Struggling with surplus inventory? Here’s how to price it for a quick sale while protecting your profits:

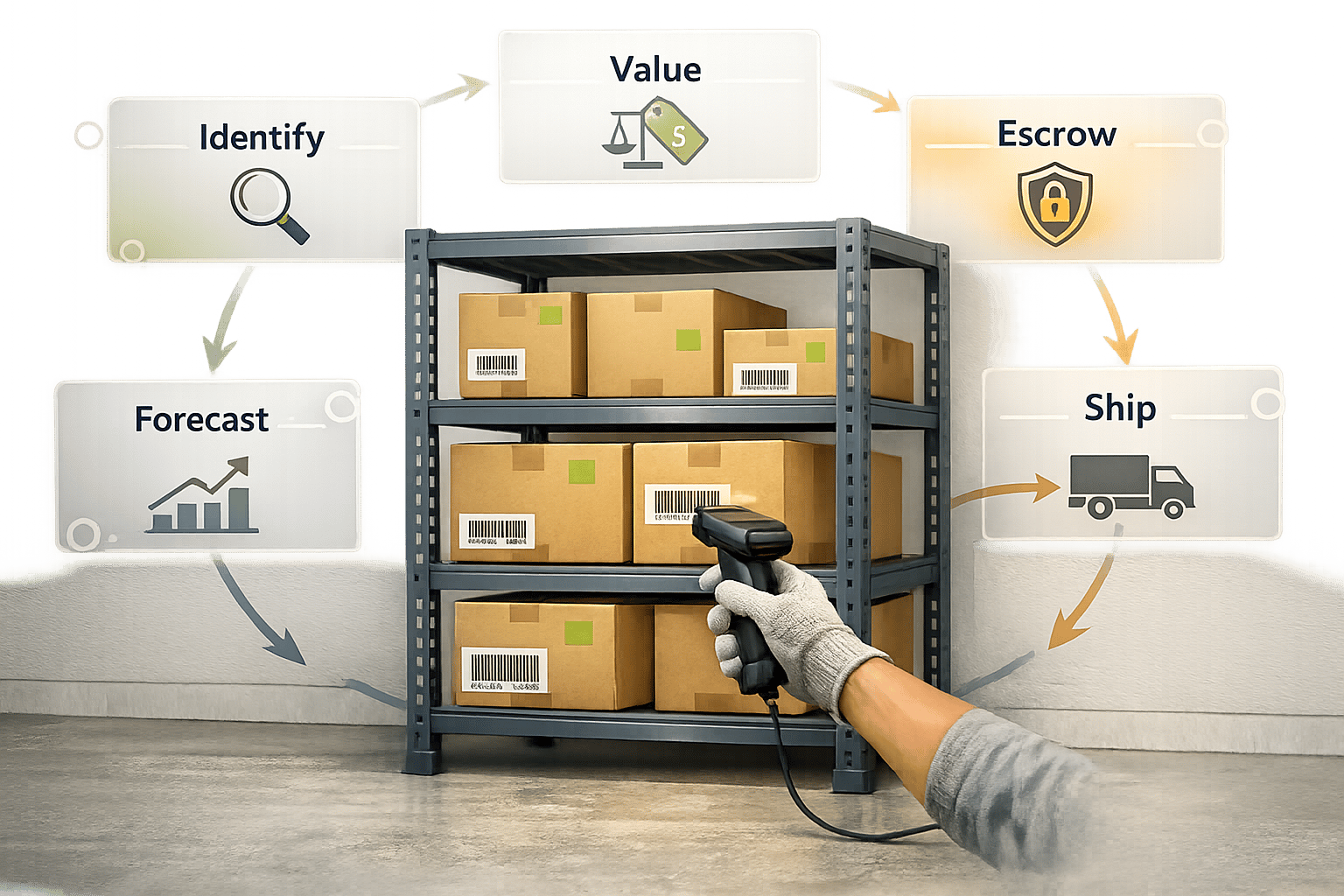

- Start with your inventory: Identify slow-moving items by analyzing sales data, stock age, and seasonal demand. Prioritize products based on storage costs, shelf life, and market value.

- Study competitors and trends: Check competitor pricing and seasonal demand patterns. Price competitively to attract buyers, especially during peak demand periods.

