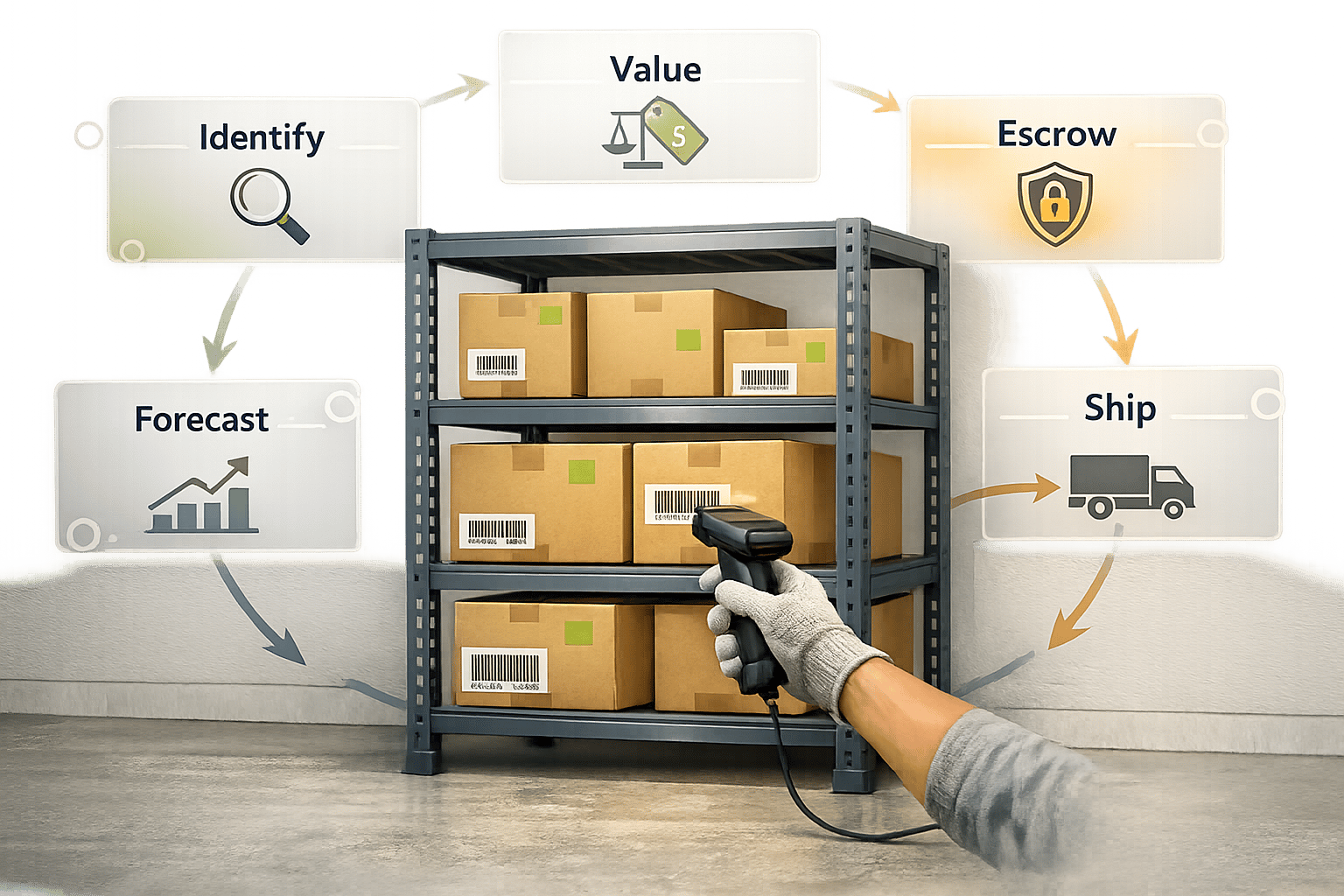

Wholesale buying can make or break your business. Whether you're stocking up for retail, managing procurement, or exploring bulk purchases, the right strategies can save money, improve margins, and streamline operations. Here's what you'll learn:

- Finding Reliable Suppliers: Use trade shows, directories, referrals, and local options. Verify credibility through online presence, certifications, and financial stability.

- Bulk Pricing Basics: Understand tiered discounts, minimum order quantities (MOQs), and how to negotiate better deals.

- Managing Inventory: Track turnover, avoid surplus, and use liquidation channels to clear excess stock.

