When you’re stuck with overstock, pricing it right for bulk buyers can turn a loss into cash flow. Here’s how to do it:

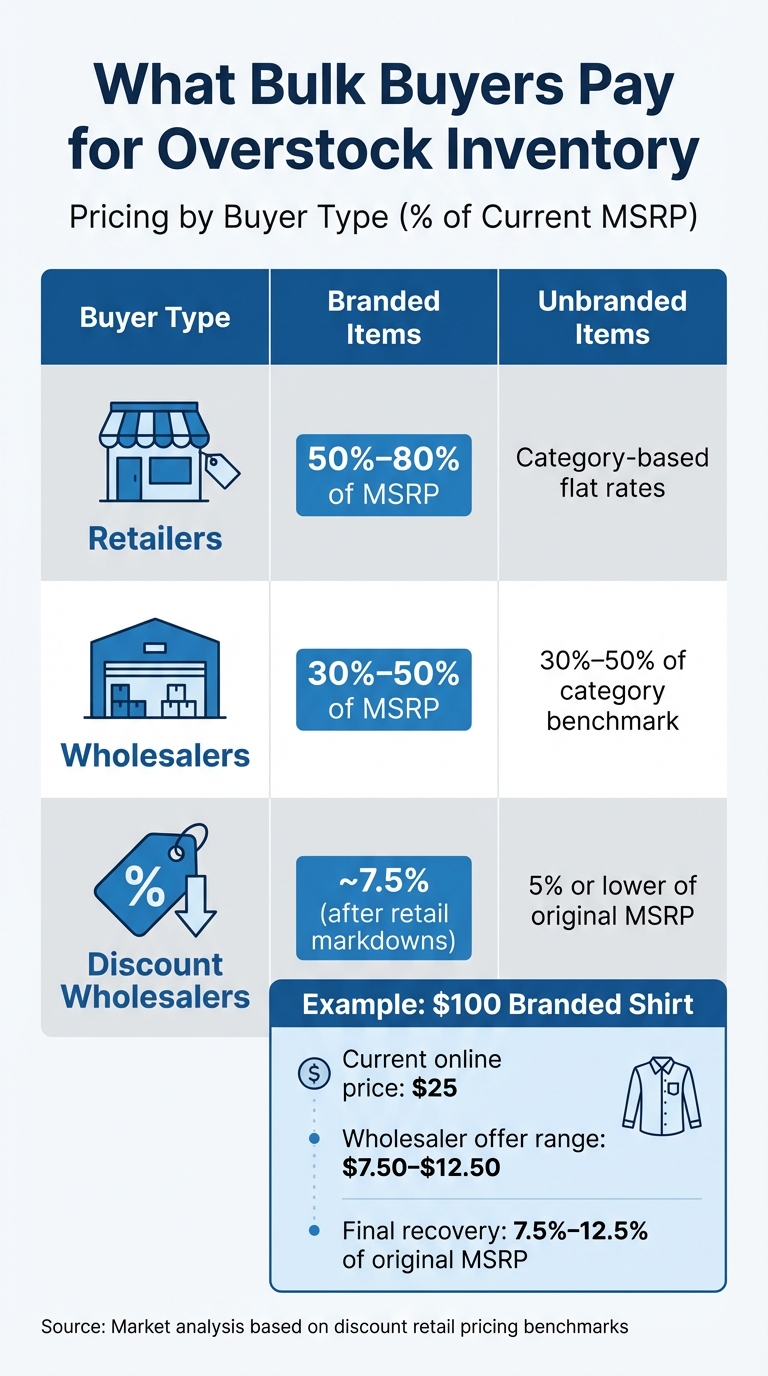

- Understand buyer pricing: Bulk buyers focus on resale margins, not original costs. Retailers pay 50–80% of MSRP, wholesalers 30–50%, and discount buyers as low as 5–7.5%.

- Factor in costs: Calculate your total landed cost (TLC), including product cost, shipping, duties, and overhead, to set a minimum price that avoids losses.

- Use tiered discounts: Offer lower per-unit prices for larger orders to attract buyers. For example, $10/unit for 100 units, $8/unit for 500 units.

- Research the market: Bulk buyers rely on the lowest online prices (e.g., Amazon, eBay) as benchmarks. Stay competitive by monitoring these trends.

- Clear inventory efficiently: Bundle items, apply spend-based discounts, and adjust prices based on holding costs or aging stock.

To manage and sell overstock effectively, tools like ForthClear can automate pricing, set bulk discounts, and connect you with verified buyers. Pricing overstock is about balancing quick sales with protecting your bottom line.