- Use smart pricing strategies: Apply tiered discounts, bundle slow-sellers with popular items, or create time-limited offers to create urgency.

- Consider liquidation if needed: Sell surplus stock at steep discounts through verified marketplaces to free up cash and storage space.

- Track and adjust: Monitor key metrics like inventory turnover and sell-through rates. Use data to refine your pricing and prevent future overstock.

What Is Excess Inventory and How to Prevent It?

Step 1: Review Your Surplus Inventory

To tackle surplus inventory effectively, start by analyzing your data to identify items that are tying up capital and storage space. This analysis is the backbone of your pricing strategy.

Find Slow-Moving Inventory

The first step is identifying which products qualify as surplus or slow-moving inventory. These are items that haven't sold within your usual sales cycle, though the exact timeframe depends on your industry and business model. A common rule is that products sitting unsold for 90–120 days warrant attention.

Here’s how to pinpoint slow-moving inventory:

- Analyze Sales Data: Look at six to twelve months of sales records to spot items with consistently low or declining sales.

- Track Stock Age: Use arrival dates to highlight items that have exceeded their typical sales cycle.

- Turnover Ratios: Calculate turnover ratios by dividing the cost of goods sold (COGS) by the average inventory. A low ratio indicates sluggish sales. For example, if a product’s turnover ratio is significantly below your overall average, it’s likely surplus.

- Shipment Frequency: Monitor shipping patterns. Items with infrequent or declining shipments are often surplus stock.

- Consider Holding Costs: Holding inventory comes with costs - like warehousing, insurance, and utilities - often adding up to 20–30% of the total inventory cost.

- Review Seasonal Trends: Check for products that underperformed during their peak demand periods. For instance, unsold winter coats after the cold season or leftover holiday decorations are clear examples of surplus inventory.

- Customer Feedback: Use feedback to understand why certain products didn’t sell as expected.

Once you’ve identified your slow-moving items, the next step is to prioritize them for pricing adjustments.

Organize Inventory by Priority

After pinpointing slow-moving items, organize them based on how urgently they need pricing action.

Here’s how to prioritize surplus stock:

- Storage Costs: Items taking up costly warehouse space or requiring special conditions (like climate control) should be liquidated quickly.

- Shelf Life and Obsolescence: Products such as technology, seasonal items, or perishables lose value over time. These should be at the top of your priority list since their market value drops the longer they remain unsold.

- Demand Patterns: Separate items with steady but slow sales from those with declining interest. Products with stagnant demand often need steeper discounts.

- Market Value: Items that retain their value provide more pricing flexibility, while quickly depreciating products require immediate action.

- Relocation Opportunities: If you operate multiple locations, consider transferring surplus stock to areas where demand might be higher. What’s surplus in one warehouse could sell well in another.

"Companies need to collaborate with customers and suppliers to more accurately forecast demand. Leveraging historical sales is an important element to demand forecasting...They should also put as much emphasis on their inventory management by focusing on products that are moving the quickest and represent a bulk of revenue and profits. This will significantly reduce excess inventory."

– Howard Forman, Associate Professor of Marketing at California State University, Fullerton

Modern inventory management systems can simplify this process. These tools can send alerts when items reach critical aging points or when holding costs exceed set thresholds. Use them to review your merchandise selection and establish clear categories.

Additionally, track gross profit trends for each product category. This helps you identify which surplus items still contribute to your profits and which are simply draining resources. Compare actual sales performance against your initial projections. Items that fell short of expectations may require a different pricing approach than those that were simply overstocked.

Step 2: Study Market Trends and Competition

Knowing what your competitors charge and how market demand changes throughout the year is essential when pricing surplus stock. Here's why: up to 84% of buyers compare prices across multiple stores before making a purchase. This means your pricing strategy should balance staying competitive with adapting to current market trends. Once you've established a competitive baseline, fine-tune it to align with seasonal shifts in demand.

Check Competitor Pricing

Analyzing competitor pricing is a smart way to set appealing prices while protecting your profit margins. Start by grouping your competitors into three categories:

- Primary competitors: Target the same customers with similar-quality products.

- Secondary competitors: Cater to different audiences but offer comparable items.

