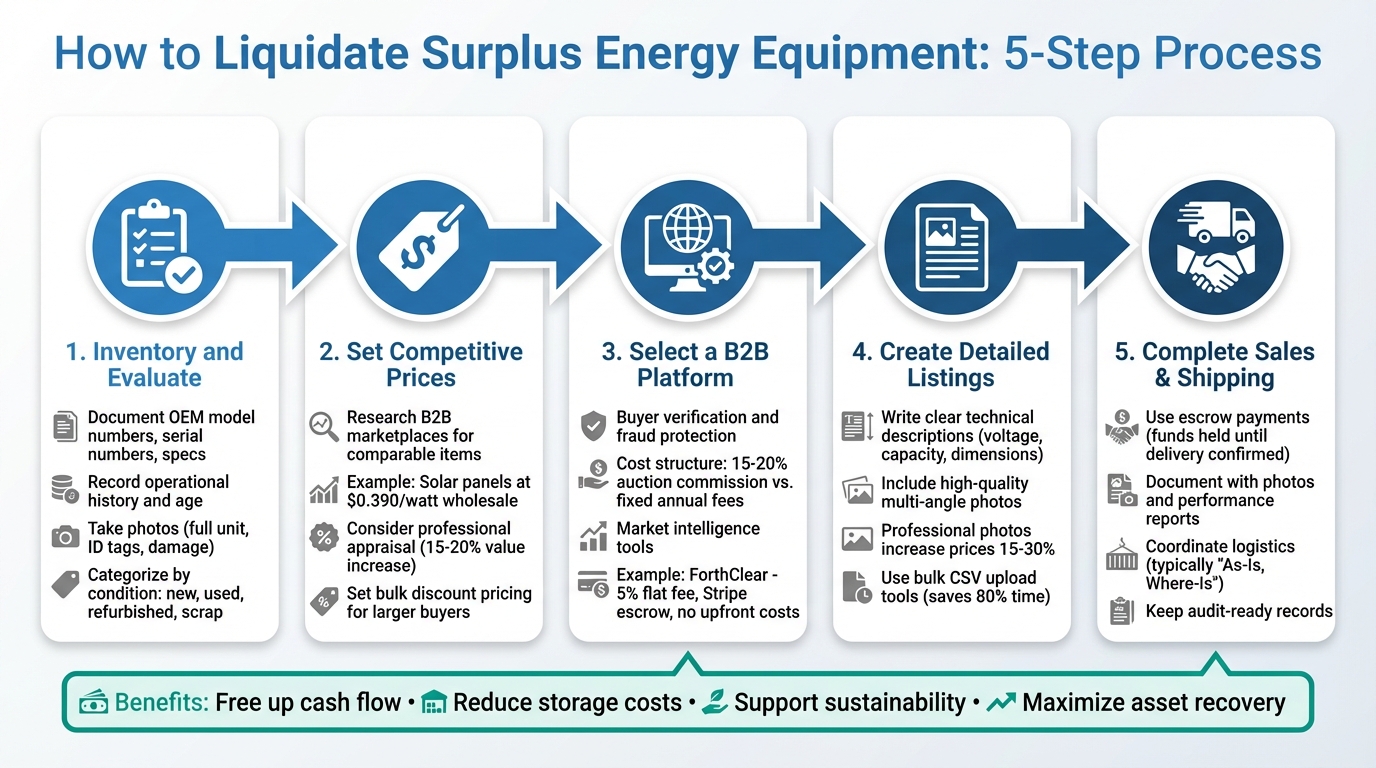

Selling surplus energy equipment can free up cash, cut storage costs, and reduce waste. Here’s a quick guide to getting it done right:

- Inventory and Evaluate: List all surplus items with detailed specs, operational history, and photos. Categorize by condition (new, used, refurbished, or scrap).

- Assess Value: Inspect for defects, review maintenance records, and research market prices to set competitive pricing.

- Choose a Platform: Use trusted B2B platforms like ForthClear for secure transactions, bulk pricing, and global reach.

- Create Listings: Write clear descriptions, include quality photos, and use bulk upload tools for efficiency.

- Handle Sales and Shipping: Use escrow payments for security, document transactions, and coordinate logistics carefully.

5-Step Process for Liquidating Surplus Energy Equipment

Step 1: Inventory and Evaluate Your Surplus Equipment

Create a Complete Equipment Inventory

Start by documenting every piece of surplus equipment in detail. Record unique identifiers like OEM model numbers, serial numbers, and brand names, along with key specifications. For instance, if you're dealing with generators, jot down capacity ratings (in kilowatts), voltage, fuel type (diesel, natural gas, or propane), and motor RPM (e.g., 1,800 or 3,600). For transformers, include kVA ratings, primary and secondary voltage, mounting type, and phase configuration.