- Domestic vs. International Sourcing: Compare costs, delivery times, and compliance requirements.

- Secure Payments & Orders: Use escrow, letters of credit, or trade terms while tracking orders effectively.

- Legal Compliance: Stay updated on tax IDs, customs, and product safety standards.

- Data-Driven Decisions: Analyze sales data to optimize purchasing and manage inventory.

Master these essentials to make smarter wholesale decisions, save money, and avoid common pitfalls.

The Best Wholesale Suppliers & How to Source Them

How to Find Reliable Wholesale Suppliers

Partnering with reliable suppliers is the backbone of successful wholesale operations. A bad supplier can lead to delays, poor-quality products, and financial setbacks. On the other hand, a trustworthy supplier becomes a key ally in helping your business thrive.

To begin your search, tap into multiple resources. Trade shows are a great way to meet suppliers in person and assess their offerings firsthand. Industry directories, such as ThomasNet for manufacturing or Wholesale Central for general goods, can guide you to a wealth of supplier options. Online B2B marketplaces also provide access to numerous suppliers, but these require extra diligence when vetting.

Don't overlook the power of referrals. Fellow business owners, trade associations, and industry groups can recommend suppliers they've worked with successfully. These recommendations carry weight because they're based on real-world experiences.

Consider exploring local and regional suppliers. They often offer faster shipping, more flexible terms, and better customer service compared to distant suppliers. Plus, their proximity makes it easier to visit their facilities and conduct audits.

Once you've identified potential suppliers, the next step is to verify their credibility through a series of checks.

How to Check if Suppliers Are Reputable

A supplier’s reputation is a strong indicator of their reliability. Start by examining their online presence. Reputable suppliers usually maintain professional websites with detailed product catalogs, clear contact information, and company background.

Customer reviews and testimonials are another valuable resource. Instead of focusing solely on star ratings, read detailed reviews that highlight specific experiences with product quality, shipping times, and communication. Pay attention to how suppliers handle negative feedback - professional responses often signal good customer service.

Look for industry certifications as a mark of quality. Certifications like ISO 9001 for quality management or Fair Trade standards for ethical sourcing indicate a commitment to high standards.

Test their communication skills by reaching out with detailed questions about their products, minimum order requirements, and delivery timelines. Reliable suppliers respond promptly and provide clear, detailed answers. Delayed or vague responses can be a red flag.

Finally, assess their financial stability. Use business credit reports from services like Dun & Bradstreet to evaluate their financial health. A financially secure supplier is less likely to face disruptions that could impact your orders.

Steps to Verify Supplier Credentials

Once you've reviewed online feedback and peer recommendations, take steps to formally verify the supplier’s credentials. This ensures you're working with a legitimate business and reduces the risk of fraud.

Start by confirming their business registration. In the U.S., you can check state secretary of state websites for verification. For international suppliers, consult their respective country’s business registration authorities.

Ask for their tax identification numbers. U.S. suppliers should provide a Federal Employer Identification Number (EIN), while international suppliers should have an equivalent tax ID. This not only confirms their legitimacy but is also crucial for accurate tax reporting.

Verify the supplier’s physical address. Use tools like Google Street View to confirm their location, or for international suppliers, consider local verification services or request photos of their facilities.

Request bank references to further establish credibility. Legitimate suppliers typically have relationships with reputable banks and can provide references upon request.

Check for insurance coverage. Ask for certificates of general and product liability insurance. This protects both you and the supplier in case of disputes or issues with the products.

Ask for trade references from other customers in your industry. Contact these references to get insights into the supplier’s reliability, product quality, and customer service.

Before committing to large orders, request samples. Testing samples allows you to verify product quality firsthand and ensures the supplier can meet your expectations. Be prepared to pay for samples - this is a common practice among legitimate suppliers.

Finally, review their contract terms. Reliable suppliers provide clear agreements outlining payment terms, delivery schedules, quality standards, and return policies. Be cautious of suppliers who avoid written contracts or offer terms that seem too good to be true.

Building relationships with dependable suppliers strengthens your supply chain and sets the stage for smarter, more confident wholesale buying.

How Bulk Pricing Works

Grasping how bulk pricing works can help you make the most of wholesale opportunities. Essentially, bulk pricing lowers the cost per unit when you buy in larger quantities. This approach not only saves money but also helps you improve profit margins when reselling products.