- Tertiary competitors: Provide alternative solutions to your products.

Gather data on their pricing, promotions, and bundling strategies. Keep this information updated regularly to reflect real-time market changes. Don't just focus on their listed prices - pay attention to their promotional campaigns, product availability, and even their customer service response times.

"Competitive pricing analysis is an evaluation of the consumers' reaction to new prices using research based on historical data or polls." – Vladimir Kuchkanov, Product Manager at Competera

Once you've done your research, decide on your pricing approach. You can:

- Match competitors to maintain market share.

- Undercut competitors to boost quick sales.

- Price higher to secure better margins when the market allows it.

For surplus stock, pricing below competitors is often the best route, especially if your main goal is to sell quickly and clear inventory.

Review Seasonal Demand Patterns

Pricing isn’t just about competition - it’s also about timing. Seasonal demand plays a huge role in how quickly you can move surplus stock. By aligning your pricing strategy with seasonal trends, you can speed up sales.

Look at historical sales data to uncover recurring patterns tied to holidays, weather changes, back-to-school shopping, or specific industry cycles. But don’t stop there. External factors like upcoming holidays, weather forecasts, major events, and even cultural traditions can all influence seasonal demand.

Economic trends matter too. Indicators like inflation, GDP growth, and consumer confidence can shape how much people spend during different seasons. For example, holiday spending has grown by about 8% year over year in some categories.

Use forecasting tools to make sense of your data. Techniques like moving averages help spot overall trends, while exponential smoothing adjusts quickly to recent changes. Seasonal indices are especially useful for products with clear seasonal cycles. Keep an eye on emerging trends too - shifts like the rising demand for sustainable products could disrupt traditional seasonal patterns.

Stay flexible with your seasonal forecasts. What worked last year may not apply this year, especially in markets where prices have swung dramatically - ranging from an 18% drop to a 66% increase between 2020 and 2022. Use these insights to time your pricing effectively. Products nearing their peak season could fetch higher prices, while those past their prime might need steep discounts to move them off the shelves.