Don't stop there - capture each unit's operational history. Note its age, total hours of operation, whether it was used as a primary or backup unit, and any added features like attachments or upgrades. Adding photos is equally important. Take clear pictures of the full unit, engine ID tag, hour meter, and any visible damage. These details make your listings more transparent and appealing to buyers.

"A disciplined, recurring review of slow‑moving or idle inventory is essential." - Liquidity Services

Organize your inventory into categories like power generation, transformers, motors, or pumps. Then, break these down further based on condition - new, used, refurbished, or scrap. A thorough inventory not only helps you stay organized but also lays the groundwork for assessing value and condition accurately.

Assess Condition and Determine Market Value

The condition of your equipment plays a big role in its resale value. Inspect each unit carefully for any defects, such as corrosion, rust, or burn marks. Equipment that’s been well-maintained and stored indoors often commands higher prices . For generators, consider conducting load bank testing to confirm their output. A successful test can significantly increase the final sale price.

Maintenance records and certifications are also key. They reduce buyer uncertainty and can make your equipment more attractive. Additionally, check whether the manufacturer still offers support and spare parts for the units you’re selling. Finally, research recent auction results and dealer listings to establish a competitive price point. This ensures you’re not leaving money on the table while staying realistic about market expectations.

Step 2: Set Competitive Prices

Once you've thoroughly evaluated your equipment's condition and market value, it’s time to set prices that work for both individual buyers and those interested in bulk purchases.

Research Current Market Prices

Pricing your surplus equipment correctly is crucial. Overpricing can lead to extended storage times, while underpricing means losing out on potential revenue. A good starting point is determining the fair market value through informed, low-pressure research.

Check out B2B marketplaces like AllSurplus, EnergyBin, and Equipment Trader to see what similar items are selling for. For instance, recent data shows Tier 1 high-efficiency monocrystalline solar panels selling at around $0.390 per watt in wholesale lots on secondary markets. Many industry exchanges also provide historical wholesale pricing for thousands of items, offering valuable benchmarks for fair pricing.

For specialized or high-value equipment, consider getting a professional appraisal. A third-party evaluation not only adds credibility but can also increase your sale value by 15-20% by easing buyer concerns. Some platforms even provide AI-powered valuation tools, which analyze market trends, real-time data, and comparable sales to help you price your assets accurately.

"If the price is too high, you'll have less interest in your listing; if the price is too low, you won't get the value you deserve for your equipment." - Equipment Trader

When setting your price, aim slightly higher than your target recovery value to leave room for negotiation. Timing also matters - seasonal demand and current inventory levels can play a big role in determining what buyers are willing to pay.

Once you've nailed down competitive pricing for individual items, it’s time to think about bulk discount strategies.

Set Up Bulk Discount Pricing

To attract larger buyers, incorporate bulk discounts into your pricing strategy. These discounts are especially appealing to B2B buyers who need large quantities, as they help offset freight costs for heavy equipment and provide flexibility. You can choose between quick cash flow through large one-time sales or steady returns via ongoing liquidation.

Decide whether to set a minimum order quantity or offer flexible options that cater to different buyer needs. Some buyers might want to acquire everything in one go to deploy capital quickly, while others may prefer smaller, incremental purchases. Bundling related items, like spare parts or accessories, can also boost your recovery rate and create opportunities for upselling.

"Monetizing slow-moving, over-max, or obsolete items frees square footage, trims carrying costs, and delivers fresh working capital." - Liquidity Services

Make sure to document your bulk pricing offers clearly. Including maintenance records and detailed condition reports for the entire lot can reduce buyer hesitation and support higher pricing.

Step 3: Select a B2B Liquidation Platform

Picking the right platform can make all the difference when it comes to recovering value, ensuring secure transactions, and speeding up the liquidation process.

What to Look for in a Platform

The best platforms go the extra mile to protect you from fraud and ensure you're working with legitimate buyers. They often pre-qualify buyers by conducting screening interviews, checking business references, and verifying compliance with regulations.

Another key feature is access to market intelligence tools. These tools provide insights like historical pricing data, supply and demand metrics for specific part numbers, and real-time updates on idle assets. They help you set competitive prices and maximize your returns.

Pay close attention to the platform's cost structure. Auction sites typically take a commission of 15% to 20% from the final sale price. On the other hand, some B2B exchanges charge a fixed annual membership fee, usually between $300 and $2,100. For instance, selling a $165,945 lot on an exchange platform could earn you $31,690 more compared to using a commission-based auction platform.