Why can suppliers offer these discounts? Larger orders reduce the costs associated with handling each unit, simplify production, and increase their overall revenue. For buyers, this translates into better profitability or the ability to price products more competitively.

Let’s look at the numbers. If you purchase 1,000 units at $8 each instead of 100 units at $10 each, you save $2 per unit. That’s $2,000 in total savings - a significant boost to your bottom line or an opportunity to offer lower prices to customers.

Now, let’s dive into how tiered discounts and minimum order requirements play a role in shaping your buying strategy.

Tiered Discounts and Minimum Order Requirements

Many suppliers use a tiered pricing system to offer bulk discounts. Instead of a single flat rate, they set price breaks based on how much you buy. Here’s an example: 100–499 units might cost $10 per unit, 500–999 units $9 per unit, and 1,000+ units $8 per unit. These price breaks encourage buyers to order more to unlock better rates.

Understanding these tiers is crucial for deciding if purchasing in larger quantities makes financial sense. But it’s not just about the price per unit. You’ll also need to consider factors like storage space, cash flow, and Minimum Order Quantities (MOQs). MOQs can vary widely - electronics suppliers often require higher minimums because of the value and complexity of their products, while apparel suppliers may offer lower minimums to accommodate seasonal needs.

Payment terms also play a big role in the true cost of bulk purchases. Suppliers often provide net-30 or net-60 terms, allowing you to sell inventory before the payment is due. This can ease cash flow constraints. In fact, over 60% of B2B buyers expect volume discounts when buying wholesale.

When evaluating tiered pricing, don’t just focus on the per-unit cost. Take into account the total cost of ownership, including storage fees, insurance, potential spoilage or obsolescence, and the opportunity cost of tying up your capital. In some cases, a smaller order at a slightly higher per-unit price might actually be the smarter choice for profitability.

How to Negotiate Better Bulk Prices

Once you understand bulk pricing, it’s time to focus on negotiating terms that maximize your savings. Successful negotiation hinges on preparation, timing, and clear business planning. Suppliers generally expect some level of negotiation, and a well-thought-out approach can lead to better deals.

Start with research. Look into competitor pricing, industry benchmarks, and current market trends before contacting suppliers. This knowledge not only strengthens your position but also shows that you’re a serious and informed buyer.

Support your negotiations with data. Share your sales projections, growth plans, and past purchasing history to highlight the value of a long-term partnership. For example, a small retailer projected a 20% sales increase and secured a 10% discount by committing to larger orders and offering an upfront deposit. This move also strengthened their relationship with the supplier.

Timing can also work to your advantage. Suppliers may be more flexible during slower seasons or at the end of a month or quarter when they’re trying to hit sales targets. These periods often present opportunities for better deals.

Remember, everything is negotiable. Payment terms, delivery schedules, and MOQs can all be adjusted to improve your deal. For instance, extending payment terms from net-15 to net-30 gives you short-term financing at no extra cost, while flexible delivery schedules can help manage storage and cash flow challenges.

Building strong relationships with suppliers is another way to secure better terms. Regular communication, timely payments, and consistent interactions can create goodwill, which may lead to preferential pricing or more flexible arrangements. Volume commitments can also carry weight - if you can guarantee a certain purchase volume over time, suppliers are often willing to offer better pricing. However, be cautious about overcommitting. Failing to meet your promises can harm your relationship and hurt future negotiations.

Finally, always have a backup plan. Be ready to walk away if the terms don’t meet your needs. Identifying alternative suppliers not only gives you leverage but also ensures you’re not overly dependent on a single source.

How to Handle Surplus Inventory

Buying in bulk often brings cost savings, but it can also lead to surplus inventory, which ties up cash and storage space. To avoid this, it’s essential to stay on top of inventory turnover and have effective strategies for liquidating excess stock when needed. By managing these aspects well, businesses can maintain healthy cash flow while reaping the benefits of bulk purchasing.

The process starts with carefully monitoring inventory to spot potential issues early. From there, having multiple liquidation channels in place ensures you can recover value when surplus stock becomes unavoidable. Done right, these strategies can turn a potential problem into an opportunity.

How to Track Inventory Turnover

Keeping a close eye on inventory turnover is the first step to managing surplus. The inventory turnover ratio is a key metric here. It measures how often you sell and replace your inventory over a set period. To calculate it, divide your cost of goods sold by your average inventory value.

