Market-based pricing helps businesses sell surplus inventory by aligning prices with current market demand, competitor rates, and buyer behavior. Unlike fixed pricing methods, this approach adjusts dynamically, ensuring excess stock moves efficiently while maintaining profitability. Key benefits include:

- Higher revenue potential: Small pricing tweaks can boost revenue by 20-50%.

- Cost savings: Reduces storage costs and prevents inventory depreciation.

- Flexibility: Adjusts prices in real-time based on demand and competition.

How It Works:

- Analyze demand: Understand buyer behavior and price sensitivity.

- Monitor competitors: Compare prices to stay competitive.

- Leverage timing: Use seasonal trends and product lifecycles to optimize prices.

- Use technology: Tools like AI-driven models and platforms like ForthClear automate and refine pricing decisions.

Key Strategies:

- Dynamic pricing adjusts prices in real-time.

- Bundle and bulk pricing encourage volume sales.

- Flash sales create urgency for quick clearance.

By combining data analytics, technology, and strategic adjustments, businesses can effectively manage surplus inventory, minimize losses, and maximize returns.

12 Ways Retailers Can Manage Surplus or Overstock Inventory

Factors That Influence Market-Based Pricing

When it comes to pricing surplus inventory, understanding what drives the market is crucial. Three key factors come into play: buyer behavior, competitor strategies, and product timing. Each of these elements influences how quickly surplus stock can be sold. Let’s start by looking at how buyer behavior shapes market-based pricing.

Market Demand and Buyer Behavior

The law of demand tells us that lowering prices tends to increase buyer interest. When you’re dealing with surplus inventory - essentially, having more stock than customers want - prices naturally drop as you aim to clear out excess goods. Shoppers focus on a product’s perceived value in the moment, rather than its original price tag.

"A surplus occurs when the quantity supplied exceeds the quantity demanded at a given price... Producers may experience excess inventory, leading to downward pressure on prices as sellers attempt to reduce their stock." – Holistique Training

Knowing how sensitive buyers are to price changes is key. For example, essential items like medicine are typically inelastic, meaning their demand doesn’t shift much even if prices do. On the other hand, luxury goods are much more price-sensitive. Between 2020 and 2022, market instability caused price swings ranging from an 18% drop to a 66% increase. The goal is to identify the market clearing price - the point where your supply aligns with consumer demand.

Analyzing the Competitive Landscape

With 83% of shoppers comparing prices before making a purchase, staying competitive is non-negotiable. When pricing surplus stock, you have three main options: match your competitors’ prices (at-market), undercut them (below-market), or charge more if your product offers added value (above-market). For surplus inventory, pricing below-market is often the fastest way to move stock.

To stay ahead, monitor competitors’ pricing trends and customer feedback so you can spot opportunities to adjust your prices. Seasonal patterns also matter - track when competitors offer discounts and use that data to fine-tune your own strategy. Running A/B tests on different price points can also help you figure out what resonates most with buyers.

Seasonality and Product Lifecycles

Timing is another critical factor in pricing surplus inventory. Your pricing strategy should adapt to both seasonal trends and the product’s lifecycle. Seasonal shifts are one of the biggest reasons for surplus stock. For instance, winter coats lose value as spring approaches, and tech gadgets like smartphones depreciate quickly when newer models hit the market.

Every product goes through distinct lifecycle stages, and pricing needs to evolve accordingly. During the introduction phase, you might choose a high (skimming) or low (penetration) price depending on your goals. As demand grows, higher prices may be an option. In the maturity stage, competition tends to stabilize prices. Finally, in the decline phase, steep discounts are often necessary to clear out inventory before it becomes dead stock. Major retailers frequently adjust prices based on real-time demand. While you might not need to change prices as often, recognizing when a product has hit its decline phase is essential. Holding onto aging stock not only ties up warehouse space but also diminishes the item’s market value over time.