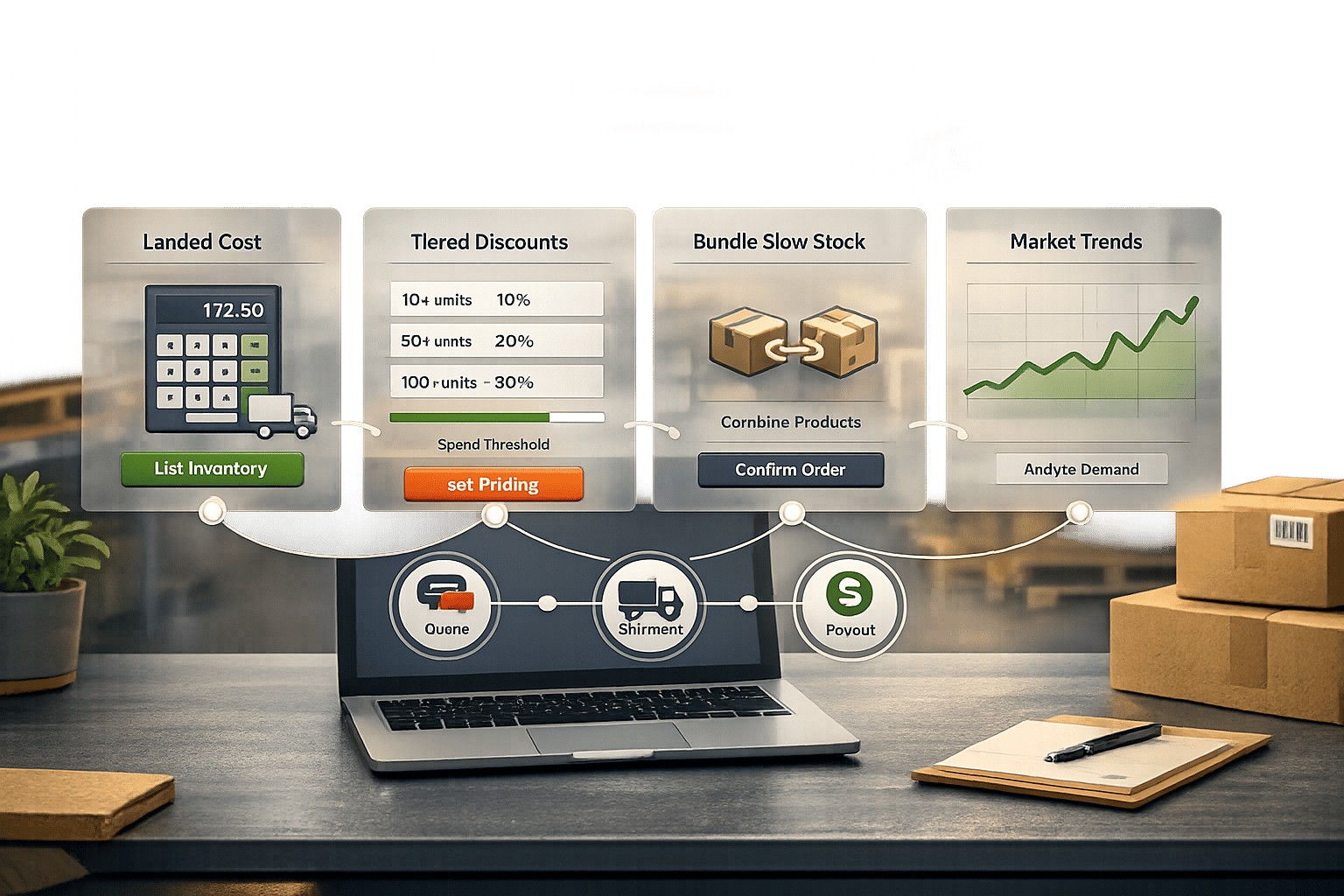

Step 3: Apply Smart Pricing Methods

After reviewing your inventory and analyzing market trends, it's time to put smart pricing strategies into action. The goal? Move surplus stock quickly while maintaining profitability. The right pricing approach can make all the difference - turning months of stagnant inventory into weeks of steady sales. Here are three powerful strategies that work well for balancing speed and profit.

Use Tiered Discounts

Tiered discounts motivate customers to buy more by lowering the price per unit as the quantity purchased increases. This approach is particularly effective for B2B businesses looking to clear excess stock since it encourages bulk orders.

Here’s how you can structure your tiers:

- Threshold Discounts: Offer the same discount for all units once customers hit a specific quantity. For example, full price for 0–49 units, 10% off for 50–99 units, 15% off for 100–149 units, 25% off for 150–199 units, and 35% off for orders of 200 or more.

- Tiered Volume Discounts: Adjust prices within the same order based on quantity ranges. For example, if an item is originally $200, charge full price for the first unit, $170 for units 2–4, $160 for units 5–9, $140 for units 10–19, and $120 for units 20 and above.

- Package Pricing: Set fixed prices for specific quantities. For instance, sell one unit for $100, five units for $400 ($80 per unit), ten units for $700 ($70 per unit), or twenty units for $1,000 ($50 per unit).

Make sure the increased sales volume offsets the reduced per-unit price. Carefully calculate your break-even point, and avoid discounts so steep that they undermine the perceived quality of your products.

Apply Bundling Methods

Bundling groups multiple products together at a lower combined price than buying them separately. This is a smart way to move slow-selling items by pairing them with popular products, while also boosting perceived value.

Research shows that bundling can increase conversion rates by 35% and still retain up to 80% of original profit margins. Mixed bundling - offering customers the choice to buy items individually or as part of a bundle - has been especially successful. One study found that mixed bundling increased video game sales by 100,000 units, while pure bundling (only offering bundles) actually reduced sales by 20%.

When creating bundles, think about products that naturally go together. For example:

- Kylie Cosmetics gained massive success by bundling lipstick and lipliner into "lip kits", helping build a $600 million brand.

- HelloFresh simplifies meal prep by bundling all the ingredients needed for a complete recipe.

For surplus inventory, pair slow-moving items with best-sellers or group related items that fulfill a specific need. Offer bundles at 25–40% below the combined price of individual products, and clearly display the savings to entice buyers.