What’s considered a "healthy" turnover ratio depends on your industry. For many retail businesses, a ratio of 4–6 turns per year is a solid benchmark. If your ratio falls below this range, it could mean you’re holding onto too much stock compared to your sales volume - a clear signal to adjust your purchasing habits.

Regular sales tracking - whether weekly or monthly - can highlight slow-moving products. Many businesses rely on the 80/20 rule: if 20% of your products drive 80% of your sales, pay close attention to when those fast-moving items start to slow down.

Seasonal trends also play a big role. Analyzing inventory on a quarterly basis can help you differentiate between seasonal fluctuations and genuine surplus.

Don’t forget to consider supplier lead times. For instance, if your supplier takes 60 days to deliver, slow-moving stock might just be a temporary issue tied to longer delivery cycles. Understanding these patterns ensures you don’t misinterpret normal delays as a problem.

Automation can be a game-changer here. Set up alerts to notify you when inventory exceeds certain thresholds. For example, if you usually sell 100 units of a product per month but suddenly have 400 units on hand without a spike in demand, an alert can flag this for immediate review.

Finally, assess the cash flow impact of slow-moving inventory. Calculate how much working capital is tied up in these items to prioritize which surplus issues need immediate attention versus those that may resolve naturally over time.

Once you’ve identified surplus inventory, the next step is finding effective ways to sell it.

How to Sell Surplus Stock

Even with the best planning, surplus inventory can happen. When it does, having a variety of liquidation options helps you recover the most value. The key is to match the right channel to your product type and timeline.

B2B surplus marketplaces like ForthClear provide a secure platform to list excess inventory. They offer features such as escrow payments, bulk pricing, CSV uploads, order tracking, and direct messaging. Keep in mind, there’s a 5% fee plus 2.9% + $0.30 per transaction.

Timing matters, too. For example, end-of-quarter periods often bring heightened demand from buyers looking to use up remaining budgets. Similarly, businesses gearing up for seasonal peaks may pay higher prices for inventory that fits their needs.

Consider product bundling as another strategy. Instead of heavily discounting individual items, bundle slow-moving products with popular ones to offer more value while clearing out excess stock.

Geographic demand can also make a difference. Products that don’t sell well in one market might perform better in another. Using B2B platforms with national or international reach allows you to tap into these alternative markets without the hassle of setting up new distribution channels.

Another option is selling to wholesale liquidation buyers. These buyers purchase large quantities quickly, often at discounted prices. While you may not get top dollar, this approach can be useful when you need immediate cash flow or want to reduce storage costs.

Transparency is crucial when selling surplus stock. Provide detailed product descriptions, clear photos, and honest information about why the items are being sold. This builds trust and helps buyers make informed decisions. Establishing relationships with regular surplus buyers can also pay off. Preferred networks with agreed-upon pricing can streamline the process and make managing surplus inventory more predictable.

Using a combination of these approaches, rather than relying on just one, gives you flexibility. You can tailor your strategy based on your timeline, the type of product, and how much value you aim to recover.

Legal Requirements for Wholesale Buying

Staying within the bounds of legal requirements is essential for running wholesale operations without hiccups, especially when dealing with international transactions.

When conducting international business, it’s crucial to adhere to import and export regulations. This includes managing customs duties, observing import quotas, meeting product safety standards, and ensuring compliance with export controls and licensing requirements. Following these rules helps avoid unnecessary delays or legal complications.

Required Business Documents

Compliance for Interstate and International Purchases

Up next, we’ll dive into the key differences between sourcing products domestically and internationally.

sbb-itb-bc600a0

Domestic vs International Wholesale Sourcing

Choosing between domestic and international suppliers boils down to weighing costs, delivery speeds, and logistical complexities based on your business goals. Your decision will directly influence inventory management, compliance requirements, and overall operational efficiency.

Domestic sourcing often means faster delivery times and avoids the headaches of customs delays. Working with local suppliers keeps you within familiar legal frameworks and makes communication easier, thanks to shared time zones and the possibility of on-site visits.

International sourcing, on the other hand, can offer lower production costs and access to a broader range of products. Some regions specialize in items that may be harder to find domestically. However, these advantages often come with trade-offs, including longer lead times, complex logistics, customs challenges, and additional regulatory hurdles.

These initial distinctions lay the groundwork for a closer look at cost and supply chain implications.

Cost and Supply Chain Differences

When it comes to costs, domestic suppliers typically charge higher per-unit prices due to local operational expenses. However, sourcing locally can help you avoid international shipping fees, customs duties, and currency exchange risks. Domestic suppliers also tend to offer more flexible payment terms, reducing the strain on your working capital.