How to Implement Market-Based Pricing

Once you're familiar with the factors that influence market-based pricing, the next step is turning that understanding into practical actions. Start by categorizing inventory using the ABC method - apply advanced pricing models to the top 20% of SKUs that generate the most revenue, while using simpler methods for the rest. Before making any major price changes, test small adjustments (around 3%-5%) to understand how sensitive demand is to price shifts. Set clear goals, whether it's boosting revenue or maximizing profits, to ensure your pricing strategy delivers measurable results.

Dynamic Pricing Adjustments

Dynamic pricing involves real-time price changes based on factors like stock levels, competitor pricing, and customer behavior. This approach works especially well for surplus inventory, as it allows you to gradually lower prices as products approach the end of their season or lifecycle. This helps speed up clearance and cuts down on holding costs.

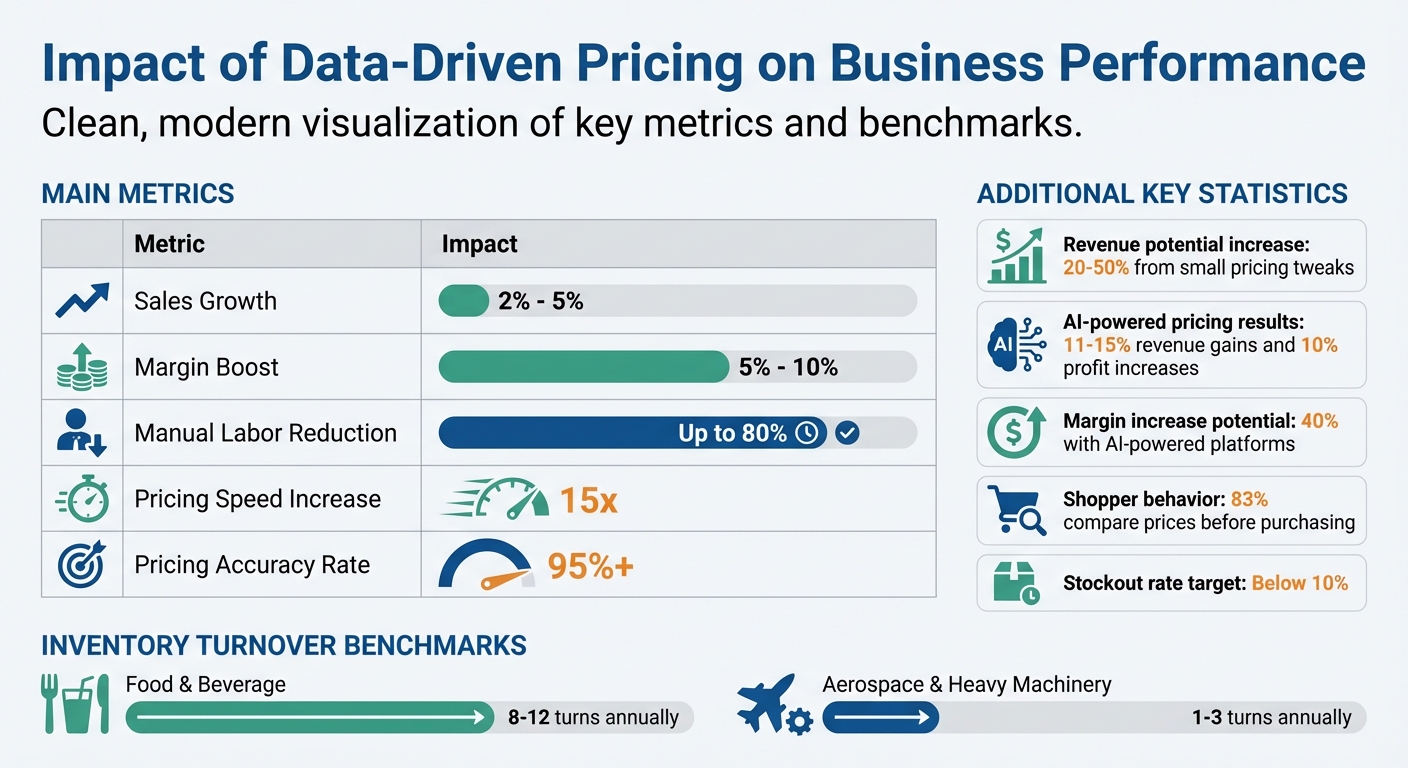

Retailers using AI-driven pricing models have reported revenue gains of 11-15% and profit increases of 10% by analyzing competitor stockouts and testing price elasticity instead of just matching competitors' prices. Businesses that adopt dynamic pricing solutions often see sales grow by 2%-5% and profit margins improve by 5%-10%.

