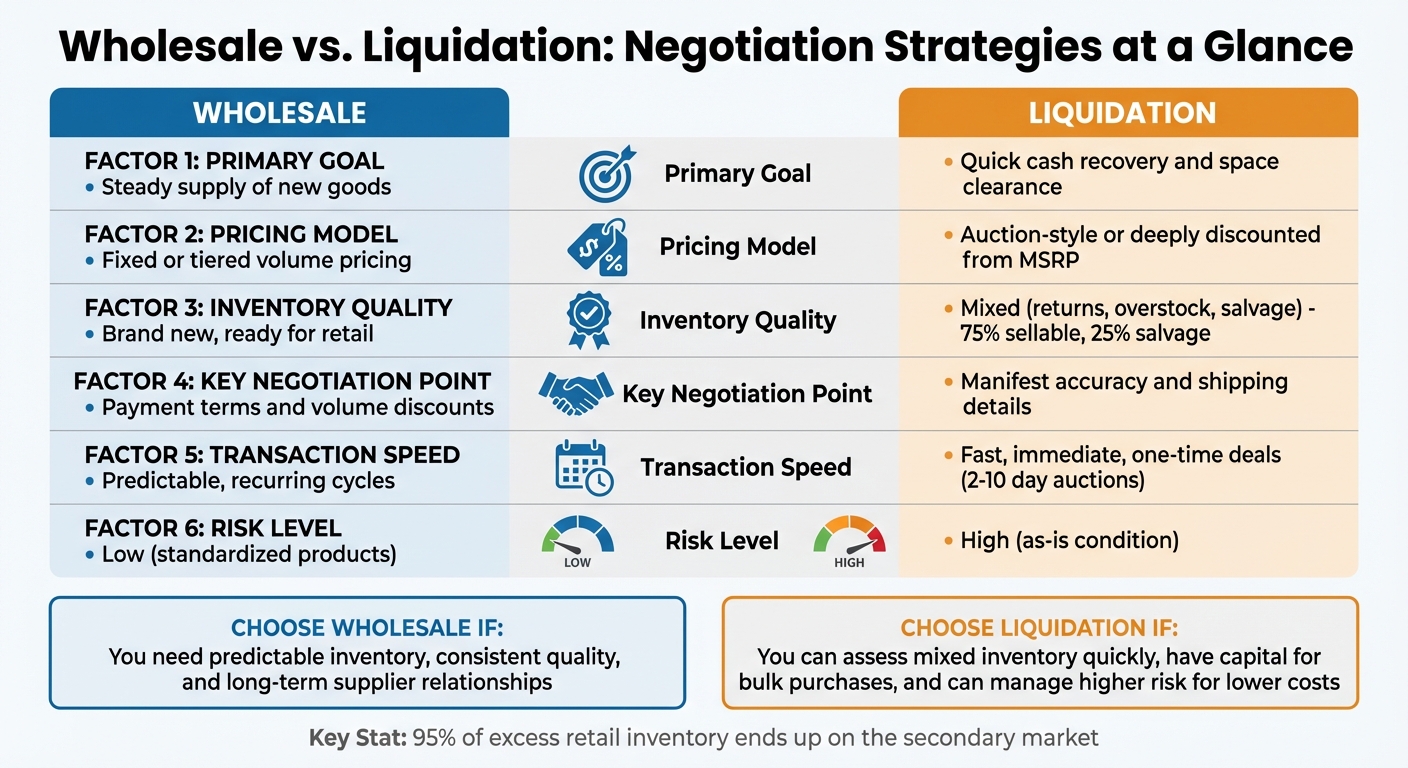

Wholesale and liquidation deals require completely different negotiation strategies. Wholesale focuses on consistent supply, long-term relationships, and predictable pricing, while liquidation is all about speed, risk management, and discounted inventory. Here’s a quick breakdown:

- Wholesale: Ideal for steady, high-quality inventory. Negotiations center on volume discounts, payment terms, and long-term contracts.

- Liquidation: Best for quick, low-cost purchases. Focus on assessing inventory quality, acting fast, and securing bulk deals.