International sourcing might lower per-unit costs, but there are hidden expenses to consider. Shipping fees, customs duties, and currency fluctuations can erode potential savings. Additionally, international supply chains are often less predictable, with delivery schedules vulnerable to delays caused by logistical issues, weather disruptions, or geopolitical tensions.

Longer lead times for international orders may require you to keep more safety stock on hand, tying up capital and increasing storage expenses. Careful inventory planning becomes critical to offset these risks.

Beyond cost considerations, international sourcing introduces the need for meticulous customs and regulatory compliance.

How to Handle Customs and Regulations

Navigating customs and regulations is a key part of international wholesale sourcing. It all starts with properly classifying your products using Harmonized System (HS) codes, which determine applicable duty rates and import requirements.

Customs duties can vary significantly depending on the product type. For instance, electronics and textiles often have different duty rates based on their classification and country of origin. To ensure smooth customs clearance, you'll need accurate HS codes, commercial invoices, packing lists, bills of lading, and certificates of origin. Missing or incorrect documentation is a common cause of delays, making experienced freight forwarders invaluable partners.

Product safety standards add another layer of complexity. In the United States, agencies like the Consumer Product Safety Commission (CPSC) regulate many consumer goods. Electronics may require certifications from the Federal Communications Commission (FCC), while food products must comply with Food and Drug Administration (FDA) guidelines. Understanding these requirements before placing orders can save you from costly border issues.

For businesses importing at scale, customs bonds might be necessary. These bonds, whether on a per-shipment basis or as an annual arrangement, help ensure compliance with customs regulations. Partnering with a customs broker can simplify the process, ensuring all paperwork is in order and minimizing potential delays.

Free Trade Agreements, like the United States-Mexico-Canada Agreement (USMCA), can also reduce or eliminate duties for qualifying products. To benefit, suppliers must provide proper certificates of origin and meet specific content criteria.

Next, we’ll explore how to ensure secure ordering and payment processing.

How to Place Orders and Make Secure Payments

When placing wholesale orders, ensuring secure payment methods and reliable tracking systems is essential. Missteps in these areas can lead to fraud risks and delays in shipments, which no business can afford.

Payment security should always take precedence, especially when dealing with new suppliers or large transactions. For instance, while wire transfers are quick, they offer little recourse once the funds are sent. Credit cards provide some dispute resolution options, but suppliers often prefer other payment methods for bulk orders.

Choosing a payment method that safeguards both parties and maintains cash flow is crucial. This is particularly important for international transactions or first-time dealings where trust hasn’t been fully established.

Secure Payment Methods

Escrow payments are one of the safest options for wholesale transactions. With escrow, funds are held in a neutral account until both parties meet their obligations. The supplier gets confirmation that the payment is secured, while you retain control until the goods are delivered and inspected. This method is especially useful for high-value orders or when working with a new supplier. If the goods don’t meet your expectations or arrive damaged, the escrow service steps in to resolve the dispute.

For larger international orders - often exceeding $10,000 - letters of credit provide another secure option. Issued by your bank, a letter of credit guarantees payment to the supplier as long as specific terms and documentation requirements are met. While this method is more complex, it offers strong legal protections and is widely accepted by international vendors.

For established relationships, trade credit terms like Net 30 or Net 60 can be beneficial. These allow you to receive goods and delay payment for a set period, improving cash flow. However, such arrangements usually require a history of trust and a credit approval process.

ACH and wire transfers are commonly used domestically due to their speed and lower fees. While they lack strong buyer protection, they’re efficient. To minimize fraud risks, always verify bank details through independent channels before initiating a transfer.

Order Tracking Best Practices

Once payments are secured, it’s equally important to implement effective order tracking to keep your supply chain running smoothly. Real-time tracking systems are invaluable, offering visibility into every stage of the process - from order placement to final delivery. These systems eliminate guesswork and provide updates on order processing, inventory allocation, and quality checks.

Start by setting up clear communication protocols with your suppliers. Define what updates you need at each stage, such as order confirmation, shipment dispatch, and delivery. Many suppliers now offer automated updates via email or SMS, reducing the need for constant follow-ups.

Using milestone tracking helps identify delays before they escalate. Key milestones include order confirmation, inventory allocation, packaging, shipment dispatch, and delivery. Each milestone should have an expected timeframe and a contact point for updates.