Identify Factors That Affect Bulk Pricing

Bulk Buyer Pricing Guide: What Different Buyer Types Pay for Overstock

Before setting bulk prices, it’s essential to understand what drives value for bulk buyers. Brand recognition plays a major role. Buyers often pay 50–80% of the MSRP for well-known brands, while unbranded items are priced using generic industry benchmarks.

The product category also impacts buyer interest. Popular items like home essentials and electronics tend to attract more bidders, which can push offers higher. On the other hand, niche products, such as specialized sporting gear, typically see fewer buyers, often resulting in lower offers. The size of your inventory matters, too. If you’re selling large quantities of a single SKU, buyers may see it as a financial risk and expect a lower per-unit price to compensate for tying up their capital.

Once you've assessed these factors, it’s time to look at market trends to refine your pricing strategy.

Research Market Demand and Trends

Market trends provide valuable benchmarks to complement your internal cost analysis. Bulk buyers often use the lowest price available online - commonly found on platforms like Amazon or eBay - as their pricing reference. For instance, if a $100 shirt is currently listed at $25, wholesalers might only offer $7.50–$12.50 for it. As Overstock Trader explains:

"Forget what you think your inventory is worth - what truly matters is what discount retailers such as TJ Maxx, Big Lots, or Ollie's are actually willing to pay."

Looking ahead, fast-moving categories for 2026 include consumer electronics, refurbished mobile phones, fashion goods, and small appliances. Shoppers are increasingly drawn to surplus and refurbished goods, especially in electronics and fashion, as sustainable alternatives. However, if too many sellers flood the market with similar inventory at the same time - often due to shared cash flow challenges - prices can drop significantly.

Calculate Holding Costs and Shelf Life

Holding inventory comes with costs that can’t be ignored. These include capital, storage, service, and risk costs, which together can account for 15% to 30% of the total inventory value for retail brands.

For non-perishable goods, inventory becomes "dusty" after about 12 months. Perishable items face even tighter timelines - the closer they are to expiration, the steeper the discounts must be. For example, consumer packaged goods lose 2.9% annually to spoilage, while personal care products see a 6% write-off from expiration. To manage this, calculate your "days cover" metric (closing inventory divided by daily sales velocity) to identify items that need aggressive bulk discounting.

Once you’ve factored in your holding costs, it’s time to analyze how competitors price similar inventory.

Review Competitor Pricing

Bulk buyers often determine pricing by referencing platforms like Amazon, eBay, and Walmart Marketplace. They’ll take the lowest price they find and cut it by an additional 50% to estimate their resale price, which then informs what they’re willing to pay you. Tools like Price2Spy (starting at $19.95/month) or Repricer (starting at $75/month) can help you track competitor pricing automatically.

It’s also helpful to know what discount retailers are paying for similar items. Here’s a breakdown of typical pricing by buyer type:

| Buyer Type | Branded Items (% of Current MSRP) | Unbranded Items |

|---|---|---|

| Retailers | 50%–80% | Category-based flat rates |

| Wholesalers | 30%–50% | 30%–50% of category benchmark |

| Discount Wholesalers | ~7.5% (after retail markdowns) | 5% or lower of original MSRP |

The condition of your packaging can also affect pricing. Products in retail-ready packaging typically fetch higher prices from discount retailers compared to items in basic e-commerce boxes. Additionally, some discount stores have strict price limits. For example, Dollar General won’t pay more than $2.50 for bed sheets, regardless of thread count or original quality.

Balancing your internal costs with market trends and competitor data ensures your bulk pricing stays competitive and appealing to buyers.

Calculate Minimum Costs to Cover Expenses

To safeguard your business from losses, it's crucial to establish a floor price that accounts for all inventory-related expenses. This baseline helps you structure competitive bulk discounts effectively.

Calculate Total Landed Cost per Unit

The Total Landed Cost (TLC) is the full expense required to bring inventory to a sellable state. It includes all associated costs:

TLC = Product Cost + Shipping/Freight + Duties/Taxes + Insurance + Overhead

For bulky, inexpensive items, transportation costs can account for as much as 40% of the TLC. Additionally, when selling overstock, don’t forget to factor in platform fees. For example, ForthClear charges a 5% fee, but only when a sale is completed.

If your shipment includes multiple SKUs, shared costs like shipping or insurance should be allocated fairly. You can divide these costs based on value, quantity, weight, volume, or even split them equally among items.

Once you’ve calculated your landed cost, incorporate indirect expenses to define your minimum price.

Set Minimum Price Points

To determine the absolute lowest price you can charge without incurring losses, calculate your fully loaded cost. This includes monthly fixed expenses and costs related to returns.

Start by dividing your monthly fixed expenses - such as warehouse rent, software subscriptions, and salaries - by your average sales volume to find the overhead cost per unit. Then, account for returns by calculating your average return rate and the cost per return, which includes expenses like shipping, inspection, and restocking. Adding these together gives you the fully loaded cost, ensuring that each sale contributes to keeping your business afloat.