To make dynamic pricing effective, set strict price floors and ceilings to protect your margins and comply with manufacturer agreements. Keep a close eye on stock levels - when inventory is low but demand is high, prices can be raised. On the flip side, when stock is abundant and demand is tapering off, discounts can be applied automatically to avoid obsolescence.

Bundle and Bulk Pricing Strategies

Dynamic pricing isn't the only tool for managing surplus inventory. Bundling and bulk pricing are also effective strategies.

Bundle pricing pairs a popular item with slower-moving surplus goods, increasing the visibility and sales rate of products that might otherwise remain unsold. This method taps into the "consumer surplus", or the difference between what customers are willing to pay and what they actually spend, by creating packages that align with their overall spending habits.

Bulk pricing, on the other hand, uses tiered discounts to encourage larger purchases. The more customers buy, the lower the per-unit price, which motivates bigger orders and helps reduce long-term storage costs. This strategy is particularly effective for B2B sales and surplus items that are commodity-like.

| Strategy | Primary Goal | Best For |

|---|---|---|

| Bundle Pricing | Increase perceived value and move slow items | Pairing popular products with surplus inventory |

| Bulk Pricing | Drive high volume and lower holding costs | B2B transactions and high-stock surplus items |

"Bundle pricing offers several products or services together at a lower rate than if customers purchased them separately... This strategy encourages sales of less popular items by attaching them to bestsellers." – Lisa Schwarz, Senior Director of Global Product Marketing, NetSuite

Experiment with different bundle configurations using A/B testing before rolling out a full-scale strategy. Make sure to clearly communicate the value of the bundle or bulk discount so customers see the pricing as fair and reflective of genuine savings. Use cost-plus pricing to determine your minimum price and value-based pricing to set your maximum, then aim for a market-driven price point somewhere in between.

Flash Sales and Time-Limited Discounts

Flash sales and time-sensitive discounts create urgency, making them ideal for clearing out seasonal or perishable surplus inventory. By setting a tight deadline - such as 24 or 48 hours - you can tap into customers' fear of missing out, prompting quicker purchasing decisions.

This strategy works particularly well for items like fashion products, electronics nearing the end of their lifecycle, or goods with expiration dates. Combining dynamic pricing with flash sales can help minimize losses by adjusting prices as items approach their sell-by dates.

Monitor competitors' discount schedules to identify the best times to launch your own sales. For seasonal surplus, time your flash sales toward the end of the season when demand is still present but starting to decline. Waiting too long can diminish the perceived value of the items. Pair these sales with clear communication about the limited-time nature of the offer, and consider using electronic shelf labels in physical stores to update prices in real time.

"The cornerstone of demand-based pricing is finding the right balance between short-term revenue and long-term customer satisfaction." – Lisa Schwarz, Senior Director of Global Product Marketing, NetSuite

While flash sales are effective for clearing inventory quickly, use them sparingly to avoid conditioning customers to wait for discounts. Rotate the product categories featured in flash sales and vary the timing to keep customers engaged and maintain a sense of urgency. By implementing these strategies thoughtfully, you can ensure your surplus inventory is priced to align with market demand and recover as much value as possible.

sbb-itb-bc600a0

Using Technology for Market-Based Pricing

Technology has revolutionized market-based pricing, making it faster and more precise. Gone are the days of relying on slow, manual methods like spreadsheets. Today, advanced platforms can analyze thousands of data points in seconds, providing optimal pricing recommendations. This shift from basic tactics - like undercutting a competitor's price by a fixed percentage - to advanced algorithms has completely changed how businesses manage surplus inventory.