"The key to successful post-holiday bundling isn't just combining products – it's creating narratives that align with customers' evolving needs and mindsets." – Sarah Chen, Retail Psychology Specialist

Create Time-Limited Offers

Time-limited promotions create urgency, pushing customers to act fast. Scarcity is a powerful motivator, and these offers are especially effective for clearing excess inventory.

Flash sales are a prime example. When Samsung ran its 4th of July deals with patriotic-themed banners, they created both seasonal relevance and a sense of urgency. Similarly, Shein’s weekly deals, offering savings of up to 90%, grab attention and drive quick purchases.

Here’s how to make time-limited offers work:

- Keep the promotion short - 24 to 72 hours is ideal.

- Use countdown timers on your website and marketing materials to emphasize the deadline.

- Pair the offer with free shipping, a tactic that 88% of online shoppers say makes them more likely to buy.

For instance, Tours4Fun’s "Sunny Getaway Deals" combined a 40% discount with a clear end-of-July deadline, driving quick decisions. Orange Theory Fitness promoted a $50 first-month discount and unlimited classes through website pop-ups, email campaigns, and social media ads.

While offering discounts, be mindful not to erode your margins or create an expectation of low prices. Instead, focus on highlighting the value of the deal and use urgency-driven language like “one-day sale” or “sale ends at midnight” to encourage action.

sbb-itb-bc600a0

Step 4: Consider Liquidation for Quick Cash Flow

If your pricing strategies aren't enough to move slow-selling items, liquidation might be the next step. Liquidation involves selling surplus inventory at steep discounts to generate immediate cash flow. While it means accepting lower returns, it can be a smart move when you need quick cash or when storage costs are becoming a burden. This approach helps turn stagnant stock into working capital without derailing your overall pricing strategy.

Weigh the Pros and Cons of Liquidation

Before jumping into liquidation, it's essential to understand the trade-offs. This decision isn't just about clearing out inventory - it impacts your cash flow, operations, and long-term plans.

Advantages of Liquidation:

- Quickly resolves excess inventory issues

- Improves cash flow and reduces debts

- Frees up storage space for new products

- Cuts down on storage and handling costs

Disadvantages of Liquidation:

- Generates lower returns compared to standard pricing

- Could harm your brand reputation due to steep discounts

Wholesale liquidation often proves more profitable than offering deep discounts directly to consumers. It saves time and reduces marketing expenses tied to individual sales.

Liquidation makes sense in specific scenarios: when storage capacity is maxed out, demand for certain products has plummeted, new seasonal stock needs space, items are nearing expiration or becoming outdated, or you urgently need cash to cover operational expenses. However, before choosing liquidation, consider alternatives like repackaging products, boosting marketing efforts, or offering bigger discounts while maintaining control over distribution. If these efforts don’t yield results within your required timeframe, liquidation could be the most practical solution.

Use Verified Marketplaces for Safe Liquidation

The liquidation industry is on the rise, with the Liquidation Service Market expected to hit $79.05 billion by 2031, growing at a 9.5% annual rate between 2024 and 2031. Verified wholesale marketplaces provide a reliable way to connect with buyers who specialize in surplus inventory.

Take ForthClear as an example. This platform offers secure escrow payments, verified suppliers, and bulk pricing. Sellers pay a 5% fee plus 2.9% + $0.30 per transaction, while buyers can browse for free. Verified marketplaces often yield higher recovery rates - 18–22% more compared to traditional liquidation methods. Additionally, geographic targeting can maximize returns. For instance, fashion overstocks recover 31% more value in South American and Eastern European markets, while consumer electronics fetch 26% higher returns in APAC regions.

When choosing a liquidation partner, do your homework. Check reviews, case studies, and references to ensure their credibility. Look for clear fee structures and transparent pricing models. Keep in mind that while these marketplaces require effort - like managing listings, monitoring prices, and communicating with buyers - the payoff is worth it when you need to convert excess inventory into cash while keeping control of the process.

Lastly, document your liquidation activities to identify and avoid overstocking patterns in the future. Consult with an accountant to ensure proper tax documentation for these transactions. Monitoring your liquidation efforts can also provide valuable insights for refining future pricing strategies.