Key Differences:

- Wholesale offers new, retail-ready products with stable pricing.

- Liquidation involves mixed-condition goods (often 75% sellable) at steep discounts, but with higher risks.

Quick Tip: Platforms like ForthClear simplify both processes with escrow payments, inventory tracking, and real-time messaging. Whether you need reliability or speed, understanding these approaches can boost your bottom line.

Negotiation Tactics for Wholesale Deals

Research and Cost Analysis Before Negotiating

Walking into a wholesale negotiation without preparation is like showing up to a game without knowing the rules - it puts you at a disadvantage. The first step is to understand your supplier's costs and what your competitors are paying. Start by gathering at least three quotes from different suppliers to establish a solid baseline for comparison. This information becomes your bargaining chip when it's time to talk numbers.

One clever move? Ask about pricing for larger volumes than you actually need. This strategy helps reveal the supplier's lowest possible price - their bottom line for maximum volume orders. For instance, if you're planning to buy 5,000 units, inquire about the pricing for 50,000 units. This insight can help you negotiate a better deal for your actual order size.

"Being upfront and transparent doesn't mean that you have to give your game away either. Play your poker face and hold your cards close." - QuickBooks

Before starting negotiations, take a close look at your internal procurement data. You might find that different departments are buying the same products from the same supplier but at varying prices. For example, an aircraft manufacturer discovered pricing inconsistencies across departments and used this information to push the supplier into aligning their margins.

This kind of cost analysis lays the groundwork for negotiating better volume pricing and payment terms.

Negotiating Volume Pricing and Payment Terms

One of the most effective tools in wholesale negotiations is volume consolidation. By combining purchase orders from different parts of your business - or even teaming up with other companies - you can significantly boost your negotiating power. A great example of this is from 2008, when four European banks formed a consortium to purchase ATM parts and maintenance. By pooling their orders, they slashed their total ATM costs by 25%.

Cash flow is another powerful lever. Offering a larger upfront deposit or agreeing to faster payment can often secure lower unit prices and better overall terms. Suppliers value the certainty of cash, especially in industries with long production cycles or fluctuating demand.

Another tactic is unbundling services from products in your contracts. For instance, separate monopoly-held goods from competitive services like delivery, analytics, or maintenance. This allows you to introduce competition for the services portion and negotiate better rates with sub-suppliers.

Building Supplier Relationships for Better Terms

Negotiating isn't just about numbers - it’s also about relationships. Strong supplier relationships can turn price-focused transactions into strategic partnerships. Instead of demanding discounts, think about what value you can bring to the table. For example, a beverage company negotiated a 10% global packaging discount by offering the supplier access to new markets.

"The most favourable deals are those that bring benefit to all the parties involved - the real-life win-win scenario." - QuickBooks

Long-term contracts can also reduce a supplier's financial risk, which may unlock better pricing. A chemical company, for instance, secured a 10% discount and a cap on annual price increases at 10% by committing to a multiyear contract with a monopoly supplier. This guaranteed the supplier a 15% return on invested capital, creating stability for both parties.

Clear and consistent communication is key to building trust. Suppliers are more likely to offer favorable terms to buyers who are transparent about their needs, timelines, and expectations. While it’s important to keep your budget limits private, being reliable and straightforward about delivery schedules and long-term plans can go a long way in fostering a productive relationship.

Negotiation Tactics for Liquidation Deals

Liquidation deals are a different beast compared to standard wholesale negotiations. They demand quick decisions and a sharp focus on managing risks.

Assessing Inventory Quality and Risk

When dealing with liquidation inventory, a fast but thorough quality check is non-negotiable. The golden rule? Make sure the merchandise ships straight from the retailer's reclamation center. Middlemen can cherry-pick the best items, leaving you with subpar inventory before it even reaches you.

"The single most important rule in liquidation is to ensure your merchandise is being shipped directly from the retailer's reclamation center." - LiquidationReviews.com

Always request a current manifest. If a supplier offers an outdated one, it’s a red flag for lower-quality goods. For truckloads, double-check that the truck’s seal number matches the Bill of Lading (BOL). A mismatch could mean tampering has occurred.