How Data Analytics Informs Pricing Decisions

Data analytics plays a key role in pricing decisions by measuring price elasticity - essentially, how sensitive demand is to price changes. This allows businesses to identify which surplus items need deep discounts to sell quickly and which can sustain higher margins without losing sales. Instead of relying on guesswork, businesses now use hard data on buyer behavior, inventory levels, and market trends.

For example, in 2023, a Chinese online retailer implemented an AI-powered pricing model for its top 30 SKUs. By tracking competitor stockouts and brand reputation, the system adjusted prices dynamically, leading to an 11% revenue increase while maintaining gross margins. Analytics platforms also reduce manual labor by up to 80% and speed up pricing tasks by 15 times. Moreover, these tools identify external factors - like marketing campaigns or local events - that could skew historical data, preventing businesses from making decisions based on misleading patterns.

"The essence of the approach we have described is the complete cycle of 'model, measure, maximize.' A piecemeal solution... may achieve minor improvements... But the integrated use of all three, powered by AI tools, will reward retailers with substantial improvements." – Marshall Fisher, Santiago Gallino, and Jun Li

One effective strategy is the ABC classification method. For "Group A" items - the top 20% of SKUs generating 80% of revenue - use advanced models for pricing. For less critical inventory, simpler models suffice. Before feeding data into predictive algorithms, clean the data by removing outliers and filling gaps to ensure accurate forecasts.

This solid data foundation is vital for leveraging platforms like ForthClear to streamline surplus inventory management.

Using ForthClear for Surplus Management

ForthClear takes the guesswork out of surplus management by automating pricing and liquidation. The platform identifies dead stock - items unsold for 60 days - and suggests liquidation options, allowing you to act quickly. Its bulk pricing tools enable tiered discounts, such as "Buy 50+ units and get 20% off", to encourage larger orders and speed up inventory turnover.

With real-time market access, ForthClear provides insights into current buyer demand, keeping your pricing competitive without constant manual monitoring. The platform connects you with verified buyers and ensures secure transactions through Stripe Connect escrow payments, protecting both buyers and sellers from fraud.

ForthClear's pricing structure is straightforward: a 5% fee only when you make a sale, with no subscription or listing fees. For businesses managing inventory across multiple channels, its bulk upload tool supports CSV/Excel files and even includes an "Auto Image Search" feature to find product photos automatically, saving hours of effort. The built-in messaging system facilitates direct negotiations with buyers, while international shipping support with tariff estimates makes global sales manageable.

Integrating Predictive Pricing Tools

Predictive pricing tools refine dynamic pricing by continuously adjusting prices based on real-time market feedback. Using machine learning, these tools analyze historical sales data, market trends, and demand patterns to pinpoint the ideal price - where inventory meets customer demand seamlessly.

Integrating predictive pricing tools with ERP and CRM systems ensures consistent pricing data across all channels, creating a centralized "single source of truth". This prevents errors and enables automated price adjustments in response to real-time changes, such as shifts in production costs or material prices.

Before implementing predictive models, ensure your data is clean and well-organized. Use A/B testing to measure price elasticity accurately, rather than relying solely on historical data, which could be skewed by past marketing efforts. Small price experiments - adjusting prices by 3% to 5% - can reveal demand sensitivity without major risks.

AI-powered pricing platforms can deliver impressive results, such as a 40% margin increase and a 95%+ pricing accuracy rate. However, achieving double-digit growth requires real-time optimization and ongoing experimentation - simple models relying only on historical data often yield marginal improvements.