Your minimum price must cover these expenses while leaving room for bulk discounts. For instance, in March 2025, OverstockTrader analyzed pricing for a branded dress shirt originally priced at $100 MSRP. If the shirt is now selling at TJ Maxx for $25, wholesalers typically pay between $7.50 and $12.50 per unit - 30–50% of the $25 discounted price. This means the seller receives only 7.5% to 12.5% of the original MSRP. If your landed cost plus overhead exceeds this recovery rate, you may need to adjust your pricing strategy or explore alternative buyers.

Structure Bulk Discount Pricing

Once you’ve determined your minimum price floor, the next step is to create a discount strategy that encourages buyers to purchase in larger quantities while still protecting your profit margins. For wholesalers, these margins typically fall between 15% and 50%. Striking the right balance is key - offering deals that are appealing without undercutting your bottom line.

Set Up Tiered Pricing by Quantity

Tiered pricing is a proven way to motivate buyers to place larger orders. The concept is simple: the more units a customer purchases, the less they pay per unit. For instance, you could set pricing like this:

- $10 per unit for orders under 100 units

- $8 per unit for orders between 100–499 units

- $6.50 per unit for orders of 500+ units

When designing your tiers, make sure they account for your operational costs. Larger orders often reduce per-unit handling expenses, which allows you to offer deeper discounts - such as 10% off at 500 units, 25% off at 1,000 units, and 40% off at 1,500 units.

It’s also smart to keep an eye on competitor pricing. If similar products are selling for $40–$50 elsewhere, aim to structure your pricing tiers to stay competitive within that range. While bulk discounts may lower your profit per unit, they can lead to faster inventory turnover and reduced holding costs, making the trade-off worthwhile.

Another way to encourage higher spending is by offering discounts based on total order value.

Offer Discounts Based on Total Spend

Spend-based discounts shift the focus from the number of units purchased to the total value of the order. This method works particularly well if you sell a variety of products with different price points. For example:

- 5% off orders over $500

- 10% off orders over $1,000

- 15% off orders over $2,500

This approach pushes buyers to increase their total spend, often adding more items to their cart to hit the next discount threshold. In fact, research shows that 83% of shoppers are influenced by discount coupons when making purchasing decisions.

If you’re looking for another creative way to increase order value, bundling products can be a game-changer.

Bundle Related Items Together

Bundling allows you to package multiple items together at a reduced price, making the offer feel like a better deal to customers. It’s also a smart way to move slower-moving inventory. For example, pairing a popular product with overstocked items can help clear out excess stock.

One retailer saw an 80% increase in bundled orders and quadrupled their average cart size - proof that bundling can be a powerful strategy.

When creating bundles, be sure to calculate your margins carefully. For products with a margin of 50% or higher, you can offer a 10–20% discount. For lower-margin items, stick to a smaller discount of 5–10%. Naming your bundles based on their benefits or use cases - like “Beach Vacation Kit” or “Ultra Smooth Package” - can make them more appealing and easier for customers to understand.

Finally, don’t overwhelm buyers with too many options. Too many choices can lead to decision fatigue, which may hurt your conversion rates. Instead, keep your bundle offerings limited and focused.

sbb-itb-bc600a0

Use ForthClear for Overstock Management

Once you've nailed down your pricing strategy, it's time to bring it to life. With ForthClear, you can list products, handle bulk orders, and ensure secure transactions. Its automated tools for managing surplus inventory align perfectly with any bulk discount strategy you’ve set up.

Detect Unsold Inventory Automatically

ForthClear’s Shopify App takes the guesswork out of identifying dead stock - products sitting unsold for more than 60 days. It even pulls product images automatically for easy listing. There’s no cost to list items, and you only pay a 5% fee when a sale is completed.

Configure Tiered Bulk Discounts

Want to move inventory faster? ForthClear makes it easy to set up tiered pricing. You can define quantity ranges - like 100 to 500 units - and assign discount percentages using its Bulk Pricing Estimator. This tool calculates everything for you, including base prices, discount tiers, and fixed costs like shipping or packaging. Plus, the platform’s messaging system lets buyers request custom quotes, while the Overstock Reduction Planner helps you test and refine pricing strategies for maximum clearance success.

"Easy to get started and offload some of our products that were nearing expiry date. Very helpful that ForthClear helps to find buyers in the process."

- Hylke Reitsma, Co-founder, vybey

Secure Payments with Verified Buyers

Security is a top priority when it comes to bulk transactions. ForthClear uses a Stripe-powered escrow system to hold funds until delivery is confirmed. If no disputes arise, payments are automatically released after 14 days. The platform also simplifies international sales with built-in tariff estimates and connects you to a verified network of buyers. All negotiations are managed through ForthClear’s secure messaging system.