Understanding the "sellable" ratio is key to pricing. Most liquidation loads are about 75% sellable items - these could be new, slightly used, or have damaged packaging - while the remaining 25% are salvage items like broken or incomplete products. This ratio should guide how much you’re willing to pay. Also, take note of the source. Returns from online retailers like Amazon or Target.com are typically in better shape due to their straightforward return policies, unlike physical store returns, which may have been resold multiple times.

Before sealing the deal, check for resale restrictions. Some brands can’t be sold on platforms like Amazon or eBay, which could leave you stuck with inventory you can’t move.

"I used to get burned by surprise brands I could not sell. Now I can see restrictions before I buy." - Adrian, eBay seller

Careful evaluation upfront ensures you’re ready to use speed and bulk buying to your advantage.

Using Speed and Bulk Buying as Leverage

In liquidation, speed isn’t just important - it’s everything. Sellers are often in a rush to free up warehouse space, especially if inventory has been sitting idle. Acting quickly and paying promptly can often get you better pricing.

Skipping auctions in favor of "Buy Now" options is another way to lock in inventory without the wait or competition of bidding wars. Buying larger quantities, like half or full truckloads, also significantly reduces your cost per unit.

"I used to sift through auctions all day. Now I just check Commerce Central - they know what works for bin stores." - Marcus, bin store owner

For high-volume buyers, negotiating direct contracts can provide consistent inventory at predictable prices over time. You can also use messaging tools to request custom quotes tailored to your purchase volume. Many suppliers offer tiered pricing, meaning the more you buy, the lower your per-unit cost.

If you’re new to a supplier, start small - buy a single pallet to test their quality. Once you’re confident, scale up to larger loads like truckloads to take advantage of volume discounts. This way, you minimize risk while positioning yourself for better deals down the road.

While speed and bulk buying can save money, securing solid inspection rights is just as critical to protecting your investment.

Negotiating Inspection Rights and Dispute Terms

Given the unpredictable nature of liquidation inventory, having safeguards in place is crucial. Escrow services, like those offered through platforms such as Stripe, provide an added layer of security. These services hold your payment until the inventory is delivered and inspected, or until a set inspection period (e.g., 14 days) has passed.

"Stripe holds funds until delivery is confirmed. Complete protection for both buyers and sellers." - ForthClear

Seal verification is a must for truckload purchases. Make sure the seal on the truck matches the seal number listed on your BOL. Any discrepancy could mean the load has been tampered with during transit.

Always insist on real-time, updated manifests rather than outdated samples. This ensures you know exactly what you’re getting. If returns are allowed, negotiate restocking fees upfront to keep them as low as possible - this flexibility can be a lifesaver if the inventory doesn’t meet expectations. Avoid payment methods like cash, Zelle, or cryptocurrency, as they offer no buyer protection.

For cleaner inventory, prioritize online retailer returns over physical store returns. The condition difference is often dramatic, so make sure your negotiated price and inspection terms reflect this.

Comparing Wholesale and Liquidation Negotiation Strategies

Wholesale vs Liquidation Negotiation Strategies Comparison

Wholesale and liquidation negotiations operate on entirely different principles. Understanding when and how to use each approach can save you money and help you avoid costly mistakes.

Side-by-Side Comparison of Key Factors

Wholesale and liquidation strategies differ in more ways than just pricing. Each has its own timeline, risks, and leverage points:

| Factor | Wholesale Negotiation | Liquidation Negotiation |

|---|---|---|

| Primary Goal | Steady supply of new goods | Quick cash recovery and space clearance |

| Pricing Model | Fixed or tiered volume pricing | Auction-style or deeply discounted from MSRP |

| Inventory Quality | Brand new, ready for retail | Mixed (returns, overstock, salvage) |

| Key Negotiation Point | Payment terms and volume discounts | Manifest accuracy and shipping details |

| Transaction Speed | Predictable, recurring cycles | Fast, immediate, one-time deals |

| Risk Level | Low (standardized products) | High (as-is condition) |

In wholesale deals, your leverage lies in building long-term supplier relationships and committing to consistent volume. Liquidation, on the other hand, revolves around speed - sellers are eager to move inventory quickly to clear space and avoid depreciation.