"A data-driven approach to pricing is increasingly becoming a requirement if you want to remain competitive." – PROS

Set clear goals for predictive tools, whether it’s increasing market share or cutting inventory carrying costs, to align them with your business objectives. Address employee concerns about automation by offering training and fostering a data-driven mindset. Finally, protect sensitive pricing data with robust security measures like encryption and strict access controls.

| Metric | Impact of Data-Driven Pricing |

|---|---|

| Sales Growth | 2% - 5% |

| Margin Boost | 5% - 10% |

| Manual Labor Reduction | Up to 80% |

| Pricing Speed Increase | 15x |

| Pricing Accuracy Rate | 95%+ |

Monitoring and Optimizing Pricing Performance

Market-Based Pricing Impact: Key Metrics and Performance Indicators

Once dynamic pricing measures are in place, the job isn’t done. Regular monitoring is key to ensuring your surplus inventory strategy delivers results. Setting the initial price is just the beginning - tracking performance and making timely adjustments is what separates effective strategies from those that fall flat. Without monitoring, you won't know if your pricing is driving sales or leaving money on the table.

Key Metrics to Measure Success

Several metrics help gauge the success of your surplus inventory pricing strategy:

- Inventory Turnover Ratio (ITR): This measures how often you sell and replace inventory over a specific period. A high ITR means you’re moving surplus quickly, while a low ratio may indicate excess stock or weak demand. For example, Food & Beverage industries often achieve 8–12 turns annually, compared to Aerospace & Heavy Machinery, which might only see 1–3. Monitoring ITR helps pinpoint which items need more aggressive pricing to avoid sitting idle.

- Sell-Through Rate (STR): STR shows the percentage of inventory sold during a specific period. For instance, if you receive 1,000 surplus units and sell 700, your STR would be 70%. A low STR might suggest it’s time to implement deeper discounts or bundle deals.

- Days Sale of Inventory (DSI): Also referred to as Days on Hand, this tracks how long it takes to turn inventory into sales. Lower DSI numbers mean greater efficiency. For surplus items, checking DSI at 30, 60, and 90-day intervals can help you adjust prices before inventory becomes obsolete. At the same time, aim for a stockout rate below 10% to ensure you don’t deplete inventory too quickly for core customers.

- Gross Margin Return on Invested Inventory (GMROI): This metric evaluates how well your inventory generates profit. A GMROI above 1.0 indicates you’re earning more than you’ve invested. For surplus, this can reveal whether your discounting strategy is still profitable or if you’re cutting prices too deeply.

"Before it can generate revenue, every item in your inventory represents an expense, whether in storage fees, capital investment, or potential obsolescence." – Billy Cassano, Applications Engineer at Tractian

These metrics provide a solid framework for making smarter, more agile pricing decisions.

Adjusting Strategies Based on Market Feedback

Metrics alone aren’t enough - you need to act on the insights they provide. Refining your pricing strategy requires constant market feedback. The "Model, Measure, Maximize" cycle is an effective approach: test pricing models, measure consumer responses (like price elasticity), and update your parameters regularly - ideally every six months or as market conditions shift. Businesses relying solely on historical data often see revenue gains of 1% or less, while those leveraging real-time AI models can achieve double-digit growth.

Price elasticity testing is especially important for surplus inventory. For example, if a product has an elasticity of -8, a 1% price drop could lead to an 8% increase in demand, making steep discounts worthwhile. On the other hand, low-elasticity items might not require price matching with competitors. Controlled experiments can reveal pricing sensitivities better than relying on outdated historical data.

To prioritize your efforts, use ABC analysis: focus advanced dynamic pricing strategies on "Group A" items (the top 20% of SKUs driving 80% of revenue). For slower-moving "Group B" and "Group C" items, simpler automated pricing rules can suffice. This ensures you allocate resources effectively, giving high-value surplus the attention it deserves.

Another tool is Product Life Cycle (PLC) pricing. Mid-season promotions can boost demand, while end-of-life markdowns help recover costs before items become obsolete. Establish clear protocols to avoid knee-jerk reactions - for instance, only match a competitor’s price if their drop exceeds 5%. With 83% of shoppers comparing prices, staying competitive is essential.