Choosing the right platform not only helps you recover value but also turns surplus equipment into working capital faster. Let’s take a closer look at how ForthClear makes this process even simpler.

How ForthClear Makes Liquidation Easier

ForthClear takes the hassle out of liquidation with its automated tools and secure transaction handling. Shopify users, for example, can leverage its native app integration to automatically detect surplus stock, eliminating the need for manual tracking.

To ensure secure transactions, ForthClear uses Stripe escrow payments. This system holds funds until the buyer confirms delivery - or after 14 days if no disputes arise - offering protection for both parties. Plus, with no upfront listing fees or monthly subscriptions, sellers only pay a flat 5% platform fee when a sale is successfully completed.

The platform connects you with verified bulk buyers worldwide and simplifies cross-border transactions with international shipping tools that include tariff estimates. Its bulk pricing management feature lets you offer tiered discounts (e.g., "Buy 50+ units, get 20% off") to encourage larger orders. A real-time messaging system also allows for direct negotiations, helping you close deals more quickly.

Even if you’re not a Shopify user, ForthClear has you covered. Its bulk CSV upload tool, equipped with an "Auto Image Search" feature, automatically finds product photos, saving you hours of tedious work.

sbb-itb-bc600a0

Step 4: Create Detailed Equipment Listings

When it comes to selling surplus energy equipment, detailed and clear listings are essential. A well-prepared listing not only attracts buyers but also speeds up the sales process, turning idle inventory into immediate cash flow.

Write Clear Descriptions and Include Quality Photos

Start by listing key technical specifications that buyers care about - voltage ratings, capacity, operational ranges, and physical dimensions. For instance, if you're selling a laboratory circulator, include details like: "8-liter capacity; temperature range -58°F to 392°F; 0-1000 rpm; dimensions 39" x 34" x 78"." Make sure to also mention the manufacturer, model number, serial number, and the equipment’s age.

Be upfront about the condition of the item. Whether it’s new-in-box, used and tested, or sold as-is, transparency builds trust with potential buyers. As Richmond Scientific points out, "laboratory equipment depreciates over time, even if it has only seen light use. New models, changing technology, and wear and tear all affect the price". Highlighting any wear, tear, or missing components can help avoid disputes down the line.

High-quality photos can make or break your listing. Clean the equipment thoroughly to remove dirt or grease, as this can significantly improve its appearance and perceived value. Capture clear, multi-angle shots, including close-ups of nameplates, serial numbers, and any unique features. Professional-looking photos can increase selling prices by 15% to 30% compared to poorly presented items. If the equipment requires specialized freight or rigging for shipping, make sure to clearly state this in the listing.

Use Bulk Upload Features for Efficiency

If you're dealing with a large inventory, manually creating listings for each item can be overwhelming. This is where bulk upload tools come in handy, allowing you to list multiple items at once using Excel or CSV files. These tools can reduce the time spent on data entry by as much as 80%.

For example, platforms like ForthClear’s Auto Image Search can simplify the process even further. By preparing a master inventory spreadsheet with all the necessary details - technical specs, model numbers, and condition assessments - you can upload everything in one go. This streamlined approach is especially useful for large-scale liquidations, where speed and efficiency are key to converting surplus equipment into cash quickly.

Step 5: Complete Sales and Handle Shipping

The last steps in liquidating surplus energy equipment involve securing payment and managing delivery logistics. These steps are crucial to ensuring a smooth and successful transaction.

Protect Transactions with Escrow Payments

When dealing with high-value energy equipment, using escrow payments adds an extra layer of security. Platforms like ForthClear offer secure Stripe escrow payments, where funds are held until both the buyer and seller fulfill their obligations. Here's how it works: after the buyer makes a purchase, the funds are held in escrow. They are only released to the seller once the buyer confirms delivery or automatically after 14 days if no disputes are raised. This process protects sellers from non-payment while giving buyers confidence that they’ll receive exactly what they ordered.

Reputable platforms also screen participants through interviews and professional references to ensure legitimate transactions. With payment security in place, you can confidently move on to organizing shipping and delivery.

Organize Shipping and Delivery

Once payment is secured, it’s time to handle logistics with care and precision. For large energy equipment, clear agreements and documentation are essential. A common industry practice is selling equipment "As-Is, Where-Is", meaning the buyer is responsible for removal and transportation. This eliminates relocation costs for the seller. To avoid delays, include a strict removal period in your sales agreement - typically within 48 hours to a few days. If the buyer doesn’t comply, they may forfeit the item without a refund.