Wholesale transactions often focus on payment terms (like net 30 days) and volume discounts. Liquidation deals, however, prioritize immediate payment in exchange for steep price reductions - sometimes just a fraction of the original MSRP. The inventory quality is another key difference: wholesale offers A-grade, retail-ready products, while liquidation typically includes mixed-condition loads, with roughly 75% of items being sellable and the rest salvage.

These distinctions highlight why negotiation tactics need to be tailored to the type of deal you're pursuing.

When to Use Each Strategy

Knowing these differences helps you decide which strategy suits your business model and risk tolerance. Wholesale is ideal if you need predictable inventory for consistent resale. For traditional retail stores or e-commerce businesses with established product lines, this approach provides the reliability necessary for steady operations.

Liquidation works best when you're willing to take on more risk in exchange for much lower costs. It's a good fit for resellers who can quickly assess mixed inventory, identify profitable items, and move products through various sales channels. Around 95% of excess retail inventory ends up on the secondary market, creating constant opportunities for savvy buyers.

If you're looking to build long-term supplier relationships and need consistent, high-quality products, wholesale is your best bet. But if you have the expertise to evaluate mixed-condition loads, the capital to buy in bulk, and the channels to resell diverse inventory, liquidation could be more profitable. For beginners, starting with General Merchandise loads is a smart way to test local demand across categories like housewares, electronics, and tools before specializing.

"Sourcing should never feel like a gamble. It should feel like a plan." - Commerce Central

Timing is another critical factor. Wholesale negotiations often take weeks or months as relationships and terms are established. Liquidation, by contrast, operates on a much faster timeline. Auction cycles typically last 2–10 days, and many platforms now offer "Buy Now" options for immediate purchases. If you need inventory quickly, liquidation may be your only option.

sbb-itb-bc600a0

Using ForthClear to Improve Surplus Inventory Negotiations

When it comes to negotiating wholesale or liquidation deals, having a tool like ForthClear can make all the difference. It tackles common challenges in surplus inventory negotiations by offering a solution built on trust, speed, and transparency - key factors that often determine the success of these transactions.

How ForthClear Simplifies Surplus Transactions

ForthClear is packed with features designed to make surplus inventory transactions smoother and more efficient. Its secure escrow system, powered by Stripe, holds funds safely until the buyer confirms delivery or 14 days have passed. This feature is especially valuable for "as-is" liquidation purchases, where trust between parties is critical. For wholesale deals, ForthClear’s tiered bulk pricing system allows sellers to set volume-based discounts upfront, giving buyers instant clarity on pricing for various order sizes.

The platform also includes a built-in messaging system, making it easy to request custom quotes or negotiate counter-offers. And because all users are verified, the risks of dealing with untrustworthy parties are significantly reduced.

"ForthClear has revolutionized how we handle excess inventory. The secure payment system and quality suppliers have made our sourcing process incredibly efficient." - Gordon Belch, Co-founder of vybey

For international transactions, ForthClear offers built-in tariff estimates, providing upfront clarity on shipping costs and taxes. These tools streamline negotiations, making it easier for both buyers and sellers to move quickly and make informed decisions.

Accelerating Decisions with Inventory Insights

Beyond managing transactions, ForthClear helps sellers make quicker decisions with real-time inventory insights. Timely action is critical when dealing with dead stock - products that haven’t sold in over 60 days. ForthClear’s Shopify integration flags these items automatically, enabling sellers to list them before their value drops further. This proactive approach ensures sellers can capitalize on opportunities without delay.

"Easy to get started and offload some of our products that were nearing expiry date. Very helpful that ForthClear helps to find buyers in the process." - Hylke Reitsma, Co-founder of vybey

The platform’s bulk upload tool and auto-image search make it simple to list multiple items quickly, while real-time notifications ensure sellers never miss a potential deal. Considering that overstocking costs retailers around $1.1 trillion annually, tools like ForthClear can make a noticeable impact on profitability by helping businesses act faster and more efficiently.