"The integrated use of all three [model, measure, maximize], powered by AI tools, will reward retailers with substantial improvements in revenues or profits that are sustainable over time." – Marshall Fisher, Santiago Gallino, and Jun Li

Conclusion and Next Steps

Market-based pricing requires ongoing vigilance - keeping an eye on competitors, understanding customer expectations, and adapting to changing market conditions. Price too high, and you risk slow sales and rising storage costs. Price too low, and you leave potential profits untapped. With 83% of shoppers comparing prices while buying, staying competitive isn’t just smart - it’s essential.

To sum it up, successful market-based pricing blends data-driven decision-making with a sharp awareness of the competitive landscape.

Key Takeaways

At its heart, market-based pricing is about focusing on perceived value rather than just production costs when pricing surplus inventory. This approach keeps you competitive by aligning prices with what customers expect to pay for similar products in the market.

Using advanced analytics and real-time data, you can adjust prices dynamically to account for shifting demand, seasonal trends, and competitor activity. Even small changes in pricing can have a big impact - boosting revenue by 20% to 50% - making pricing one of the most effective tools for growth.

This strategy isn’t just about clearing out surplus; it’s a cornerstone of managing inventory effectively while capitalizing on market dynamics.

How to Get Started

Ready to put market-based pricing into action? Here’s a roadmap to help you optimize your surplus inventory:

- Start with a deep dive into your inventory: Assess demand patterns, shelf life, and market trends. Gather competitive data to decide whether to price your products at, below, or above market rates based on their unique value.

- Use technology to your advantage: Platforms like ForthClear simplify surplus management. For example, its Shopify integration flags products that haven’t sold in 60+ days, allowing you to list them quickly. Features like tiered bulk pricing and built-in negotiation tools help you sell inventory faster while staying profitable.

- Experiment and adapt: Run A/B tests on pricing and review market trends regularly to fine-tune your strategy.

FAQs

How does market-based pricing help maximize revenue from surplus inventory?

Market-based pricing lets businesses adjust their prices according to current market demand and conditions, rather than just adding a markup to costs. This method helps strike the right balance - avoiding prices that are too high (which can push customers away) or too low (which risks losing potential profit).

By setting prices closer to what customers are willing to pay, companies can boost sales and earn more per unit sold. It’s a smart way to clear out extra inventory while ensuring profitability stays on track.

How does technology support market-based pricing for surplus inventory?

Technology has become a game-changer in streamlining market-based pricing for surplus inventory. Tools like inventory management systems offer real-time updates on stock levels and turnover rates, making it easier for businesses to spot surplus and adapt to changing market demands. On top of that, advanced analytics and AI dig into competitor pricing, demand patterns, and past sales data to deliver precise, dynamic pricing suggestions.

ForthClear takes full advantage of these advancements to make market-based pricing simpler. Its platform uses automated pricing tools to determine the best bulk discounts, update listings instantly, and secure transactions through an escrow system. By blending data-powered algorithms with a transparent marketplace, ForthClear enables sellers to price surplus competitively, gives buyers access to fair deals, and supports a more sustainable approach to commerce.

How do seasonal trends and product lifecycles influence surplus inventory pricing?

Seasonal trends have a big influence on how surplus inventory is priced. During peak times - like winter for cold-weather gear or December for holiday decorations - demand tends to soar. This allows sellers to set prices closer to the original value. However, once the season wraps up, demand takes a nosedive, and holding onto unsold inventory becomes costly. To clear out stock quickly, sellers often resort to lower prices or offer bulk discounts. Planning price adjustments in advance - say, marking the end of the holiday season on January 15, 2025 - can help minimize losses when products are no longer in demand.

The lifecycle of a product is another key factor in pricing decisions. At the start of a product's life, demand is usually strong, making it possible to charge higher prices. As the product enters its middle stage, pricing strategies often shift to focus on maintaining steady cash flow. By the end of the lifecycle, significant markdowns are usually necessary to prevent the items from becoming obsolete. Adjusting prices based on these patterns not only helps move surplus inventory efficiently but also reduces waste and protects profit margins.