"ForthClear has revolutionized how we handle excess inventory. The secure payment system and quality suppliers have made our sourcing process incredibly efficient."

- Gordon Belch, Co-founder, vybey

Track and Adjust Pricing Over Time

Setting bulk pricing isn’t a one-and-done task. Market conditions shift, inventory ages, and buyer preferences evolve. To stay competitive and maintain profitability, you need to regularly revisit and fine-tune your pricing strategy. This ensures you keep inventory moving while protecting your bottom line.

Monitor Sales and Inventory Metrics

Keeping an eye on key performance metrics is essential. For instance, the inventory turnover ratio - calculated by dividing your Cost of Goods Sold (COGS) by your average inventory value - should ideally land between 4 and 6 annually for e-commerce businesses. A lower ratio might signal sluggish sales or overstock issues.

Pay attention to your days of inventory cover. If it exceeds 30–60 days, it may be time to apply steeper bulk discounts. Another critical metric is the sell-through rate, which you calculate by dividing units sold by total units received. A rate of around 70% is often a good target for long-term products. Additionally, if a product contributes as little as 0.2% to your total revenue but has been sitting unsold for months, it might be time to price it aggressively for liquidation. Reviewing "dusty inventory" reports regularly, as mentioned earlier, can also help you identify slow-moving items.

These metrics aren’t static - adjust your pricing strategy as they shift.

Adjust Pricing Based on Market Conditions

Real-time market data should guide your pricing updates. Bulk buyers often base their resale targets on the lowest online price, typically reducing it by 50% to remain competitive.

"Often the lowest price found online is where they [bulk buyers] draw the comp from, not the highest." - Overstock Trader

Be mindful of market saturation. If discount channels are flooded with similar products, your overstock value could drop. For items older than 12 months, consider them obsolete and price them for quick clearance. For perishables, use a tiered markdown approach: apply an initial discount at 6 months from expiration, increase the discount at 3 months, and liquidate entirely at 1 month.

Static spreadsheets won’t cut it here. Use real-time analytics to respond quickly to changes in demand or competitor pricing. For example, if a product category holds a disproportionate share of your inventory compared to its revenue contribution - say, 40% of inventory but only 25% of revenue - consider offering targeted bulk discounts or creating bundles to move that stock.

Conclusion

Bulk pricing is all about what buyers are willing to pay, not necessarily tied to the original cost. Market pricing hinges on demand, making it essential to understand that the value of your overstock lies in buyer interest rather than production expenses.

"The value of your excess inventory extends far beyond traditional metrics like cost of goods and MSRP. In the discount and closeout market, the true worth of your products is defined by what professional retail buyers... are willing to pay." - Overstock Trader

This insight helps shape both your pricing floor and discount strategies. Start by calculating your total landed costs to determine a break-even price. From there, implement tiered discounts and bundle offers to encourage larger purchases and move inventory faster. Companies that embrace digital pricing strategies often see margin gains of 2% to 7% within three to six months.

FAQs

How do I set the right discount for bulk buyers?

To determine the right discount for bulk buyers, start by digging into your costs and profit margins. This will help you set volume-based discount tiers that still leave room for profitability. For instance, you could offer a 10% discount for orders between 100 and 500 units, and a 20% discount for purchases exceeding 500 units.

Take into account additional factors like shipping expenses and current market trends to ensure your pricing stays competitive without cutting too deeply into your margins. Analyzing past sales data can also provide valuable insights, helping you fine-tune your discount strategy to match your inventory levels and customer preferences. Testing different discount tiers and keeping an eye on the results will guide you toward striking the right balance between moving excess stock and boosting revenue.

What should I consider when setting a minimum price for overstock items?

When setting prices for overstock items, you need to account for both fixed costs (like storage fees) and variable costs (such as shipping and platform charges). It's also smart to factor in the risk of depreciation or products becoming outdated - this helps reduce potential losses and speeds up inventory turnover.

The goal is to find a price point that moves surplus stock quickly while still safeguarding your profit margins. This way, you can clear out excess inventory without compromising your financial bottom line.

How does market saturation impact pricing for overstock items?

When the market is flooded with similar products, pricing overstock items becomes a tricky balancing act. A surplus means more competition, giving buyers plenty of choices and often pushing prices downward. To remain competitive, you might need to adjust your prices, but don’t forget to factor in costs like storage, depreciation, and platform fees to avoid cutting too deep into your margins.

Another challenge in a saturated market is slow-moving inventory. To tackle this, consider strategies like offering discounts or bundling products to encourage quicker sales. The key is to analyze demand, assess how appealing your product is, and keep an eye on competitor pricing. This approach can help you strike the right balance between clearing out inventory and maintaining profitability.