Conclusion

Negotiating wholesale and liquidation deals requires distinct approaches tailored to their unique goals. Wholesale negotiations are about cultivating long-term partnerships, securing volume discounts, and ensuring a steady supply of retail-ready inventory at consistent prices. On the other hand, liquidation negotiations emphasize speed, cash recovery, and carefully evaluating inventory condition to manage higher risks.

To recap, the strategy you choose should align with your business needs. If your priority is a reliable supply of brand-new merchandise, wholesale negotiations are the way to go. However, if you're focused on quickly offloading excess stock or sourcing discounted items for resale, liquidation strategies are more appropriate. Recognizing and applying these differences can make a significant impact on your business performance.

Technology plays a key role in streamlining these processes. Platforms like ForthClear enhance both wholesale and liquidation efforts by offering secure escrow payments, verified suppliers, and clear pricing structures. Their messaging system allows for direct, customized negotiations, while automated tools, such as dead stock detection, help identify inventory sitting for over 60 days - prompting quicker liquidation decisions to preserve value.

Ultimately, aligning your negotiation tactics with the right tools is essential. Use transparent and secure technology to meet your inventory goals effectively.

FAQs

How do negotiation tactics differ between wholesale and liquidation deals?

Wholesale negotiations are all about building strong, long-term partnerships and making the most of bulk orders. To succeed, focus on open communication, ensure on-time payments, and highlight the size and consistency of your orders when requesting bulk discounts. Additionally, be clear about product specifications, quality standards, and shipping terms - this helps you lock in better pricing and reliable service.

Liquidation negotiations, however, have a different focus. They rely heavily on market knowledge and pricing flexibility. Since liquidation deals often involve overstock, returns, or closeout items, buyers can negotiate lower prices by being open to varying product conditions. Being flexible with lot sizes and having the capacity to move inventory quickly can also give you an edge. Tools like ForthClear make these negotiations easier by offering secure transaction features, real-time communication, and a streamlined way for buyers and sellers to connect efficiently.

What steps can businesses take to reduce risks when purchasing liquidation inventory?

To reduce risks when purchasing liquidation inventory, start by doing in-depth research on the seller. Check their business credentials through public records and confirm they offer detailed product information, such as photos, serial numbers, or supporting documentation. If a seller is unwilling to provide this information, it could be a red flag for potential problems.

Opting for a reliable B2B marketplace with verified sellers and escrow payment options can provide added security. Escrow services ensure your payment is held until you’ve confirmed that the inventory matches the description, helping to prevent fraud or non-delivery. Look for platforms that also offer tools like real-time communication and order tracking to keep you informed throughout the process.

Another smart strategy is to take a phased approach to purchasing. Start with a small test order to assess the supplier’s trustworthiness. Compare the received goods against the invoice and maintain thorough records of all transactions. By combining seller verification, secure marketplaces, and a step-by-step buying process, you can lower the risk of encountering counterfeit products or shipping issues.

How can I build strong supplier relationships during wholesale negotiations?

Building solid supplier relationships during wholesale negotiations starts with doing your homework. Dive into market trends, understand what drives supplier costs, and collect multiple quotes to have a clear picture of your options. The goal here is to create mutual value - find ways to help suppliers meet their goals, like offering consistent order volumes or quicker payments, while asking for concessions that align with those benefits. Be upfront about your expectations for pricing, delivery timelines, and quality standards. Using hard data, such as sales trends, can keep discussions grounded and transparent.

Once the deal is sealed, keeping the partnership strong requires ongoing communication and adaptability. Tools that provide real-time updates and secure payment options can help build trust and reduce potential risks. For example, platforms like ForthClear make this easier with features such as verified suppliers, bulk pricing options, and built-in messaging. Regularly assess performance, share demand forecasts, and tweak terms when necessary to stay aligned with market shifts. These habits not only build loyalty but also enhance collaboration, putting you in a better position for future negotiations.