Step 5: Track and Adjust Your Pricing Approach

Pricing surplus stock isn’t something you can set and forget. The most successful businesses keep a close eye on their results and adjust their strategies based on real data. Without tracking key metrics, you’re essentially flying blind, missing out on opportunities to improve how you handle surplus inventory.

Monitor Key Performance Metrics

Keeping track of the right metrics gives you a clear picture of what’s working and what needs tweaking. Focus on data points that directly impact your goals - moving excess stock quickly while retaining as much value as possible.

Sales metrics should be at the top of your list. Start with the inventory turnover rate, which measures how fast you’re converting stock into cash. Combine that with the sell-through rate, which compares the amount of inventory sold to the amount received. A high turnover rate signals that your pricing strategy is on point, while a low rate might mean it’s time to consider steeper discounts.

Another critical metric is the stock-to-sales ratio, which shows how efficiently you’re turning inventory into revenue. A lower ratio means better turnover and more streamlined inventory management.

Operational metrics also play a big role in profitability. Keep tabs on your inventory carrying costs, which typically account for 20–30% of your total inventory value each year. Watch your dead stock percentage - businesses with more than 25–30% dead stock often struggle to stay competitive. Additionally, the backorder rate can signal pricing issues. For example, if a bicycle manufacturer receives 1,000 orders in a month but can’t deliver 100 bikes due to shortages, the resulting 10% backorder rate indicates strong demand that might warrant a price adjustment.

Revenue and cost metrics round out the picture. Metrics like revenue per unit and cost per unit help you understand your actual margins on surplus items. Calculating gross margin by product can also highlight which categories offer the best returns, even with discounts.

"KPIs will tell you where they truly stand – what your company is doing right, what could use some improvement, and what needs immediate attention."

– SkuNexus

To make tracking manageable, focus on metrics that align with the SMART framework - specific, measurable, achievable, relevant, and timely. Start small with a few key metrics in each category, and make sure your team understands what each one means and how to act on it. These insights will guide you in refining your pricing strategy to achieve measurable results.

Improve Methods Based on Data

Data is only as valuable as the actions you take with it. Once you’ve identified gaps through your metrics, use that information to fine-tune your pricing approach. This step builds on the strategies discussed earlier, helping you avoid repeating costly mistakes.

Study pricing elasticity patterns in your data. If lowering a price significantly boosts sales, it suggests demand is elastic, meaning further discounts might make sense. On the other hand, if a price cut doesn’t move inventory, consider alternative strategies like bundling products or testing new sales channels.

Leverage seasonal and timing insights to plan smarter. If your data shows that certain products sell better during specific months, time your liquidation efforts to align with those trends. Instead of constant markdowns, use strategic seasonal discounts and schedule inventory reviews before peak sales periods.

Understand customer behavior to find pricing sweet spots. Analyze which discount levels generate the most activity without eating into your margins.

"Pricing KPIs help you identify pricing methods that are yielding desired results and pinpoint areas that need fine-tuning. This approach allows you to make data-driven decisions and optimize pricing for the evolving market."

– Flipkart Commerce Cloud

Keep an eye on competitors to refine your strategy. If your sell-through rates are lagging despite competitive pricing, investigate whether rivals offer perks like faster shipping, better terms, or enhanced customer service. Sometimes, the solution isn’t lowering prices - it’s improving your overall value proposition.

Operational improvements can also emerge from analyzing your metrics. If high carrying costs are cutting into profits, consider renegotiating storage terms or speeding up disposal timelines. If specific suppliers consistently lead to surplus, it might be time to reevaluate your procurement processes instead of just adjusting prices.

Set up regular review cycles - monthly for fast-moving products and quarterly for slower-moving ones. Dashboards that automatically pull data from your systems can simplify tracking and help your team build institutional knowledge for future surplus situations.

Cost optimization strategies should evolve based on what you learn. Negotiate better terms with vendors, streamline operations, or explore outsourcing options to lower the costs that make surplus pricing a challenge. Sometimes, improving your day-to-day operations can reduce the need for aggressive liquidation altogether.

For example, one major airline managed to cut excess inventory by 30% within a year. This freed up $3 million in working capital and slashed annual carrying costs by over $600,000. Their success came from consistent tracking, data-driven adjustments, and refining their processes.

Ultimately, the goal isn’t just to move surplus inventory - it’s to create systems that reduce surplus in the first place while maximizing recovery when it does occur.