For more complex orders, documentation management is critical. Keep digital copies of purchase orders, invoices, shipping documents, and inspection reports in a centralized system. These records are invaluable for resolving disputes, managing returns, or handling insurance claims.

Maintaining proactive communication with suppliers can prevent minor issues from becoming major disruptions. For large orders - those exceeding $25,000 or with time-sensitive delivery dates - many buyers schedule weekly status calls to stay updated.

Finally, integrating order tracking with your inventory systems can streamline operations. This ensures stock levels are updated automatically and helps avoid stockouts or duplicate orders, which can tie up valuable working capital.

Reducing Waste Through Inventory Liquidation

Dealing with excess inventory is a common challenge for wholesale buyers. Instead of viewing surplus stock as a liability, it can be liquidated to recover value and promote sustainability. By turning potential waste into revenue, businesses can keep products out of landfills and make the most of their resources.

This approach is gaining traction as companies recognize the financial and environmental toll of unsold stock. Through liquidation channels, businesses can recoup part of their investment and avoid the complete loss associated with stagnant inventory.

The first step in effective liquidation is identifying slow-moving stock. Products that sit unsold for too long - especially in fast-changing categories like electronics or seasonal items - are strong candidates for liquidation.

Benefits of Selling Surplus Inventory

Liquidating excess inventory offers multiple advantages. It can help recover initial investment, lower storage costs, and even provide tax benefits if unsold goods are donated. Clearing out surplus stock also opens up valuable warehouse space for higher-demand items, optimizing storage expenses.

On the environmental side, liquidation is a smarter choice than disposal. It helps reduce waste, aligns with corporate sustainability goals, and appeals to consumers who value eco-conscious practices.

Digital platforms now make liquidation faster and easier. These tools streamline the process, allowing businesses to react quickly to market shifts and improve inventory turnover. When combined with sustainable supplier practices, liquidation can also strengthen supply chain resilience.

How to Choose Responsible Suppliers

Reducing surplus inventory starts with selecting suppliers who prioritize waste reduction and responsible practices. Making thoughtful choices at the supplier level can prevent overproduction and support long-term sustainability.

- Evaluate sustainability practices early: Look for suppliers that emphasize efficient production, strong quality control, and return programs for unsold goods. These measures minimize waste and improve overall inventory management.

- Seek production flexibility: Partner with suppliers who can adjust order quantities to match actual demand. Smaller batch sizes or scalable production options are key to avoiding overstock.

- Demand transparency: Suppliers who openly share details about their manufacturing processes, labor conditions, and environmental policies make it easier to align with responsible business goals and communicate those efforts to stakeholders.

- Consider geographic proximity: Working with nearby suppliers can reduce transportation costs and waste. Domestic suppliers often offer more flexibility in order size and delivery timing, ensuring inventory better matches real-time demand.

- Negotiate return and exchange terms: Before placing orders, ensure suppliers have clear policies for returns or exchanges of unsold merchandise. These safety nets can help mitigate surplus risks, though they should be weighed against potential pricing impacts.

- Leverage technology: Suppliers that integrate with your inventory systems or provide real-time stock updates can help optimize demand planning and reduce the likelihood of overordering.