To prevent disputes, document the equipment thoroughly with photos of serial numbers, data plates, and overall condition. For high-value items like decommissioned solar panels or laboratory equipment, consider providing a performance report from an independent certified testing company, such as TÜV Rheinland or PVEL, to ensure quality assurance.

Shipping costs are another key consideration. Buyers often cover freight expenses, but you might offer discounts or share the costs to close the deal. For international sales, platforms like ForthClear provide built-in tariff estimates, helping you calculate cross-border costs upfront and price your equipment competitively for a global market. If the equipment requires specialized packaging or rigging, partnering with professional logistics providers can help prevent damage and unexpected expenses.

For example, Liquidity Services successfully managed the sale and removal of 154 mobile refueling trucks across 36 sites in 20 states, showcasing the importance of efficient logistics coordination in large-scale asset recovery.

Lastly, keep detailed, audit-ready records throughout the process. Document asset valuations, bidding activity, final sale prices, and shipping confirmations. This not only satisfies finance teams and auditors but also supports sustainability reporting by showing how reselling equipment reduces waste and minimizes the environmental footprint of manufacturing new units.

Conclusion

Selling surplus energy equipment doesn't have to be complicated. By taking a structured approach - like cataloging your inventory, pricing items competitively, picking the right platform, crafting detailed listings, and ensuring secure transactions - you can effectively turn idle assets into working capital.

The advantages go well beyond just financial recovery. Clearing out unused equipment helps free up warehouse space, lowers storage costs, and reduces local inventory taxes. Plus, it lets your team focus on what they do best instead of getting bogged down in asset sales. These gains are a direct result of smart inventory management and thoughtful pricing strategies.

There’s also an environmental upside. When equipment gets a second life, it reduces the demand for manufacturing new products. This means fewer raw materials are extracted, less energy is consumed, and transportation emissions are minimized. In an industry increasingly focused on decarbonization and renewable energy, managing assets responsibly benefits both your business and the planet.

On top of that, ForthClear simplifies the entire liquidation process. With features like secure Stripe escrow payments, verified buyers, bulk pricing tools, and built-in tariff estimates, it’s easy to sell with confidence. And with a flat 5% platform fee applied only when a sale is made, you can maximize your returns while keeping transactions safe.

In short, evaluating your assets carefully, setting the right prices, and using secure sales methods can help you get the most out of your surplus equipment. Whether it’s decommissioned solar panels, lab gear, or mobile refueling trucks, don’t wait too long - sell now to capture peak market value and turn idle equipment into resources that drive your business forward.

FAQs

How can I determine the value of my surplus energy equipment?

To figure out how much your surplus energy equipment is worth, begin by looking at a few important factors: its condition, age, and the current demand for similar items. Checking the resale prices of comparable equipment on the market can give you a solid starting point.

You might also consider using industry-specific platforms with valuation tools or reaching out to professionals who specialize in pricing used equipment. These approaches can help you set a fair and competitive price, making it easier to attract the right buyers and get the best possible return on your inventory.

What should I look for in a B2B platform to sell surplus energy equipment?

When choosing a B2B platform to sell surplus energy equipment, there are a few important factors to keep in mind to ensure the process is both secure and efficient. First, take a close look at the platform’s reputation and security measures. A platform with verified buyers and sellers can help protect you from fraud and make transactions smoother. Trustworthy platforms create a sense of confidence, which is crucial when dealing with high-value equipment.

Next, check out the platform’s fee structure. Make sure the pricing is clear and aligns with your financial expectations. Transparent pricing allows you to weigh the costs against the potential returns without any surprises. Also, consider the platform’s buyer network. A marketplace with broad reach or one specifically targeting energy-related industries can help you connect with the right buyers faster.

Finally, features like real-time communication, secure escrow payments, and order tracking can make the entire process much simpler and safer. Platforms that focus on surplus inventory, such as ForthClear, often offer specialized solutions to help you sell effectively while also supporting sustainability efforts.

How do escrow payments make equipment sales more secure?

Escrow payments offer a safe and straightforward way to manage transactions by serving as a neutral middleman. Here’s how it works: the buyer’s payment is placed in an escrow account and remains there until they receive and approve the equipment. Once the buyer is satisfied, the funds are released to the seller.

This system safeguards both sides of the deal. Buyers can be confident they’ll get what they paid for, while sellers are assured they’ll receive payment without worrying about fraud. It’s an effective way to build trust, especially in high-value transactions like surplus energy equipment sales.