Conclusion: Balance Speed and Profitability

Effectively pricing surplus stock is all about striking the perfect balance between moving inventory quickly and recovering the most value possible. The strategies discussed here are designed to help you achieve both goals without compromising one for the other.

Did you know that 66% of retailers struggle with overstock, with an average turnover rate of 10.86%? The solution lies in approaching surplus pricing as a thoughtful, strategic process - not as a last-minute fire sale.

A tiered discounting strategy works wonders: offer 20–30% discounts on high-demand items, 30–50% on slower-moving stock, and 50–70% on seasonal or hard-to-sell items. This method creates a strong foundation for layering in additional tactics.

The most successful businesses don’t rely solely on discounts. Instead, they combine several approaches: bundling slower-moving products with bestsellers, running flash sales to create urgency, and using secure wholesale platforms to reach new audiences. These strategies allow you to connect with customer segments and sales channels that traditional markdowns might miss.

Data is your best ally. Metrics like inventory turnover rates, sell-through percentages, and carrying costs provide a clear picture of what’s working and what’s not. By basing decisions on real performance, you can fine-tune your strategy, avoid costly mistakes, and stay aligned with market demands.

Using these insights, aim for both immediate wins and long-term stability. Speed and profitability don’t have to be at odds when you plan ahead. Investment Recovery strategies not only free up working capital but also cut down on waste and storage costs while maximizing ROI. The goal isn’t just to clear out surplus - it’s to create systems that prevent future overstock and optimize recovery when it happens.

With 98% of eCommerce visitors leaving without making a purchase, every effort to convert browsers into buyers has a direct impact on your bottom line. Whether through tiered discounts, product bundles, or wholesale platforms, these strategies are essential for turning surplus stock into sales.

Businesses that excel in surplus pricing see it as an opportunity, not a setback. They use it to attract new customers, boost cash flow, and build their brand through strategic moves. By following the approach laid out in this guide - combining smart pricing, targeted discounts, and data-driven insights - you can transform surplus inventory from a challenge into a powerful advantage.

FAQs

What are the best ways to identify and prioritize surplus inventory for a quick sale?

To spot and address surplus inventory efficiently, start with a detailed inventory analysis. Take a close look at your stock to identify items that are slow-moving, outdated, or overstocked. Pay special attention to products nearing their expiration date or those with declining demand.

Leveraging inventory management software can make this process much smoother. These tools provide insights into sales trends and customer preferences, helping you quickly identify excess stock and refine your approach. On top of that, applying ABC analysis - which categorizes items based on their revenue contribution - can help you prioritize which surplus items to tackle first, focusing on those with the biggest financial impact.

By following these steps, you can cut storage costs, clear out unneeded stock, and create room for products that customers are actively seeking.

How can I discount surplus inventory without hurting my profit margins?

To clear surplus inventory without taking a big hit to your profit margins, start by evaluating the profitability of each product. Prioritize items with higher profit margins - offering moderate discounts on these can boost sales while keeping your bottom line intact.

Another smart tactic is tiered discounting, which encourages customers to buy in bulk by offering better deals for larger purchases. For older inventory, applying steeper discounts can help move those items faster without resorting to blanket price cuts. You might also explore dynamic pricing, a strategy that adjusts prices based on demand and stock levels. This ensures your discounts are precise and purposeful. By using these approaches, you can efficiently clear out excess inventory while safeguarding your brand’s reputation and profitability.

When should I liquidate surplus inventory, and how can I do it effectively?

When surplus inventory starts piling up, it can quickly become a strain on your resources, especially if storage costs are rising or products are nearing obsolescence. This often happens due to misjudging demand, seasonal changes, or unexpected supply chain hiccups.

To tackle this efficiently, begin by reviewing your stock to pinpoint items that need to be sold quickly. Strategies like offering competitive prices, bulk discounts, or running flash sales can help attract buyers. You might also consider teaming up with wholesale or liquidation platforms to tap into a larger audience. Bundling products or collaborating with local liquidators can further help you recover value while keeping losses in check. Throughout the process, clear communication with all stakeholders and a focus on minimizing financial risks will ensure the operation runs smoothly.