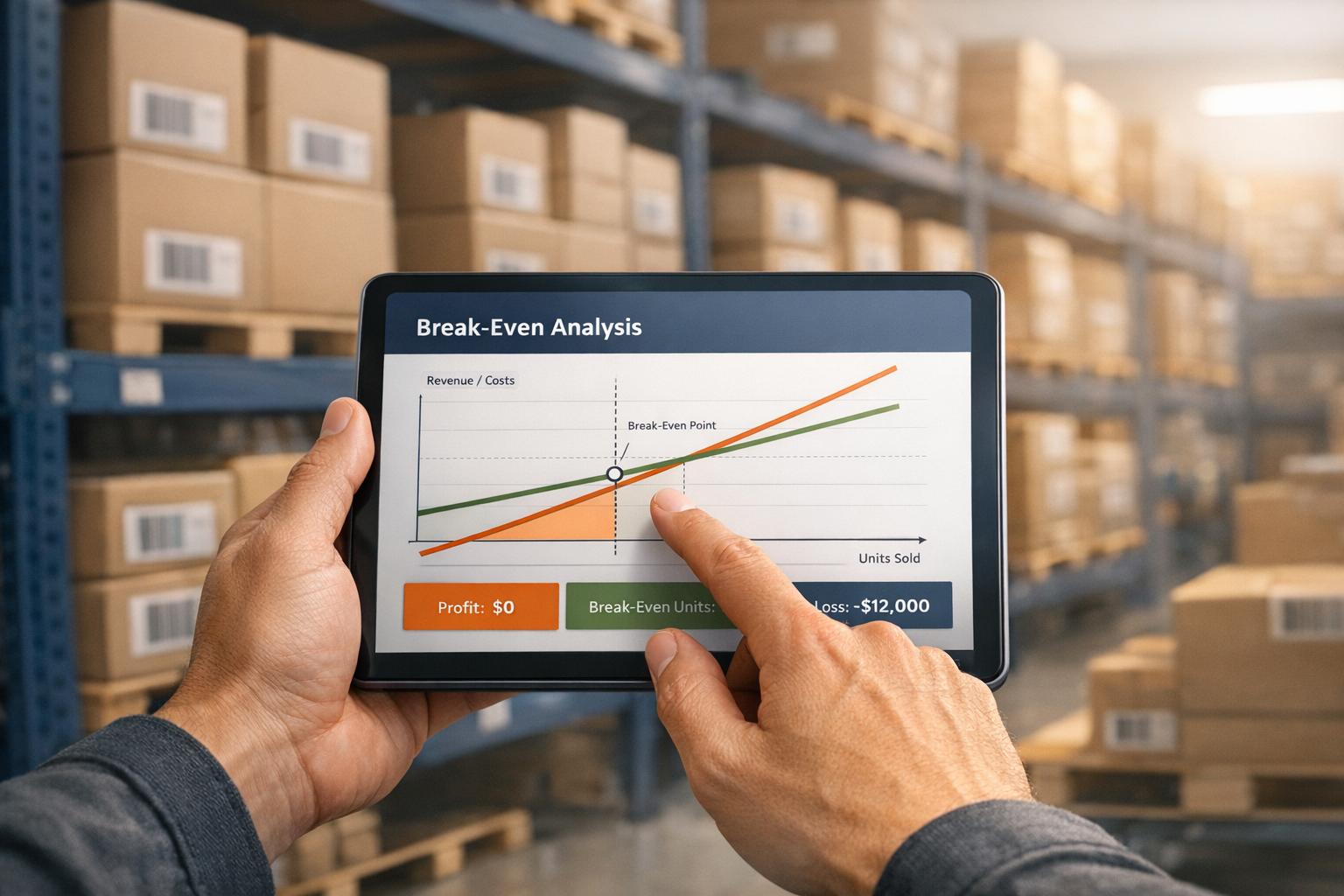

Using Sales Data to Improve Profitability

Data analytics take your purchasing and inventory management strategies to the next level, helping wholesale buyers make smarter decisions. Sales data doesn’t just show what’s happening - it reveals patterns that intuition might miss. When you know what products sell, when they sell, and at what price, you can fine-tune your buying strategy to maximize profits.

Turn raw numbers into meaningful insights. With modern analytics tools, you can spot seasonal trends, predict demand shifts, and identify high-margin products. This kind of information is incredibly useful when negotiating with suppliers or deciding how much stock to carry.

But here’s the thing: many businesses collect sales data without actually using it. What sets thriving wholesale operations apart is how well they interpret and act on analytics. By focusing on the right metrics, you can transform your data into a serious advantage.

How to Use Data for Better Purchasing Decisions

Historical sales data is your best friend when it comes to making smarter purchasing choices. Reviewing one or two years of past sales can help you identify patterns, like seasonal spikes, so you can plan bulk orders accordingly.

Keep an eye on sell-through rates across your product categories. Fast-moving items might be worth ordering in larger quantities, while slow movers call for a more cautious approach to avoid overstocking.

Price elasticity is another key factor. If raising prices causes a noticeable drop in sales, it’s a sign the product is price-sensitive. On the other hand, if demand stays steady even with price adjustments, you might have room to increase margins with bigger orders.

Don’t forget to consider customer acquisition costs alongside product performance. Some products might have lower initial margins but attract new customers who bring repeat business, making them worthwhile investments.

Geographic sales trends can refine your strategy even further. For instance, if a significant portion of your sales comes from a specific region, working with suppliers who can efficiently deliver to that area can reduce shipping costs and improve delivery times.

By using these insights to guide your purchasing decisions, you’ll not only optimize inventory but also set yourself up to handle surplus more effectively.

Managing Surplus Inventory with Analytics

Analytics tools can turn surplus inventory management into a proactive process instead of a last-minute scramble. Start with inventory turnover ratios to identify products at risk of becoming surplus. This lets you address potential issues before they pile up.

Demand forecasting models are another game-changer. By analyzing historical data, these models can predict future sales trends, helping you spot potential overstock situations early. If demand for a product is declining, you can adjust orders or plan liquidation strategies in advance.

Platforms like ForthClear simplify this process with features like CSV upload capabilities. By uploading your inventory data, you can quickly pinpoint which products need attention, saving time on manual analysis.

Seasonal adjustment techniques help you separate normal fluctuations from long-term declines. For example, a seasonal drop in sales might not be a concern, but a similar dip in a steady-selling product could signal trouble.

Finally, use margin analysis by product age to understand the true cost of holding unsold stock. Older inventory might require price cuts to move it quickly, reducing carrying costs and protecting your profitability.

When you combine these analytical tools with smart decision-making, you’ll not only improve your purchasing strategy but also manage inventory more efficiently, keeping your business on a path to growth.

Conclusion

Mastering wholesale buying is all about focusing on strategies that improve your bottom line. Start by choosing reliable suppliers - verify their credentials, check references, and make sure you fully understand their policies before committing to any agreements.

Once you’ve secured trustworthy suppliers, negotiation becomes a powerful tool. Go beyond just discussing unit prices. Work to secure better payment terms, delivery schedules, and minimum order quantities (MOQs) that align with your business needs.

Effective inventory management is another cornerstone of success. Use tools like your point-of-sale system and sales history to make smarter purchasing decisions. This approach reduces the risk of running out of stock or being stuck with costly excess inventory. And if you do find yourself with surplus stock, having a clear liquidation plan can help protect your investment and free up funds for other opportunities.

Staying on top of legal compliance is non-negotiable. Keep your business documents up to date and thoroughly understand compliance requirements, especially if you’re dealing with interstate or international transactions. This attention to detail can save you from unnecessary complications down the road.

Finally, rely on data-driven decisions to refine your strategy. Track metrics like inventory turnover, gross margins, and surplus levels. By monitoring these, you can spot potential issues early and make adjustments before they escalate.

Now’s the time to put these strategies into action. Reassess your supplier relationships, upgrade your inventory systems, and dive into your sales data for better insights. Even small, consistent improvements can lead to significant results over time.

FAQs

How can I make sure my wholesale supplier is financially stable and won’t cause supply chain issues?

To make sure your wholesale supplier is reliable and financially sound, it's important to dig into their financial stability. Start by examining key factors like their payment history, credit ratings, and any outstanding debt. If the supplier is a publicly traded company, you can also review their financial statements and compare their performance to industry standards for a clearer picture.

Beyond finances, take the time to assess their reputation. Reach out to industry peers, check trade references, or explore online forums where businesses discuss their experiences with suppliers. These steps can help you reduce risks and ensure your supply chain operates without disruptions.

What should I consider when choosing between domestic and international suppliers for wholesale sourcing?

When choosing between domestic and international suppliers, several factors come into play, such as cost, delivery speed, and potential logistical hurdles.

Domestic suppliers typically offer advantages like quicker shipping, smoother communication, and fewer concerns about customs or regulatory issues. They also often provide better quality control and shorter lead times, which can be crucial for businesses that value reliability and responsiveness.

Meanwhile, international suppliers can be appealing due to lower production costs and access to a broader range of products. That said, working with overseas suppliers may come with challenges like higher shipping costs, longer delivery times, and navigating complex regulations. Ultimately, the right choice depends on your priorities - whether it's cutting costs or ensuring faster delivery. Align your decision with what best supports your business goals.

How can I use sales data to improve purchasing decisions and handle excess inventory effectively?

To make better purchasing decisions and handle surplus inventory effectively, start by diving into your historical sales data. Look for patterns like seasonal spikes or consistently popular product categories. This analysis can guide your forecasts and help fine-tune your purchasing strategy.

Keep a close eye on your inventory to identify items that aren't selling well. For excess stock, consider strategies like offering discounts, bundling products, or running special promotions. These approaches can clear out space and improve your cash flow. Using demand forecasting tools is another smart move - they help strike the right balance between having enough stock to meet customer demand and avoiding costly overstocking. By staying proactive and using data wisely, you can streamline your inventory management and boost your bottom line.